What is Chime Alternatives?

There are more mobile banking software options besides Chime. Look into other and competitive choices. Customer service is an additional crucial feature to take into account when looking into Chime alternatives. N26 Bank Account, MX, STARLING, and BankWorld Mobile are among the products on our list of alternatives and rivals to Chime that reviewers deemed to be the finest overall.

The greatest checking accounts available just online don’t have any fees. Online banking is simple because to free ATM access and mobile deposit.

If you’re like the majority of people, you no longer frequently enter banks. You no longer need to monthly check deposit because of direct deposit. You can use a mobile app to deposit a paper check if you do.

You most likely use online bill pay when you need to pay a bill. Additionally, if a paper check is needed, the online bank will send one without charge. For making cash deposits, a nearby bank is still required. Otherwise, the majority of your financial needs can be met via online checking accounts. Chime is a well-known digital app with outstanding technology and a high APY. But Chime is a financial technology firm, not a bank.

List of 12 Best Chime Alternatives

For those who are unable to obtain a standard bank account due to a poor ChexSystems score, Chime offers a fantastic alternative banking choice.

Chime does have certain limitations, though. Review the best Chime substitutes in the list below.

1. Ally Bank:

Initially known as GMAC, General Motors’ banking division was known as Ally. Ally is currently a full-service online bank with affordable rates. Ally offers a savings account APY that is comparable to Chime’s, but they also offer to check account interest.

Additionally, Ally offers paper checks, whereas Chime does not, in contrast. As a Chime account holder, your sole choice if you need to utilize a conventional paper check is to have a pre-printed check shipped to the receiver from Chime corporate headquarters, which can take some time.

Ally provides IRA retirement accounts, money market accounts, certificates of deposit (CDs), house, vehicle, and personal loans, in addition to spending and savings accounts.

2. LendingClub:

Like Chime, LendingClub Banking is an online financial technology startup that provides checking accounts for both individuals and businesses. Worldwide free ATM rebates are endless. Additionally, you can get interested in up to 0.15 percent APY. Each account includes a debit card, and paper checks are offered without charge. After all, there are still situations where writing a check is necessary.

Currently, checking account options for both personal and business use are available through LendingClub Banking. The Rewards Checking account offers the most rewards. There is no monthly maintenance cost and only a $100 down payment is required.

You might enjoy the LendingClub Banking Tailored Checking account if you run a business. You may pay your bills online for free, and there are no ATM costs either. The $10 monthly account fee is waived when you maintain a $5,000 balance, and you receive 0.10 percent APY on the full balance.

3. Cash App:

Like Chime Bank, Cash Software is a terrific app if you’re seeking a straightforward smartphone application that will enable you to send and receive money as well as invest your money.

Download the Cash App, register, and you may move money instantaneously, expedite deposits, and even invest as little as $1 in stocks and bitcoin.

Additionally, Cash App offers its users a debit card tailored to their needs so they can spend their money in any way they like.

Cash App has evolved from being a simple money transfer tool to a flexible financial tool that may help you better manage your finances.

4. Bank5 Connect:

Online bank Bank5 Connect is a little-known institution. It is a branch of BankFive, a community bank with roots in Massachusetts and Rhode Island that was founded in the middle of the 19th century.

Except for residents of Massachusetts and Rhode Island, Bank5 Connect is accessible nationwide and provides high-yield checking, savings, and CD accounts. Your first order of paper checks is free, and there are no minimum balance restrictions or monthly maintenance costs.

The SUM ATM network, which has hundreds of free locations, includes Bank5 Connect. The bank reimburses up to $15 in monthly ATM costs and does not impose fees for using out-of-network ATMs.

Although Bank5 Connect is a banking institution that is a member of the FDIC, its accounts are also insured by the Massachusetts Depositors Insurance Fund (DIF), meaning deposits are fully safeguarded rather than simply up to the typical $250,000 limit.

