In 2026, high-risk merchant accounts are no longer a fallback solution, they are a core payment strategy for businesses operating in regulated, global, or fast-moving industries. As banks tighten automated risk controls and mainstream processors aggressively shut down accounts, specialized providers like HighRiskPay.com have become essential infrastructure rather than optional services.

This guide explains how high risk merchant account at highriskpay.com works, why its model fits 2026 payment realities, and when it makes more sense than traditional processors, using practical analysis instead of marketing claims.

What a High-Risk Merchant Account Means in 2026

A high-risk merchant account allows businesses to process card payments when they fall outside standard banking risk thresholds. In 2026, “high risk” is no longer based only on industry, it is driven by data behavior.

Why businesses are still labeled high risk

Even legitimate companies are classified as high risk due to:

-

Subscription or continuity billing models

-

Cross-border or multi-currency transactions

-

Higher refund or dispute probability

-

Digital or instantly delivered products

-

Advertising methods that trigger compliance flags

-

Rapid scaling that looks suspicious to automated systems

Key 2026 insight:

Risk classification is now predictive, not reactive. Banks flag businesses based on what might happen, not what already has.

HighRiskPay.com Overview (2026 Positioning)

HighRiskPay.com operates as a specialized high-risk payment processor designed for merchants rejected by mainstream platforms like Stripe, PayPal, Square, or Shopify Payments.

Instead of forcing merchants into rigid rules, HighRiskPay focuses on risk alignment matching businesses with acquiring banks that are comfortable with their transaction patterns.

Industries commonly approved

-

CBD and supplements

-

Adult content and dating platforms

-

Coaching, info products, and memberships

-

Forex, crypto, and Web3 services

-

International eCommerce and dropshipping

-

Travel, ticketing, and digital services

This specialization matters in 2026, because generic processors prioritize automation over nuance.

How HighRiskPay’s Approval Process Works (Explained Simply)

Unlike low-risk processors that auto-approve or auto-reject, HighRiskPay uses manual + data-assisted underwriting.

Step 1: Business risk mapping

They review:

-

Business model logic

-

Fulfillment and refund structure

-

Marketing channels

-

Expected transaction volume

-

Past processing history (if any)

This step determines where your business fits, not whether it deserves approval.

Step 2: Acquiring bank matching

Instead of using one sponsor bank, HighRiskPay works with multiple acquiring partners, increasing approval odds and long-term stability.

Why this matters in 2026:

Single-bank accounts fail more often because one policy change can shut you down overnight.

Step 3: Conditional approval terms

Most accounts launch with:

-

Rolling reserves

-

Volume caps

-

Short settlement delays

These controls are gradually relaxed as the account proves stable.

Pricing Structure in 2026: What to Expect and Why

High-risk pricing reflects risk insurance, not greed.

Typical HighRiskPay cost ranges

-

Transaction fees: ~4%–7%

-

Per-transaction fee: $0.20–$0.50

-

Monthly fee: $20–$50

-

Rolling reserve: 5%–10% (time-based release)

Why cheaper processors fail high-risk merchants

Low fees usually mean:

-

Aggregated accounts

-

Zero underwriting

-

Automated shutdowns

-

No chargeback defense

Expert takeaway:

Stability is cheaper than restarting payment infrastructure every 3 months.

