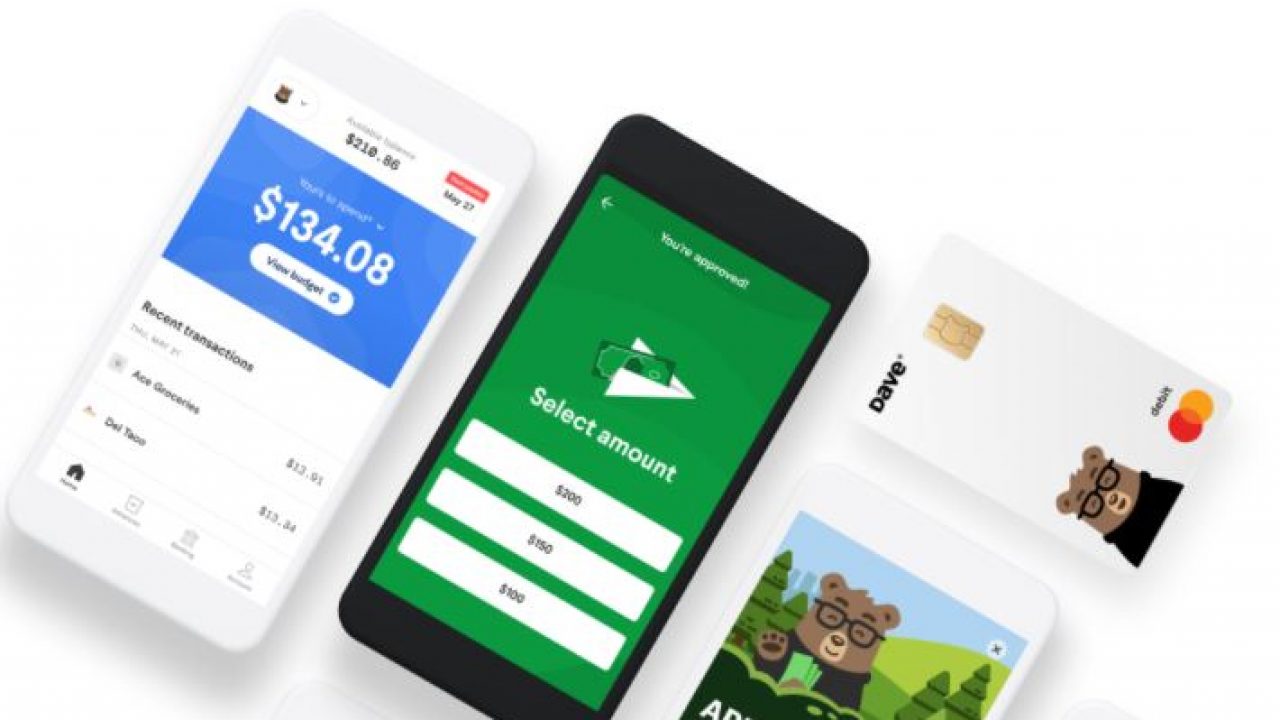

Dave for Getting Cash Advances:

Dave is in a class by himself when it comes to the top applications for advanced cash near me. Many people have found it a lifeline in overcoming financial obstacles. The app’s best benefit is that the user does not have to be concerned about excessive interest rates. Though the app has numerous advantages, one disadvantage is that it can only seek a maximum paycheck advance of $100.

Your phone bill for the month arrived sooner than planned, but payday is not for another two weeks. Things like these might be a pain, mainly if you live paycheck to paycheck. Thankfully, there are now financial apps that can assist you in getting by without putting you in debt. Dave, a cash advance app, has been helping customers get the money they’ve previously earned while avoiding bank overdraft penalties. But it’s no longer simply Dave. Apps like Dave have begun to develop, providing you with more and possibly better options.

What Are the Best Dave Alternatives?

Regarding cash advance online apps that give cash advances, Dave is in a class by himself. It has proven to be a lifeline for many users, allowing them to handle their immediate costs until their following income arrives. Moreover, you won’t have to be concerned about excessive interest rates. The $1 monthly fee is essentially non-existent, and you can get it waived if you make certain purchases.

