In this article, we’ll talk about the top TradingView alternatives. TradingView is an online stock picker and screener for inexperienced and seasoned active traders. You can incorporate several cloud-based charting tools for study purposes. Users can collaborate and share resources with other online dealers.

This online trading analysis tool includes a stock screener, an HTML5 chart viewer, a sizable knowledge base, and other features. However, this tool has several limitations, including the inability to be utilized offline and limited deep backtesting. Here is a list of the best alternatives to TradingView that has been thoroughly vetted.

What is TradingView?

Popular online trading and investing platform TradingView offers sophisticated charting tools, technical analysis, and real-time market data. It provides a simple user interface for monitoring financial markets, analyzing price changes, and exchanging trading concepts with other users. TradingView is a flexible tool for inexperienced and expert traders to make informed trading decisions because it covers various financial assets, including stocks, cryptocurrencies, FX, and commodities.

Pros and cons:

Pros:

- Tools for Advanced Charting: TradingView is helpful for traders relying on technical analysis because it provides a broad selection of technical analysis tools and indicators.

- Actual data: The platform offers real-time and streaming market data for various financial instruments, assisting traders in keeping track of price changes.

- Friendly User Interface: Both novice and seasoned traders will find TradingView’s interface user-friendly and adaptable.

- Social and communal characteristics: Users can collaborate and learn by exchanging trade concepts, charts, and analyses with a vast and vibrant community.

- Access across platforms: Because it can be accessed on mobile apps and computer browsers, traders can access their accounts anywhere.

- Paper Exchange: Users can practice trading with TradingView’s paper trading function without putting any real money at risk.

Cons:

- Cost: TradingView provides a free version, but many more sophisticated features and data sources demand a membership, which might be pricey for specific users.

- Little Basic Information: TradingView generally focuses on technical analysis. Thus, there won’t be much access to fundamental data like financial statements and economic indicators.

- Learning Spiral: There may be a learning curve for beginners with more complicated features and charting tools.

- Need for more Robust Backtesting: Although it provides backtesting capabilities, some traders might find them less effective than those provided by specialized backtesting software.

- Required Internet Connection: TradingView depends on an internet connection; problems may arise when the network is down or otherwise disrupted.

Features:

- A full range of charting tools, including different chart styles (candlestick, bar, line, etc.), drawing tools, and several technical indicators for in-depth technical analysis are offered by TradingView.

- Users can access real-time and streaming market data for various financial assets, including equities, cryptocurrencies, FX, commodities, and more.

- The platform enables users to design workspaces relevant to their trading requirements and includes various charts, watchlists, and data streams.

- Traders may engage with one another by exchanging charts, trading ideas, and analysis with a lively community. They can also imitate other traders and pick up trading tips from them.

Best Tradingview Alternatives

Here is a brief list of the top TradingView substitutes and TradingView competitor websites for 2023.

1. CryptoView:

Similar to a seasoned fund manager for cryptocurrency, CryptoView. With this comprehensive portfolio management and trading software, users may easily connect with all 15+ exchanges in one convenient location. With CryptoView, you can monitor your balances and trading history in one location and sync your portfolio and trade history with all platforms.

You can use a range of tools from CryptoView to study the cryptocurrency market. With 75 different indicators and charting tools, you can sync data from many exchanges. Additionally, it contains sophisticated features that will protect your cash during volatile periods.

One advantage of managing your portfolio is that you only need a glance to see where you stand. In addition to giving balance information from all associated wallets, exchanges, and accounts, CryptoView assists you in achieving this goal. Share this quick-access portfolio with your contacts, customers, or coworkers.

2. Pionex:

Pionex is a TradingView substitute that has gained much attention in recent years due to its several advantages for traders. Their software not only lets you follow the cryptocurrency market, but they also act as an exchange and offer trading bots. Up to 346 coins can be monitored, and they’ve teamed up with organizations like Circle, Binance, Coinfirm, and more. It’s one of the best trading tools for crypto enthusiasts and is readily available with both a desktop and a mobile version. To help you get the most out of their platform, Pionex also offers many tutorials, and they constantly seek to improve the value they bring to their clients.

The only fee associated with trading on the platform is a 0.05% commission for spot trading. They are a business that cares about the community, giving traders access to a wealth of information they can use to make their own investments. Pionex is a top alternative for individuals who choose to concentrate on the cryptocurrency market while managing analysis and live trading simultaneously, even if some businesses offer in-depth trading perspectives across numerous markets.

3. TabTrader:

Only available for mobile devices, TabTrader is a mobile trading platform for cryptocurrency exchange. It is intended for those who have some prior trading experience.

Regular traders will benefit from it because by linking their accounts to TabTrader, they can keep track of all their stocks and maintain a portfolio that displays the activity of all their linked accounts. Additionally, TabTrader will offer data analysis, stock performance, and price information. Since it is a mobile app, you can enable a lock to stop unauthorized users from taking over your trading app.

For example, you can create your pairs and exchanges, and most of the app’s functions are DIY. Given how simple it is to register and track accounts using TabTrader’s services, it is one of the most popular portfolio trackers for cryptocurrency trading.

