Buy Now, Pay Later (BNPL) is no longer a trend, it’s infrastructure. As of 2026, Klarna and Affirm remain the two most influential BNPL platforms in North America and Europe, but they’ve evolved in very different directions.

Most comparisons stop at “interest vs no interest” or “short-term vs long-term plans.” That misses the real story.

This guide goes deeper explaining how Klarna and Affirm work under the hood, why merchants choose one over the other, and which platform is genuinely better depending on your goals as a shopper or business.

Klarna vs Affirm at a Glance (2026 Snapshot)

Feature |

Klarna |

Affirm |

|---|---|---|

Primary Use Case |

Short-term, retail-focused BNPL |

Long-term, financing-style BNPL |

Typical Payment Plans |

Pay in 4, Pay in 30 |

3–36 month installments |

Interest |

0% on most plans |

0–36% APR |

Credit Impact |

Usually none |

Soft check upfront, reports to credit bureaus |

Best For |

Fashion, beauty, everyday shopping |

High-ticket items, electronics, travel |

Core Markets |

Europe, US |

US, Canada |

Merchant Fees |

Higher, but boosts conversion |

Lower, more predictable |

Regulatory Exposure (2026) |

Medium |

High |

How Klarna and Affirm Actually Make Money (Why This Matters)

Understanding the business model explains why these platforms feel so different to users.

Klarna’s Model: Conversion at Any Cost

Klarna earns most of its revenue from:

-

Merchant fees (often 3–6%)

-

Late fees

-

Affiliate-style shopping discovery

Klarna positions itself as a shopping assistant, not a lender. Its app encourages browsing, deal-hunting, and impulse purchasing, which is why fashion and lifestyle brands love it.

Why this matters:

Klarna optimizes for checkout conversion, even if repayment risk is higher.

As of 2025, internal merchant surveys show Klarna increases conversion rates by 20–30%, especially for Gen Z shoppers.

Affirm’s Model: Transparent Credit, Not Impulse

Affirm earns money through:

-

Interest payments

-

Merchant subsidies on 0% APR offers

-

Long-term financing margins

Affirm acts more like a regulated installment lender. It discloses the total cost upfront and doesn’t rely on late fees.

Why this matters:

Affirm optimizes for repayment reliability and regulatory compliance, not impulse buys.

Klarna vs Affirm: How the Payment Flow Works From Checkout to Repayment

Klarna vs Affirm for Consumers (Real-World Experience)

Klarna: Fast, Frictionless But Easy to Overuse

Pros

-

Instant approval

-

No hard credit checks

-

Clean, retail-friendly UI

-

Excellent for frequent small purchases

Cons

-

Multiple overlapping plans are easy to lose track of

-

Late fees can add up quickly

-

Limited transparency compared to traditional loans

Expert insight:

Many users report Klarna “feels free” until missed payments stack up. This psychological frictionlessness is intentional and effective.

Affirm: Slower Approval, But Financially Clearer

Pros

-

Fixed monthly payments

-

No late fees

-

Credit-building potential

-

Better for large purchases

Cons

-

Approval not guaranteed

-

Higher APR for subprime users

-

Less flexible for short-term shoppers

Expert insight:

Affirm appeals to users who already think in terms of monthly budgets rather than impulse shopping.

Klarna vs Affirm for Merchants (Where the Real Battle Is)