The only disadvantage of using Dave is that you can only seek a $100 payday advance. Thankfully, some apps, such as Dave, allow you to borrow a higher sum. You may use a mix of these applications to handle your finances better, learn how to save money, and borrow money in an emergency.

List of Top 12 Apps Like Dave for Getting Cash Advances:

Most of the above-mentioned Best Apps Like Dave are free to use. But they do ask you to enter some personal information, so can secure their portal from scammers. However, you can install these applications on your smartphone, after viewing the details about them.

1. Earnin:

Earnin is ideal for folks with consistent salaries because they can link their bank accounts to the app. It allows you to withdraw $100 daily or up to $500 per pay period. In essence, the app works similarly to Dave in that it will enable you to borrow money based on your work hours. This software, on the other hand, does not impose a monthly fee on users. There is a tipping system in place that allows you to tip Earnin anywhere from $1 to $15. This approach was created as an alternative for borrowers who do not want to be subjected to interest rates or credit checks.

You can also have immediate access to borrowed funds through their Lightning Speed service, which deposits the amount you borrowed into your bank account the same day. What’s the catch, exactly? There are no strings attached. Cashing out with Earnin is free, but most banks impose express fees for transfer transactions. Earnin then automatically deducts the amount borrowed from your bank account on payday.

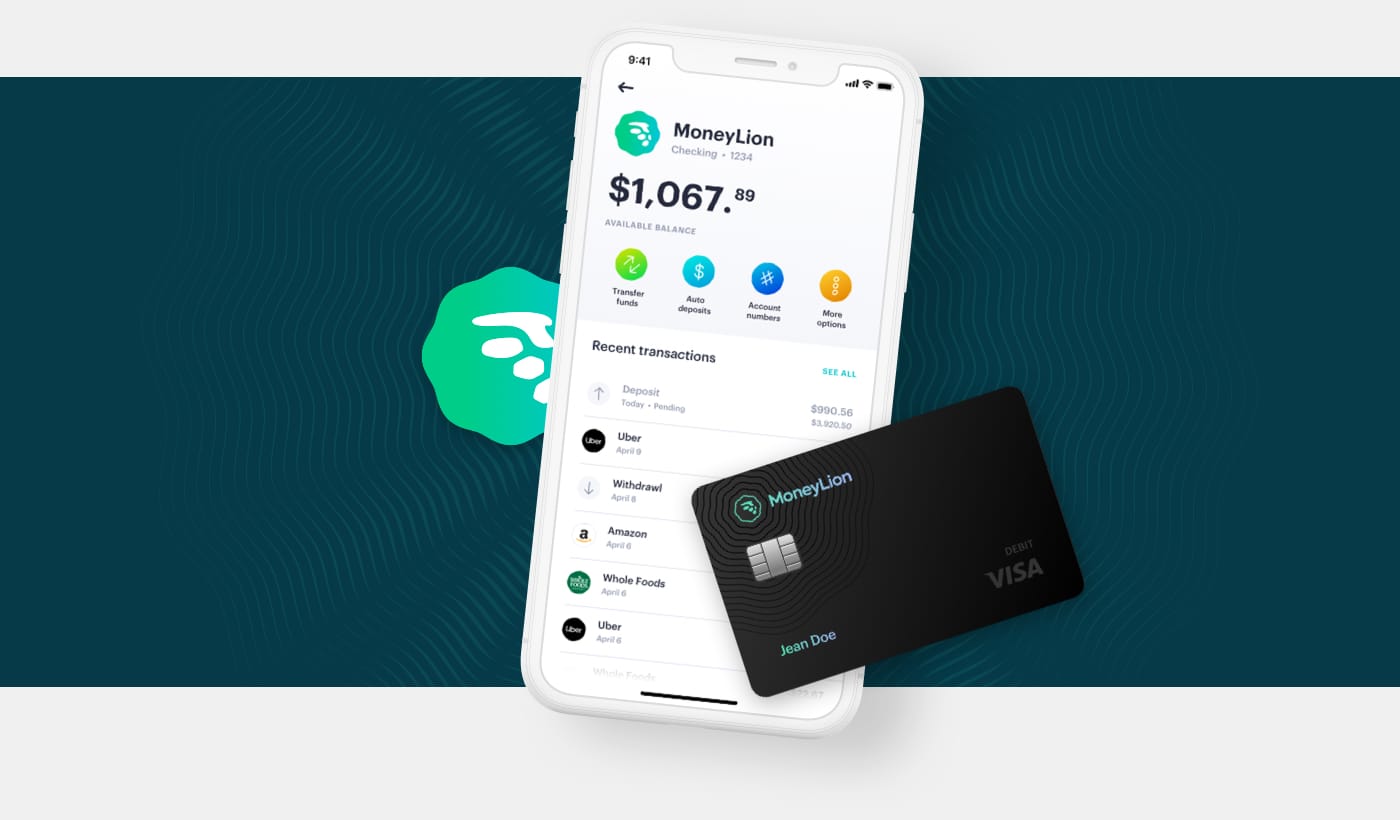

2. MoneyLion:

MoneyLion is a mobile banking app that allows users to borrow, save, invest, and make money in one place. Like Dave’s, its ‘Instacash’ option allows quick cash advances and early paycheck access. It will enable you to borrow up to $250 from your next paycheck without paying interest or checking your credit. The company states that the money will be transferred to your account immediately, regardless of the time of day. RoarMoney, an app function, allows you to get your paycheck up to two days early.

MoneyLion’s best feature is that there is no minimum balance requirement. Standard transfers, overseas transactions, mobile check deposits, and card replacements are free with the app.

Furthermore, the app can assist you with your investments by allowing you to transfer money from your savings account into exchange-traded funds specifically tailored to your goals and risk tolerance. An essential subscription to the app costs $1 per month, while the ‘Credit Builder Plus’ membership, which provides access to loans up to $1,000, costs $19.99 a month.