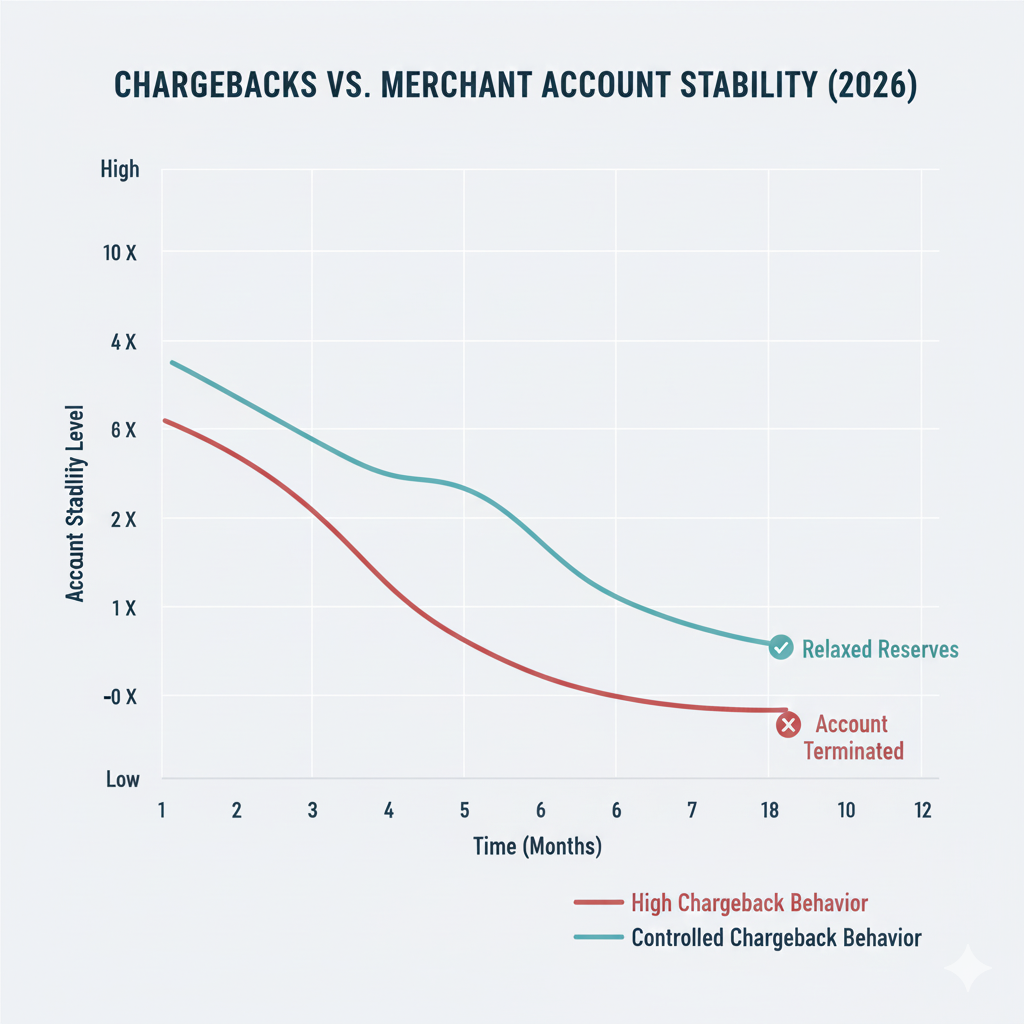

Chargeback Control: The Real Differentiator

In 2026, chargebacks are less forgiving. Accounts can be reviewed or restricted before thresholds are exceeded.

How HighRiskPay approaches chargebacks

-

Early dispute alerts

-

Pattern analysis instead of generic templates

-

Guidance on billing descriptors and refund timing

-

Compatibility with external dispute tools

This proactive stance matters because banks now evaluate behavior trends, not just raw percentages.

HighRiskPay vs Other High-Risk Merchant Account Providers (2026)

HighRiskPay vs PaymentCloud

-

HighRiskPay is stronger for international and digital businesses

-

PaymentCloud suits US-based merchants with simpler operations

HighRiskPay vs PayKings

-

high risk merchant account at highriskpay.com offers broader industry tolerance

-

PayKings is more rigid but predictable for established brands

Summary:

HighRiskPay favors flexibility and global reach, while competitors often prioritize conservative approval.

Pros and Cons (Unfiltered)

Advantages

-

Higher approval rates for complex businesses

-

Multi-bank routing improves longevity

-

Strong international and digital support

-

Better handling of subscription risk

Limitations

-

Fees higher than low-risk processors

-

Reserves are common

-

Not ideal for businesses that are clearly low risk

Who Should Use HighRiskPay in 2026

Best for:

-

Subscription-based businesses

-

High-ticket digital services

-

Cross-border sellers

-

Merchants previously shut down

-

Regulated or gray-area industries

Not ideal for:

-

Local retail stores

-

Cash-on-delivery businesses

-

Startups without a website or documentation

Common Questions (2026 Edition)

Is HighRiskPay safe to use?

Yes. It operates with licensed acquiring banks and standard compliance controls.

How fast is approval?

Usually 2–5 business days, depending on risk complexity.

Can accounts be shut down later?

Yes but risk is lower than with aggregators if chargebacks are managed correctly.

Does HighRiskPay support international cards?

Yes. Multi-currency and cross-border acceptance is a core strength.

High-Risk Payment Trends Shaping 2026

-

Predictive risk scoring replacing static rules

-

Faster settlements improving cash flow

-

Subscription models under stricter review

-

Merchants prioritizing stability over lowest fees

-

Increased reliance on alternative payment methods

HighRiskPay’s structure aligns well with these shifts.

Final Verdict: Is HighRiskPay Worth It in 2026?

If your business operates in a regulated, international, or subscription-driven environment, high risk merchant account at highriskpay.com offers something more valuable than low fees continuity.

In high-risk payments, the real cost isn’t processing rates.

It’s downtime, frozen funds, and repeated shutdowns.

2026 expert conclusion:

HighRiskPay is best for merchants who want a long-term processing relationship, not a temporary workaround.