For checking or savings accounts, a $10 minimum opening deposit is required, while a $500 CD opening deposit is required.

5. Varo app:

Every customer of Varo is treated equally and has access to all of their services and features thanks to their bank account, which has no monthly fees, overdraft fees, or ATM costs.

Along with a current account, they also provide a savings account with an APY of up to 3%, a $100 advance, and a program for building credit. Hence, quite comparable to Chime.

A Varo Savings Account has no minimum balance requirement, in contrast to several traditional banks. To start earning money with your online savings account, you only need $0.01.

The Federal Deposit Insurance Corporation (FDIC) insures any funds in your Varo Bank account, including checking and savings, up to $250,000 in total. Your high-yield savings account deposits and any interest you receive are both covered by the FDIC.

Cash deposits and bank account transfers are both accepted at 90k+ Green Dots. You may manage all the additional financial accounts that you link to the Varo app using the open banking function.

The Varo app is easy to use and comprehend, making it simple to access and integrate each function into your regular personal banking. Varo provides a variety of cutting-edge budgeting tools in addition to the traditional financial components like transfers and transactions to assist users to maintain control over their funds.

6. Synchrony Bank:

Customers of iOS and Android devices give Synchrony Bank’s mobile banking app good marks, maybe because it may be used for more than just making payments, depositing checks, and starting transfers. You may also use it to keep tabs on your credit card balances and usage. Customers who open CDs, high-yield savings accounts, and money market accounts, both of which come with an optional ATM card, benefit from competitive APY rates. Savings and money market accounts at the bank don’t have any minimum balance requirements. ATM usage in the MoneyPass and Co-op networks is fee-free.

Strong security methods are used by Synchrony, which provides browsers with 128-bit high encryption, multi-factor authentication to confirm customers’ identities, round-the-clock security monitoring, and free identity theft resolution.

7. Capital One 360:

In addition to checking and savings accounts, business and commercial bank accounts, and vehicle loans, Capital One 360 provides competitive banking solutions.

Chime is inferior to Capital One in several ways, yet it offers a slightly better savings APY than Capital One 360 Savings.

To begin with, Capital One users have access to “branch” locations using Capital One Cafes and can deposit cash into their accounts without incurring any fees.

The only Chime substitute this author has used personally that matches or exceeds Chime’s technology in terms of app simplicity, user-friendliness, and security is Capital One.

8. Acorns:

Through its Acorns Spend product, Acorns provides an online checking account with a debit card. Additionally, there are over 55,000 automatic savings transfers and fee-free ATMs.

It’s possible to keep your spending money and investing money in the same place because Acorns is a micro-investing program.

The app includes the ability to round up your purchases and invest the difference. Acorns also invest the rewards from your online purchases. It is simple to invest tiny amounts of money thanks to these characteristics.

To open an Acorns Spend account, you must pay $3 per month. The Acorns Later IRA retirement account and the standard Acorns Core investment program are both available to you. You can also set up investment accounts for your kids for $5 each month.

Your bank account balance won’t be invested by Acorns. On the other hand, you can annually have Acorns invest your spare cash.

Assume for the moment that you already pay $1 each month for Acorns Core. If so, the Acorns checking account costs $2 extra. Additionally, using the Acorns Later IRA costs just $1 extra each month.

A drawback is having to pay a monthly service fee. You receive limitless free ATM access in exchange. If you now regularly pay ATM fees, this benefit covers the monthly $3 fee on its own.

9. Dave:

Like Chime Bank, Dave is one of the most flexible apps since it offers banking services like simple money transfers via mobile apps, but it also assists users with cash advances, budgeting, and even creating financial chances.

With Dave, you may improve your credit history and receive payments up to two days faster than with traditional banks.

Additionally, Dave provides fee-free advances up to $250 that you can repay. Additionally, Dave is fantastic since there are no overdraft fees, no costs for maintaining a minimum balance, and just a minimal price to use Dave’s debit card at practically any ATM.

