Health insurance remains one of the biggest financial and administrative challenges for freelancers in 2026. Unlike traditional employees, freelancers must independently navigate complex insurance systems, forecast income accurately, and absorb rising healthcare costs without employer subsidies. As healthcare inflation continues globally and freelance work expands across borders, choosing the right plan is no longer just about compliance, it’s about long-term financial resilience.

This updated 2026 guide breaks down how freelance health insurance actually works, compares real-world plan options, explains why costs differ, and shares practical cost-reduction strategies used by experienced freelancers. It covers the Netherlands, the United States, and international freelancers, with insights based on current policy trends and insurer behavior as of 2026.

Why Health Insurance Is Structurally Different for Freelancers

For freelancers, health insurance risk is individualized, not pooled by an employer. This creates three structural differences:

-

Higher price sensitivity: Premiums directly compete with rent, tools, and taxes.

-

Income volatility risk: Subsidies, deductibles, and penalties often depend on annual income estimates.

-

Coverage gaps: Switching countries, contracts, or income levels can leave freelancers temporarily uninsured.

Understanding these dynamics helps explain why some plans look cheap but cost more over time and why others are strategically better even if premiums are higher.

Legal Health Insurance Requirements (Updated for 2026)

Freelancers in the Netherlands (ZZP’ers)

In the Netherlands, basic health insurance (basisverzekering) remains mandatory in 2026 for all residents and working freelancers. Enforcement has tightened in recent years due to rising uninsured rates among self-employed workers.

Key legal points (2026):

-

You must enroll within 4 months of registering with the municipality.

-

Failure triggers fines and forced enrollment by CAK.

-

Coverage is standardized by law price and service quality are the real differentiators.

What basic insurance covers (unchanged, but cost pressure rising):

-

GP and hospital care

-

Prescription medication

-

Maternity care

-

Mental healthcare (including psychologist referrals)

2026 cost reality (average):

-

Monthly premium: €152–€158

-

Mandatory deductible: €385 (voluntary deductible up to €885)

-

Income-related contribution: ~5.4% (paid via tax)

Expert insight: In 2026, insurers increasingly steer patients toward contracted providers to control costs making policy type more important than ever.

