The current hot issue is cryptocurrency. Although the virtual currency has been in various forms since the 1980s, it is currently gaining popularity. Then what exactly is a cryptocurrency, how does it operate, and is it legal?

What is cryptocurrency ?

Cryptography safeguards the procedures involved in creating units, carrying out transactions, and confirming the transfer of ownership in cryptocurrency, a digital form of money.

Fiat currency, controlled and created by the government, is used to describe most modern money. A prime example of a fiat currency is the US dollar. In contrast, no government entity issues cryptocurrencies. It often uses a distributed consensus technique rather than being directly administered by a single authority.

The words “cryptography” and “currency” are combined to form the term “cryptocurrency.” A complex encryption-based cryptographic method is at the core of all cryptocurrencies. Creating cryptocurrency involves solving a long chain of cryptographic hashing algorithms. It is a mathematical calculation rather than a tangible object like a coin or a dollar bill. Digital wallets that track cryptocurrencies are frequently used to store bitcoin assets.

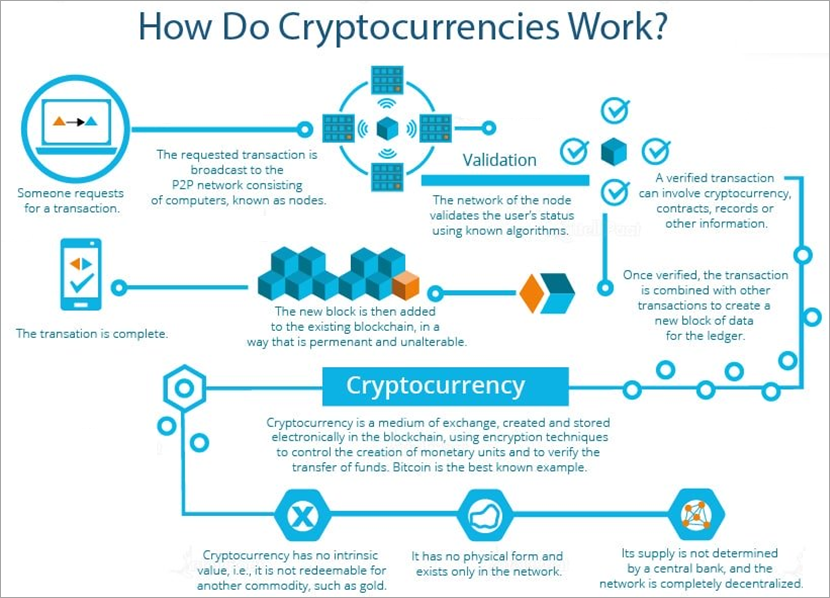

A global ledger that is decentralized and dispersed keeps track of all cryptocurrency transactions. In the case of the well-known cryptocurrency Bitcoin, the distributed ledger is referred to as a blockchain, a computerized system that records blocks with cryptographic hashes.

How Does Cryptocurrency Work ?

Governments and other central regulatory bodies do not have jurisdiction over cryptocurrencies. Cryptocurrency, as a concept, operates outside of the banking system using several brands or types of coins, with Bitcoin serving as the leading participant.

Purchasing, promoting and storing:

Today, users can sell cryptocurrencies to them or purchase them via brokers, exchanges, and private currency owners. The simplest ways to purchase or sell cryptocurrencies are through exchanges or online marketplaces like Coinbase.

Cryptocurrencies can be kept in digital wallets after purchase. You can have “hot” or “cold” digital wallets. Hot refers to an online-connected wallet, making transactions straightforward but leaving it open to fraud and theft. On the other side, cold storage is safer but makes transactions more difficult.

Mining:

Cryptocurrencies are created through a process known as “mining,” which is entirely digital. This procedure is intricate. In essence, miners get paid with bitcoins in exchange for using specialized computer systems to solve specific mathematical riddles.

In an ideal environment, mining one bitcoin would take just ten minutes, but in practice, it typically takes about thirty days.