Remember that you won’t even incur any fees when using any of the 32,000 MoneyPass ATMs in the USA to withdraw cash using Dave’s debit card.

In addition, Dave has included helpful charts, graphs, and reports that will help you budget more effectively. However, Dave’s app also allows you to search for a side job, which is a novel way to supplement your income even if you have full-time work.

10. MoneyLion:

Through MetaBank, a partner financial institution, MoneyLion, a personal finance app, offers a virtual bank account and an investing account.

The RoarMoney account, the company’s primary banking service, is an all-in-one account with early direct deposit, daily spending rewards, up to $1,000 in annual price protection, and an integrated spending tracker.

RoarMoney is primarily a free account with a tiny $1 monthly cost. At Allpoint ATMs, there are no costs associated with cash withdrawals, minimum deposit requirements, ACH transfers, international transactions, or card replacements.

You can select an investment plan based on your financial objectives, and there are no fees associated with portfolio management.

11. Current:

This following online bank is a good substitute for Chime as well. Its black Visa debit card, which was launched in 2015 and is in the hands of every well-known influencer, has been taking over social media.

With all the jokes aside, Current provides a dependable checking account solution intended to speed up and simplify the banking process while also enabling users to control their finances more precisely. There are many factors in Current’s favor. They provide a free account as well as a Premium membership for a $4.99 monthly cost. You can access early direct deposits and receive the unmistakable black card with the Premium account. You also receive three savings accounts as opposed to only one.

When you receive a qualifying direct deposit and enable Overdrive while using Current Premium, you are also eligible to overdraw up to $100 without being charged an overdraft fee. The only restriction is that you must receive at least $500 each month in direct deposit from your employer.

Instant gas hold removal is the most intriguing function that Current can give. I am aware that the removal of this authorization by gas stations occasionally takes up to 72 hours. However, I didn’t believe it to be a problem that would make it a selling point for online banks.

12. GO2Bank:

The Chime Bank app is very similar to GO2Bank’s focus on offering the best mobile banking solution, but it comes with extra features like the ability to deposit cash at a nearby store, cash a check from the app, earn an instant cashback of 7%, and even save money at a rate that is significantly higher than what national banks offer.

The GO2Bank account allows you to keep your money secure, utilize it to raise your credit score, and yet have access to a Visa debit card that you can use every day without having it reflect negatively on your credit history.

GO2Bank also offers programs like no monthly fees, no additional costs, and no account opening minimum balance restrictions. Additionally, they offer up to $200 in overdraft protection, and you can even receive payment earlier (up to four days earlier).

Conclusion:

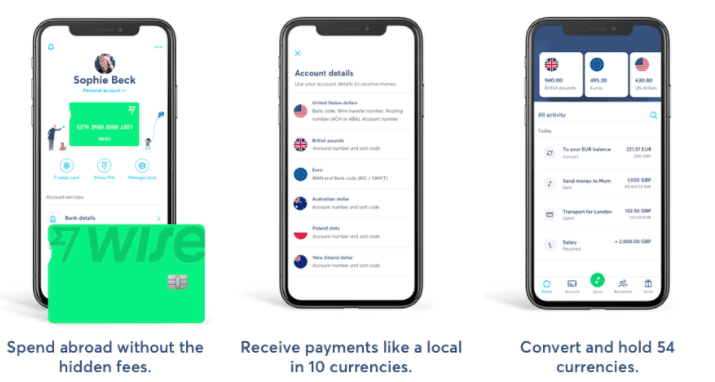

Chime Bank offers much more advantages than a typical bank. You can choose an app to suit your banking and financial demands among the various options available. Wise, which is incredibly adaptable, enables users to hold several currencies in one account, and even includes a savings option to keep your money secure, is one of the top apps like Chime Bank.

It’s vital to check out each of these applications to determine which one would be most useful to you because each one of them has at least one distinctive feature that might be just what you’re searching for.