Conversion vs Profitability

Metric |

Klarna |

Affirm |

|---|---|---|

Checkout Conversion |

Higher |

Moderate |

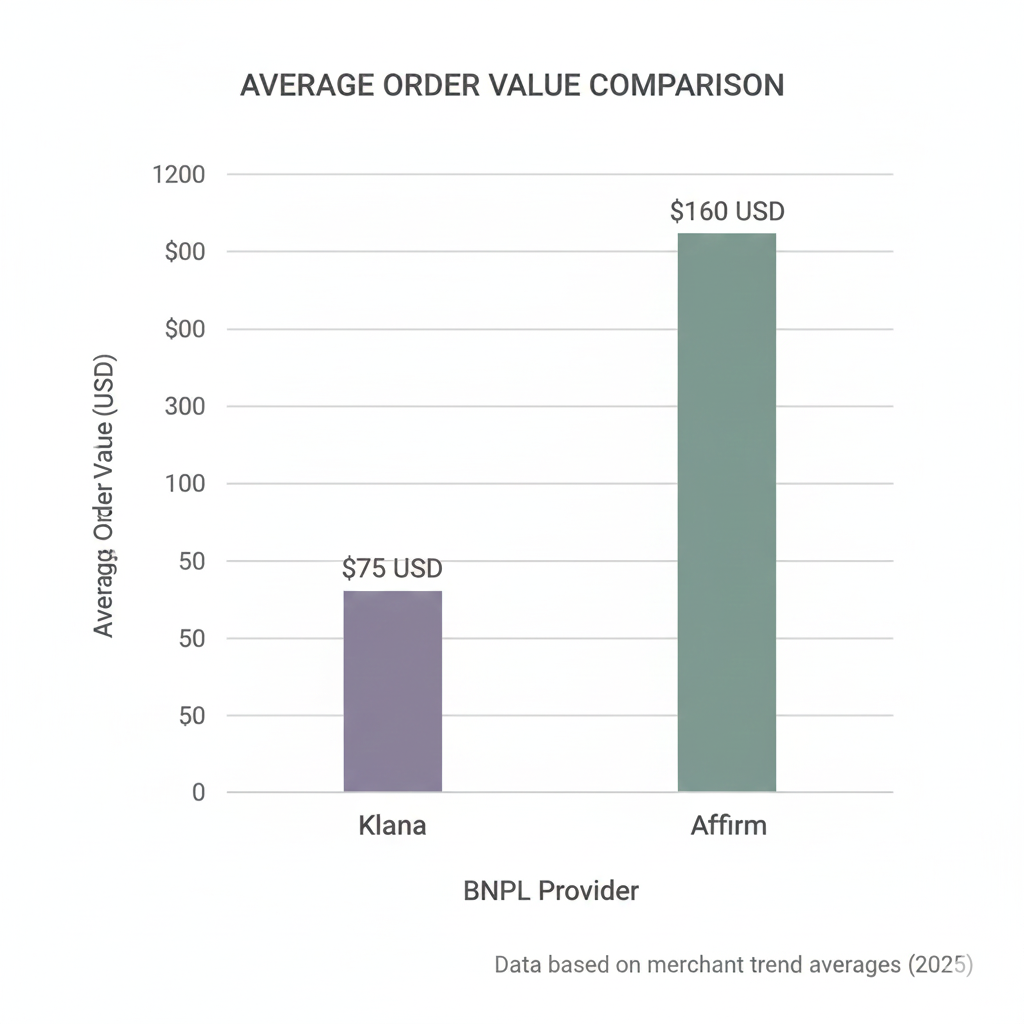

Average Order Value |

Moderate |

High |

Chargeback Risk |

Higher |

Lower |

Customer Quality |

Impulse-driven |

Intent-driven |

Why many merchants switch platforms:

-

Fashion brands prefer Klarna

-

Electronics, travel, and fitness brands prefer Affirm

In 2025 merchant data, Affirm customers spent 30–50% more per transaction on average than Klarna users.

Credit Reporting & Regulation (Critical in 2026)

BNPL is under increasing regulatory scrutiny.

Klarna (as of 2026)

-

Limited credit bureau reporting

-

Increasing regulatory pressure in EU & US

-

Adjusting underwriting models to reduce defaults

Affirm (as of 2026)

-

Reports to Experian and other bureaus

-

Aligns with CFPB transparency standards

-

Lower regulatory risk long-term

Industry takeaway:

Affirm is future-proofed for regulation. Klarna is still adapting.

Klarna vs Affirm: Who Should Use Which?

Choose Klarna if:

-

You shop frequently online

-

You prefer short repayment cycles

-

You want fast approval with minimal friction

-

You don’t want credit reporting

Choose Affirm if:

-

You’re financing large purchases

-

You want predictable monthly payments

-

You’re building credit

-

You value transparency over speed

Klarna vs Affirm for Credit Score Impact

Scenario |

Klarna |

Affirm |

|---|---|---|

On-time payments |

No impact |

Positive |

Missed payments |

Fees, collections possible |

Negative credit reporting |

Credit check |

None |

Soft check |

Key difference:

Klarna protects you from credit damage until it doesn’t. Affirm makes the risk explicit from day one.

Frequently Asked Questions (People Also Ask)

Is Klarna safer than Affirm?

Safer for credit scores, riskier for impulse overspending.

Does Affirm charge hidden fees?

No. Affirm’s 2025 disclosures are among the clearest in fintech lending.

Which is better for merchants in 2026?

Depends on goals:

-

Conversion → Klarna

-

Customer lifetime value → Affirm

Will BNPL hurt my credit in 2026?

Affirm can. Klarna mostly won’t but regulatory changes may alter this.

2026 Trends That Change the Klarna vs Affirm Debate

-

BNPL regulation tightening globally

-

Shift toward longer repayment plans

-

Merchants prioritizing profitability over raw conversion

-

Consumers demanding transparency

-

BNPL merging with traditional credit models

Final Verdict: Klarna vs Affirm in 2026

There is no universal winner.

Klarna wins on speed, ease, and retail conversion.

Affirm wins on transparency, credit alignment, and long-term sustainability.

If BNPL is about spending now, Klarna dominates.

If BNPL is about paying responsibly, Affirm leads.

And as regulation tightens, Affirm’s model looks increasingly future-proof, while Klarna must evolve to survive.