Buying, selling or investing:

Transferring cryptocurrencies like Bitcoins between digital wallets is simple and requires only a smartphone. Once you have them, you have the option to:

a) Spend them on products or services

b) sell them.

b) Sell them for cash.

The simplest way to make purchases with Bitcoin is through debit-card-style transactions. These debit cards allow you to make cash withdrawals like at an ATM. It is feasible to convert cryptocurrencies to cash using banking accounts or peer-to-peer transactions.

How do you get cryptocurrency ?

The majority of cryptocurrencies are produced using a procedure called cryptomining. High-performance GPU systems are utilized in cryptomining to decipher the cryptographic hash to produce a new block. A limited number of blocks may be mined for each form of coin. Mining coins from an established cryptocurrency grows more complex and challenging over time. For instance, a typical user with a GPU-powered computer may have been able to mine Bitcoin in 2010. Cryptomining is becoming more difficult due to today’s much more complex computer requirements.

Some cryptocurrency developers will give out coins initially to encourage use. Before 2020, Dogecoin, for instance, was well known for giving users free coins through a feature called a “Doge Faucet.”

An Initial Coin Offering (ICO) is a well-liked strategy to promote the value and interest of a new cryptocurrency (ICO). Through an initial coin offering (ICO), the company launching a cryptocurrency offers prospective investors a set quantity of the new cryptocurrency in exchange for a set amount of either fiat money or another cryptocurrency, generally Bitcoin or Ethereum.

A cryptoexchange is currently the most popular method for buying cryptocurrencies. Users can purchase a specific cryptocurrency at a cryptoexchange using either another cryptocurrency or a fiat currency, such as the US dollar. A user might purchase Dogecoin with Bitcoin and vice versa. A specific cryptocurrency can also be converted into cash or a fiat currency at cryptocurrency exchanges.

Are cryptocurrencies legal ?

The globalization of the cryptocurrency business has prompted the need for regulation. The American government has increased its monitoring of space throughout time. Following the frenzy of 2017 and 2018, the Securities and Exchange Commission (SEC) tightened regulations on initial coin offerings or ICOs. Other American organizations, including the Commodity Futures Trading Commission (CFTC), have also participated in various roles.

Additionally, crypto regulation outside of the United States has evolved due to changing regulatory standards. For instance, the fifth Anti-Money Laundering Directive from the European Union mandates that cryptocurrency purchasing, selling, and other operations in particular countries must adhere to specific rules.

Since the cryptocurrency sector is still young compared to other sectors, there needs to be more legal clarity regarding the criteria for all facets of the industry. Asset classification is one aspect of such clarity. Although many other assets are not classified, Bitcoin and Ether are seen as commodities.

Pros and Cons of cryptocurrency:

Pros:

Self-managed and governed:

Any currency’s governance and maintenance are essential factors in its development. Developers/miners store cryptocurrency transactions on their hardware in exchange for a fee known as a transaction fee. Since they obtained it, the miners have kept transaction records accurate and up to date, maintaining the decentralized nature of the records and the integrity of the coin.

Decentralized:

The fact that bitcoins are primarily decentralized is a considerable advantage. Many cryptocurrencies are controlled by those who create them, those who own a large portion of them, or businesses that create them before they are made available on the market. Contrary to fiat currencies, which the government controls, cryptocurrencies are kept stable and secure by decentralization, which helps keep the currency monopoly free and in check. As a result, no organization can decide the flow and, consequently, the coin’s value.

Private and safe:

For cryptocurrencies, privacy and security have always been issues. The blockchain ledger is based on complex mathematical riddles that are challenging to crack. Cryptocurrency is, therefore, safer than standard electronic transfers. Cryptocurrencies employ pseudonyms unrelated to user accounts or stored data that might be linked to a profile for improved security and privacy.