3. Brigit – Apps like Dave:

It is one of the most popular services, with many users preferring it. If you’re seeking Dave-like apps, this is the greatest option and may be used for various purposes.

It’s also a popular internet tool that can help people get extra income and stay afloat until their next paycheck arrives. Customers’ accounts will be checked, and the amount they spend for various purposes will be tracked.

When a person uses an overdraft, the app will send a unique message indicating the expense as a red flag. It provides email assistance, and users can communicate with the team by email.

4. DailyPay – Apps Like Dave for Advance Cash:

Instead of selling to customers, DailyPay is an app that begins by marketing to employees in various ways. On the other hand, the app will function similarly to Dave and have all of the same features.

Employees maintain a healthy work-life balance by providing excellent assistance and support to one another. They can also withdraw funds from the account before payday if they require immediate cash.

The money will be deposited in the bank, and users can withdraw it at any time until payday. It allows you to charge a fee to transfer money from your hours to your bank account and the amount you spend. The app also states that each transfer costs $1.25.

5. Branch:

This software, like MoneyLion, is jam-packed with incredible capabilities, but it also has employer-side functionality that enables companies to assist employees with their individual financial needs. Users can obtain cash advances from their hard-earned money on schedule this way.

The Branch app doesn’t have set restrictions; instead, it looks at how many hours you’ve worked and pays you accordingly. You might receive up to 50% of your next paycheck if you meet the requirements. You can also pay a small fee and get the money right now. When you receive your paycheck, it is deducted from your account.

6. Affirm:

Affirm is one of the most user-friendly finance apps, allowing you to break your online purchases into manageable monthly installments. It can also be used as a virtual credit card with no additional costs. To get a real-time decision, fill out an application on the app and select a payment schedule that works for you.

With Affirm, you can buy anything from anywhere. This software can set up a monthly payment schedule that suits your spending habits when installing it and entering your purchase amount. Furthermore, Affirm allows you to send money to others in seconds.