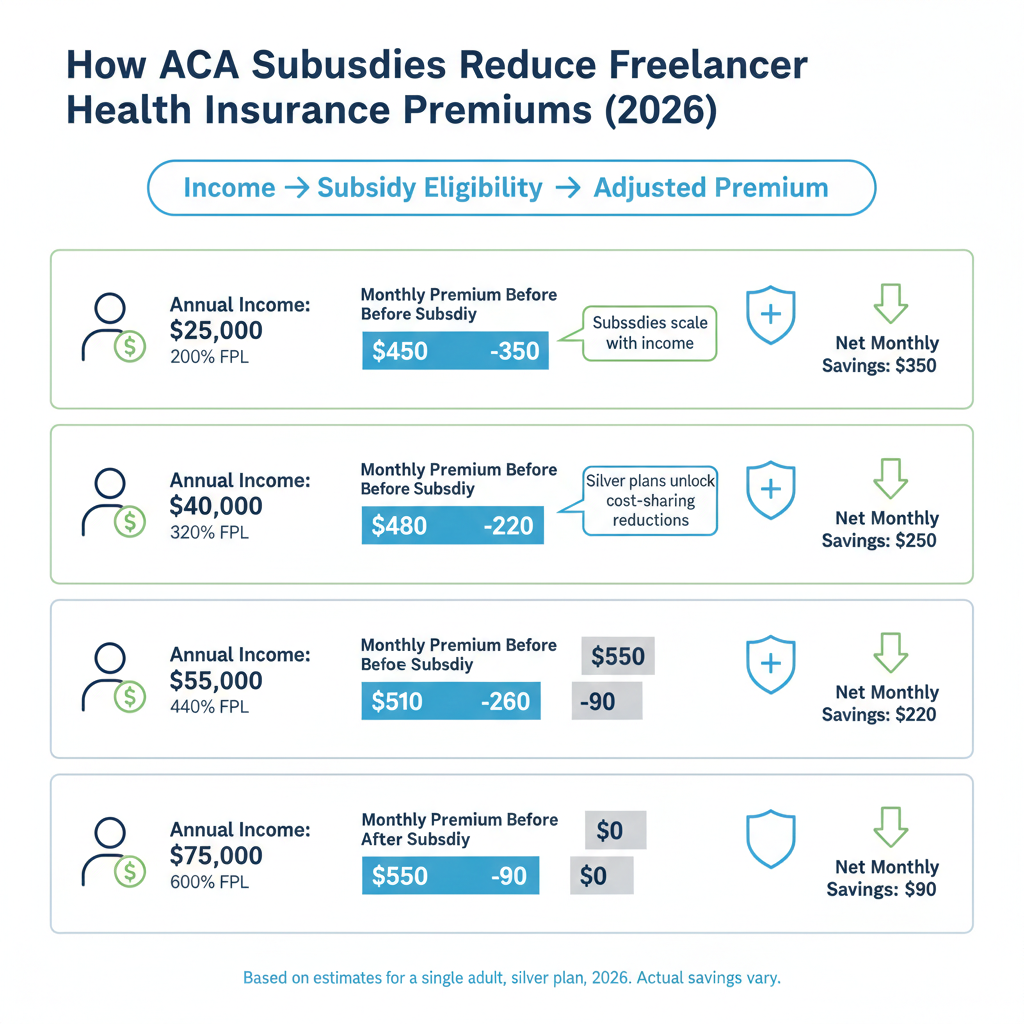

Freelancers in the United States

The U.S. remains fragmented, but ACA marketplaces are more stable in 2026 due to extended subsidy frameworks and insurer participation.

Important 2026 updates:

-

Federal mandate penalty remains zero.

-

State mandates still apply (CA, MA, NJ, RI, DC).

-

ACA subsidies continue beyond 400% FPL due to expanded income caps.

Main coverage paths:

-

ACA Marketplace plans

-

Private insurers

-

Freelancer collectives (Opolis, Freelancers Union)

-

Spouse or domestic partner plans

-

COBRA (short-term, usually expensive)

Expert insight: ACA Silver plans remain the “sweet spot” for most freelancers earning $30k–$55k due to cost-sharing reductions.

Health Insurance Plan Types Explained (With Strategic Use Cases)

1. Dutch Policy Types: What Actually Changes

Policy Type |

Best For |

Trade-Off |

|---|---|---|

Naturapolis |

Budget-focused freelancers |

Limited provider choice |

Restitutiepolis |

Those needing specialist freedom |

Higher premiums |

Combination |

Balanced users |

Mid-range pricing |

2026 trend: Naturapolis premiums are rising slower than Restitutie, but access restrictions are increasing.

2. ACA Metal Tiers (U.S.)

Tier |

Who Should Choose It |

Why |

|---|---|---|

Bronze |

New freelancers |

Lowest monthly cost |

Silver |

Moderate income |

Best subsidies |

Gold |

Chronic conditions |

Lower out-of-pocket |

Platinum |

Rare use case |

High cost, minimal risk |

2026 insight: Gold plans are increasingly cost-effective for freelancers using mental health or ongoing care.

3. Short-Term Plans (Use With Caution)

Short-term insurance still exists in some U.S. states, but in 2026:

-

Excludes pre-existing conditions

-

No maternity or mental health coverage

-

Increasing regulatory scrutiny

Best used only as a temporary safety net.

4. International Health Insurance (Digital Nomads)

Popular providers in 2026:

-

Cigna Global

-

Allianz Care

-

IMG Global

-

SafetyWing (Nomad-focused)

Why international plans cost more:

They price in cross-border risk, private hospitals, evacuation, and currency volatility.

5. Freelancer Group & Cooperative Plans

Organizations like:

-

Opolis (U.S.)

-

Freelancers Union

-

IPSE (UK)

offer group leverage, but coverage varies significantly by state.