Easy money transfer:

Cryptocurrencies have consistently maintained their position as the best option for transactions. Cryptocurrencies enable instantaneous domestic and international transactions. It will be because there are only a few hurdles to overcome, and the verification takes little time to complete.

Defending against inflation:

Many currencies have seen a gradual loss in value due to inflation. Almost all cryptocurrencies are introduced with a hard and fast amount at the time of their inception. There are only 21 million Bitcoins that have been released worldwide, according to the ASCII computer file, which lists the quantity of each coin. As demand rises, its value will also rise, helping keep the market stable and preventing inflation in the long run.

Cons:

Illegal business dealings:

Since cryptocurrency transactions are highly private and secure, it is challenging for the government to track down any user by their wallet address or keep an eye on their data. Bitcoin has been used as a mode of payment (exchanging money) during many illegal deals, like buying drugs on the dark web. Some people have also used it to convert their illicitly acquired money to hide its source through a clean intermediary.

Risk of Data Loss:

The developers wanted to make untraceable ASCII documents, strong hacking defenses, and impenetrable authentication protocols. It would be safer to position money in cryptocurrencies than physical cash or bank vaults. But if any user loses the private key to their wallet, there is no getting it back. The number of coins within the wallet will also stay kept away. It might lead to the user’s departure.

High energy consumption:

It takes a lot of computer power and electricity to mine bitcoins, making it a very energy-intensive process. Bitcoin is frequently the biggest offender here. Advanced computing power and a lot of energy are needed for bitcoin mining. It cannot be done with standard computers. Significant Bitcoin miners are located in nations like China, where coal is used to generate electricity. China’s carbon footprint has dramatically expanded as a result.

Susceptible to hacking:

Cryptocurrencies are quite secure, but exchanges need to be more secure. Most exchanges track users’ wallet information to determine their user ID. Hackers frequently steal this data, giving them access to numerous accounts.

These hackers can effectively move money from such accounts once they get access. Several exchanges, including Bitfinex and Mt Gox, have recently been hacked, resulting in the theft of Bitcoin worth hundreds to millions of US dollars. Today’s exchanges are generally very safe, but new hacks are always possible.

Purchase of NFTs using other tokens:

Only one or a few fiat currencies can be used to trade some cryptocurrencies. It forces the user to first convert these currencies into one of the more popular ones, such as Bitcoin or Ethereum, before exchanging that money for the one they want. It may only apply to some cryptocurrencies. This adds additional transaction fees to the method and results in unnecessary expenditures.

Investing safely in cryptocurrencies:

According to Consumer Reports, all investments have risk, but some experts think cryptocurrency is one of the riskier investment options available today. If you intend to invest in cryptocurrencies, the following suggestions can help you make intelligent choices.

Diversify your investments:

Diversification is crucial to any smart investment strategy, which remains true when investing in cryptocurrencies. Don’t put all your money in Bitcoin, for example, because that’s the term you know. There are dozens of possibilities, and spreading your investment among different currencies is preferable.

Research collaborations:

Learn about cryptocurrency exchanges before investing. There are more than 500 exchanges available. Before making a decision, do your homework, read reviews, and consult with more seasoned investors.

Be ready for turbulence:

The cryptocurrency market is volatile, so be prepared for the ups and downs. You will observe huge swings in prices. If your investment portfolio or mental welfare can’t manage that, cryptocurrency might not be wise for you.

Cryptocurrency is all the rage right now, but remember, it is still in its relative infancy and is regarded as highly speculative. Investing in something new comes with problems, so be prepared. Do your homework and start investing prudently if you intend to take part.

A comprehensive antivirus is one of the best methods to keep secure when browsing the internet. Kaspersky Internet Security protects you from malware infections, spyware, data theft, and online payment security utilizing bank-grade encryption.

Understand how to keep your digital currency safe:

You must store cryptocurrency if you purchase it. You can save it in a digital wallet or on an exchange. Wallets come in wide varieties, and each has advantages, technical needs, and security standards that must be met. You should research your storage options before investing, just like with exchanges.