7. Axos Bank:

Axos Bank, like Dave, is a financial service that allows users to receive their wages sooner. When you open a high-yield savings or checking account with Axos Bank, you instantly qualify for Direct Deposit Express. Even if your check doesn’t appear in your account for a few days, you can receive a cash advance on money you’ve already earned. You’ll be able to use this option once you’ve set up a direct deposit for your account. Axos will handle the rest.

Unlike its competitors, such as Dave, Axos Bank does not charge a monthly service fee. It also has no overdraft fees or a minimum balance requirement to keep your account operational. Cashback Checking is another service offered by the bank, which allows you to earn up to 1% cashback on your transactions.

Axos will also reimburse you for ATM fees incurred by other American banks. Personal money management, investment options, and the ability to transfer cash, deposit checks, and pay bills on time are all available through Axos Bank, which is not available through applications like Dave.

8. Even:

Here’s an app similar to Dave that provides early grants for unpaid salaries and a variety of financial planning features. For employees or users to use Even’s Instapay app function and obtain early access to pay, employers must first have an open account with the company. Users can borrow up to 50% of their unpaid salary for a given pay period. Workers get credits for every hour they labor, according to this notion. As a result, they are entitled to every money spent during those hours.

Furthermore, users do not incur any taxes or interest rates when cashing out from Even. However, each user is paid a monthly subscription cost. Users can obtain their cash-out money the next working day or use Walmart MoneyCenter to get an Instapay.

9. Chime:

Chime is another service that provides users with Earned Wage Access. It’s similar to Even and DailyPay in that it gives you access to your paycheck two days before the regular payment date. It does not provide you with a cash advance in the same way that Dave does. Chime is free to use, with no monthly fees, minimum balance requirements, or foreign transaction costs.

Using the Chime app, you can also send money to friends, relatives, or roommates without incurring any transfer fees. With Moneypass and Visa Plus Alliance, consumers can access over 38,000 ATMs across the United States. You must, however, pay any relevant out-of-network ATM withdrawal costs.

10. FlexWage – Instant Getting Cash Apps:

Like other payday loan alternatives, it assists employees in gaining access to their paychecks based on their needs. This program allows you to get a quick cash advance over the internet.

One of the reasons that these cash loan applications are becoming more popular is that they do not have to worry about the administrative headaches that come with the traditional payroll advances.

This app also offers reloadable payroll debit cards to employees who receive their paychecks based on clicks. It can benefit workers who do not have a bank account and cannot accept direct deposits from their employers.

There are specific fees, such as $5 for on-demand wage transfer and using a debit card, but they are not prohibitively expensive compared to other apps.

11. Avant app:

Another useful application is the Avant app, which allows customers to manage their loans in real-time. The app has cutting-edge features and capabilities that will enable you to collect your payment history. You can also be advised about future payments, check for additional payments, and evaluate all other relevant information. Everyone can operate the app, which is available for Android and iOS devices.