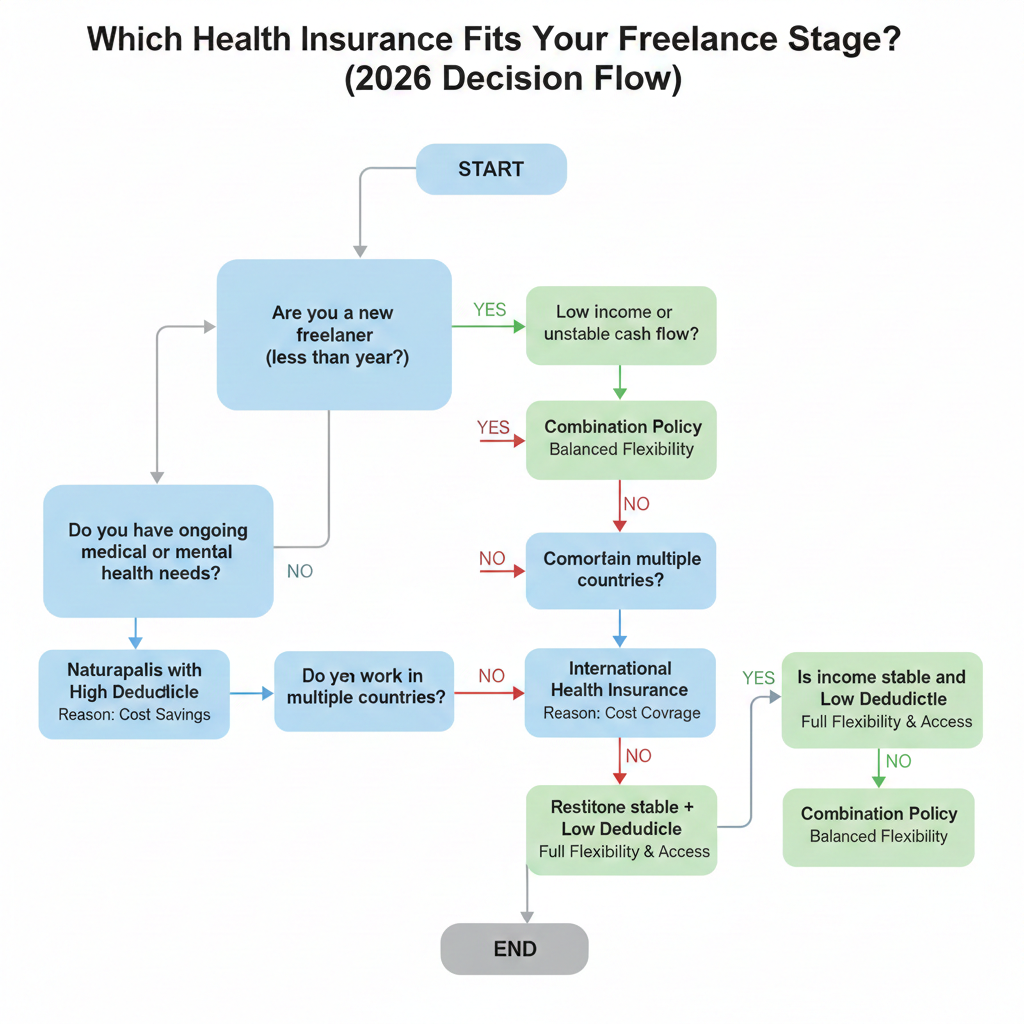

How to Choose the Best Plan (Expert Framework)

Step 1: Map Health Usage, Not Just Risk

Ask:

-

How often do I realistically visit doctors?

-

Do I need mental health or prescription coverage?

-

Do I travel internationally?

Frequent users benefit from lower deductibles, not cheaper premiums.

Step 2: Understand True Annual Cost

Netherlands (2026 example):

-

Premium: €156 × 12 = €1,872

-

Deductible (used): €385

-

Net after zorgtoeslag: often 30–70% lower

U.S. (2026 example):

-

Premium: $420/month → $5,040/year

-

Subsidy: −$2,100

-

Effective cost: ~$245/month

Step 3: Network & Portability

-

Dutch freelancers should verify contracted hospitals.

-

U.S. freelancers should confirm out-of-state coverage.

-

Nomads should confirm emergency evacuation clauses.

Smart Cost-Saving Strategies (That Actually Work)

1. High Deductible + Safety Buffer

Works best if you:

-

Have emergency savings

-

Rarely visit doctors

2. Skip Add-ons Strategically (NL)

Dental and physiotherapy add-ons often cost more than paying out-of-pocket.

3. Annual Switching (NL Advantage)

Switching insurers yearly can save €150–€300, as loyalty discounts are rare.

4. Use Telehealth First

In the U.S., telehealth reduces deductible impact and is often fully covered.

Step-by-Step Enrollment (2026)

Netherlands

-

Register with municipality

-

Receive BSN

-

Compare on Zorgwijzer / Independer

-

Enroll online

-

Register with GP

United States

-

Estimate annual income conservatively

-

Apply on Healthcare.gov

-

Compare subsidy-adjusted prices

-

Verify documents

-

Pay first premium

Real Freelancer Scenarios (Updated)

Anna (NL, 2026)

Uses Naturapolis + €885 deductible. Net cost after zorgtoeslag: €8/month.

Mike (US)

Silver ACA plan with CSR benefits. Effective deductible reduced by 40%.

Sara (Nomad)

International plan with evacuation coverage essential after 2025 Southeast Asia policy tightening.

Jorge (CA)

Bronze ACA + telehealth saves ~$2,000 annually during early freelancing stage.

FAQs Freelancers Ask in 2026

Can I change plans mid-year?

Only after qualifying life events.

Is health insurance tax-deductible?

U.S.: Often yes

NL: No, but allowances apply

What if I earn more than expected?

U.S.: You may repay part of subsidies plan conservatively.

Final Thoughts: Choosing Health Insurance as a Freelancer in 2026

Health insurance for freelancers is no longer a checkbox, it’s a financial strategy. The best plans are rarely the cheapest upfront; they’re the ones aligned with your income volatility, health usage, and geographic flexibility.

By understanding how insurers price risk, how subsidies actually work, and where freelancers overpay unnecessarily, you can protect both your health and your independence.

As freelance work continues to grow globally in 2026, informed insurance decisions are becoming a core professional skill not an afterthought.