eCommerce has changed dramatically during the last few years. For those unfamiliar with the term, eCommerce refers to the activity of purchasing and selling goods via the internet. The goods could be anything from household stuff to handcrafted ones. Numerous eCommerce sites have sprung up in response to the latest Coronavirus outbreak. The well-established ones, such as Amazon, Flipkart, and eBay, are also performing well.

It is best to have dominance over the internet if you are running a successful online business. It’s quite simple to start an online business these days. You simply need to engage a web developer to put up an eCommerce website to sell your things online. However, you’ll need a payment gateway to receive payments from users.

Best Payment Gateways for Online Businesses

Because the payment gateway is the most crucial aspect of your organization, it becomes the most important thing. As a result, this placement will provide a list of the top payment gateways for eCommerce websites. Let’s get this party started.

1. Razorpay

2. PayPal

You may be familiar with PayPal if you have ever purchased services from freelance websites. PayPal is more well-known than other payment solutions, and it may be the best option for your online business. PayPal has the advantage of accepting any foreign credit or debit card. PayPal now allows retailers to withdraw money in 56 different currencies. PayPal also features a strong anti-fraud system that analyses customer transactions 24 hours a day, seven days a week.

3. Paytm

Paytm, on the other hand, is an online payment provider that accepts UPI. The good part about Paytm is that it is simple to use. The beautiful thing about Paytm is that everyone in India understands how to use it. India’s payment gateway accepts all domestic credit and debit cards from 50 different Indian banks. This payment service is used by a number of well-known Indian companies, including Zomato, Jio, Swiggy, Uber, Ola, and others.

4. CCAvenue

The best part about utilizing CCAvenue is that it accepts 200 different payment methods, including 58 different net banking choices, 97 different debit cards, 14 different bank EMIs, and 6 different credit cards.

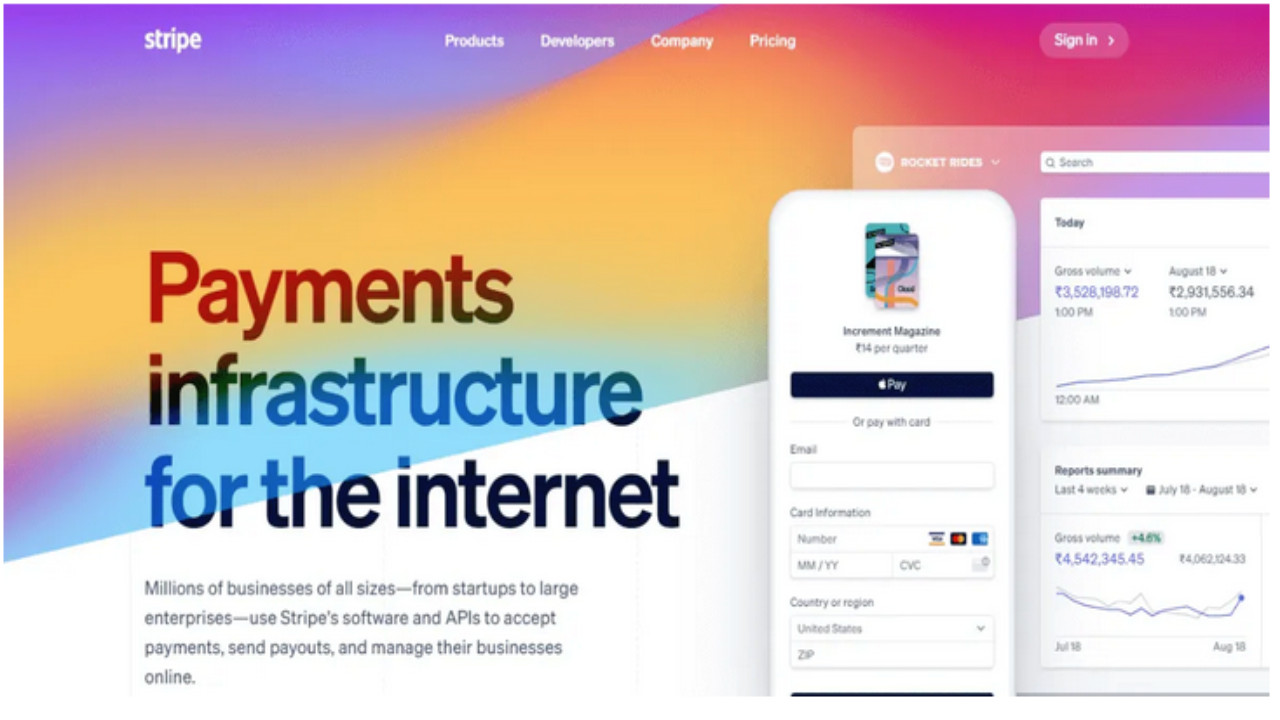

5. Stripe

Stripe is a payment gateway that takes you to accept credit card payments by transferring money between your dealer account and a payment processor. It was first introduced in 2011 and is a payment gateway that allows you to accept credit card payments simply by transferring money between your merchant account and a payment processor.

Security, scalability, and safety are all built into the payment gateway’s cloud-based infrastructure. Stripe can also be used as a stand-alone solution for individuals that need to send invoices and collect payments for goods or services.

6. Instamojo

Instamojo is India’s largest on-demand payments and e-commerce platform, collecting payments and producing free online invoices. It also transports merchandise and helps customers to obtain loans to expand their business’s strength. Instamojo makes digital commerce accessible to everyone, resulting in more opportunities and sustainable resources.

7. PayU

8. Amazon Pay

Amazon Pay is a less well-known choice, but it offers a simple, quick, and secure payment solution for your business. The sole disadvantage of Amazon Pay is that it is only available in a few locations; nevertheless, the company intends to expand its operations to every country in the near future.

Thanks to the payment gateway, both sellers and online merchants should have a pleasant buying experience. Setting up automatic payments, merchant website integration, inline checkout, and fraud protection are just a few of Amazon Pay’s important features.

9. PayKun

PayKun is one of the more trustworthy payment options available, despite its lack of popularity. PayKun is well-known for its safe, secure, and quick transaction methods. PayKun now accepts over 100 different payment methods and has a simple refund policy. PayKun offers faster payment settlements than other payment gateways.

10. Skrill

Skrill is another another fantastic payment option to consider. The company was established in 2001 and provides both online payment and money transfer services. Skrill can operate in over 120 countries and support 40 different currencies.

Additionally, the service includes free global funds transfer possibilities as well as a few transaction security measures. Skrill can also be used with third-party shopping carts, and it works with a variety of eCommerce platforms, including WooCommerce, Shopify, Wix, Magento, and others.

These payment methods can be used on eCommerce sites or accept any online payment type. I hope you found this fabric useful! Please give it on to your friends as well. Please let us know if you have any alternative payment gateways to recommend in the comments section below.