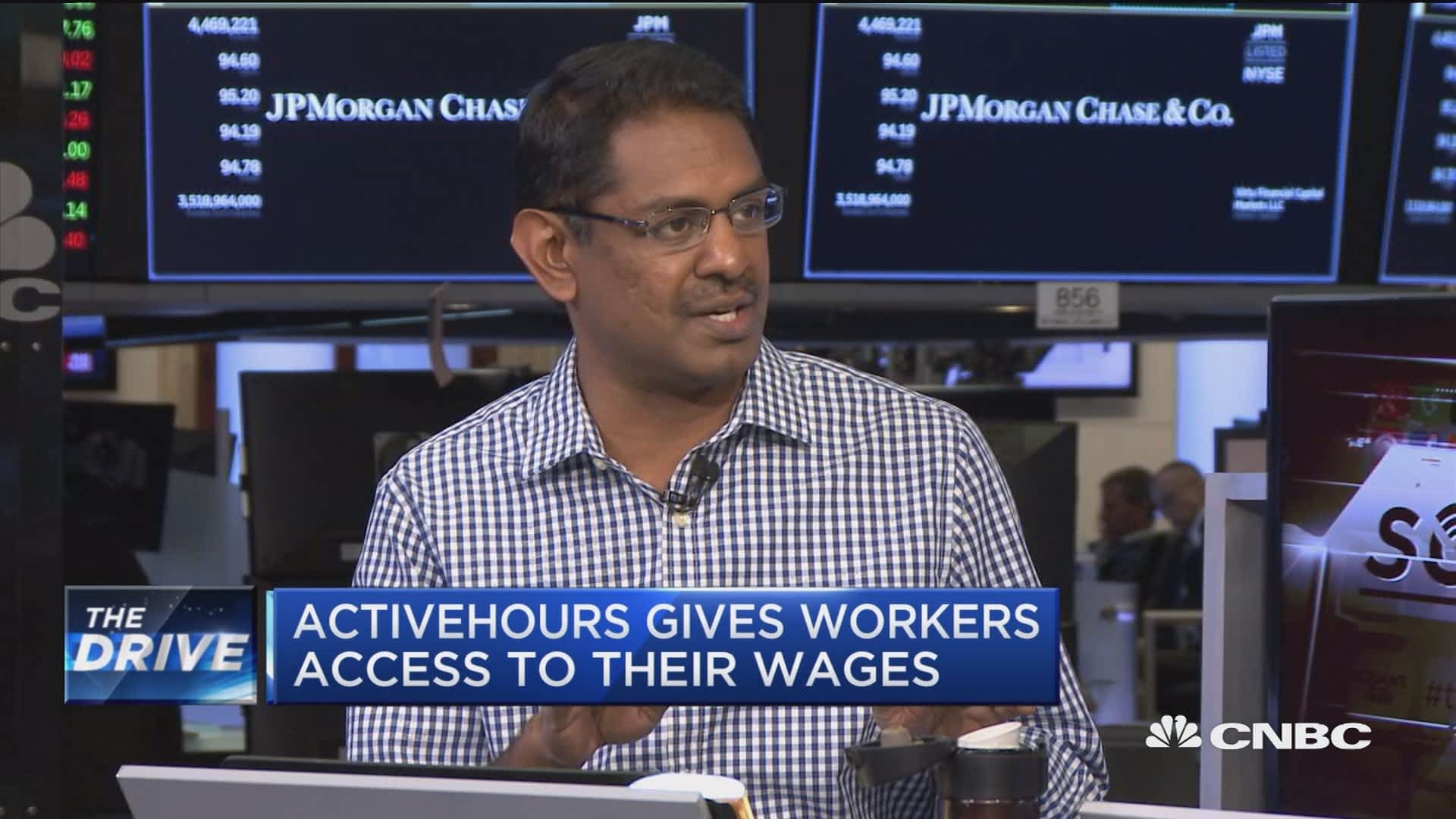

12. Activehours:

Unlike other cash advance applications that take at least one business day to process your payment, Activehours pays you immediately after completing your task. This program is suitable for practically all business sizes, making it easier for employees to receive funds immediately rather than waiting for their next paycheck. Your employer, on the other hand, must have an Activehours account. The app will inquire about your employer and working hours.

You must also link your bank account to this app. Another benefit of using Activehours is that you can take up to $100 daily from your salary. Withdrawals have no fees or hidden costs, making them useful software for daily salary earners. You can track your expenses in addition to receiving fast payouts.

Conclusion:

This app works like an insurance policy where you pay $1 every month and protects you from the vicious cycle of overdraft. I recommend this app to those who mostly live paycheck to paycheck because if you already have like $1000 in your bank account or a few hundred at least, you will probably not worry about overdraft fees.

However, if you are living paycheck to paycheck and your account balance goes down to 15, you recharge when payday comes. Dave Advance could be a good option if you are more in that zone or between $10 and maybe $100 in your bank account. However, do not use the Dave Advance app in the wrong way.