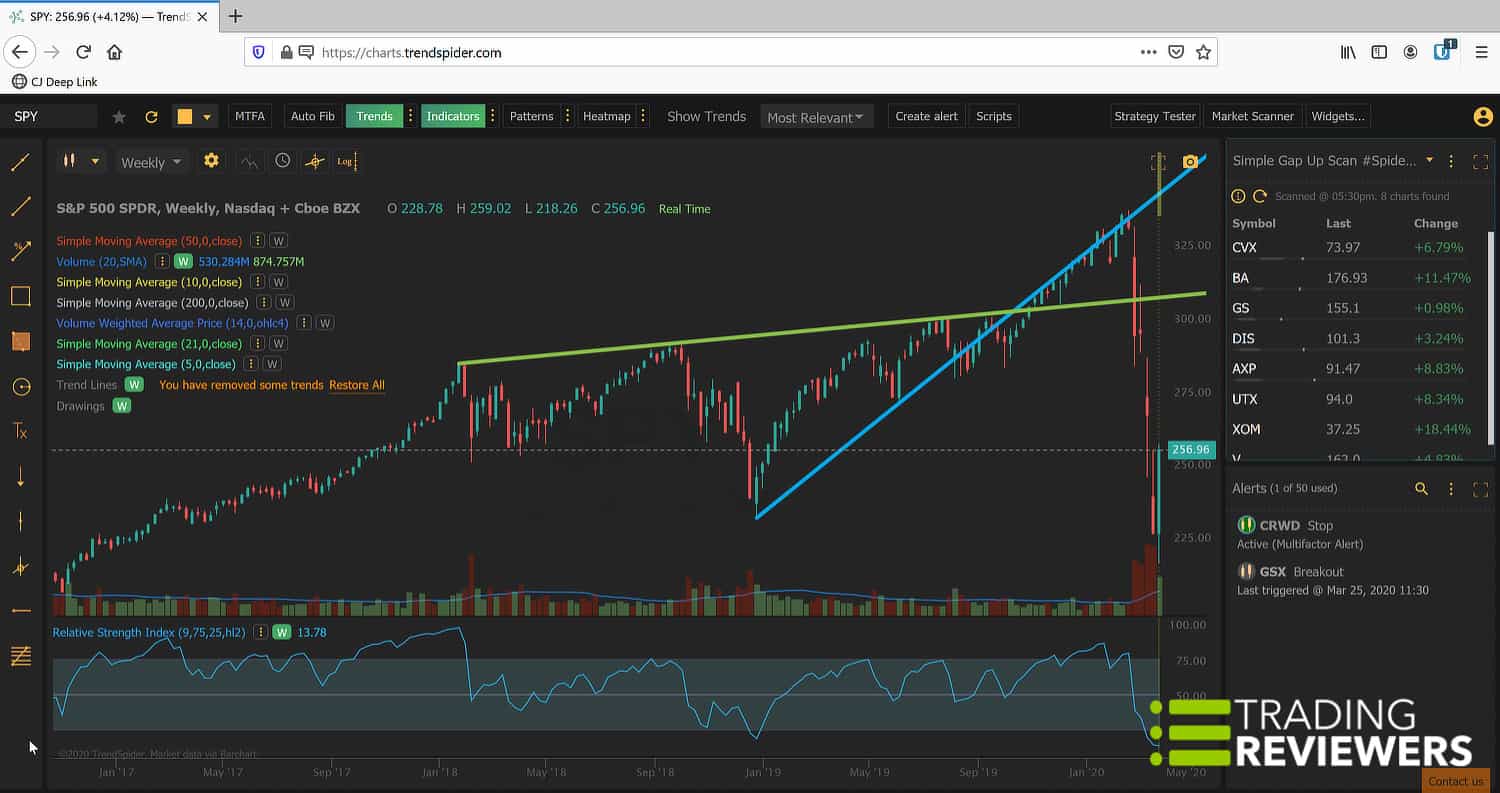

4. TrendSpider:

The best chart analysis program, TrendSpider, was created to assist you—whether you’re a beginner or an experienced trader—in making better-informed, effective trading decisions. You may anticipate a complete handle on the entire crypto market thanks to data coming from more than 150 cryptocurrency exchanges and 6500 trade pairings.

In addition, TrendSpider allows you to create stunning charts, automate the manual technical analysis you previously performed, and perform immediate backtesting using the data at hand.

Interestingly, compared to TradingView, which has cost thousands of dollars in the past, all these features are available at a much lesser cost and with a higher uptime.

5. GoCharting:

As its name suggests, GoCharting is a trading tool primarily focusing on generating sophisticated real-time charts. GoCharting is one of the few platforms with comprehensive coverage of the cryptocurrency sector, monitoring over 100 cryptocurrencies and 20,000 cryptocurrency pairs.

The GoCharting program can generate various charts, including imbalance charts, session, composite, and fixed volume profiles, all in real-time, to support one’s trading requirements. While tick-by-tick performance charting is the main focus of GoCharting, they also offer more than 150 indicators and drawing tools to supplement the use of charts in GoCharting.

GoCharting also automatically computes price ladders, DOM charts, market and volume profile charts, and other types of analysis. A user can draw any graph from the data because it employs the open-source Golang and its exclusive charting capabilities, including but not limited to the spline, line, and area graphs. This utility is a binary that works with any environment or library.)

GoCharting offers Silver and Gold subscriptions with added features like extra graphs compared to the free membership. These are very resource-intensive projects; revenue is required to keep the service functioning.

6. Tradelize:

Traders’ Network, Tradelize Terminal, and Tradelize Mobile App are the three apps that make up the Tradelize package. The Tradelize Traders’ Network is more of a social media platform than a platform for trading cryptocurrencies. It connects traders to discuss strategies for boosting trading earnings with novices and experts. A trader’s profile will be regularly watched to provide a rating that reflects the effectiveness of his trading style.

This is accomplished by adding an API key that links a trader’s account to the Tradelize Traders’ Network. Everyone on the network will gain from amateurs’ ability to observe and learn from professionals’ trading practices. It is similar to LinkedIn in many ways but for trading.

Like many terminals featured here, Tradelize Crypto Terminal enables trading from several well-known cryptocurrency exchanges and cryptocurrency trading pairings. Traders can quickly decide whether to conduct transactions in derivative and futures markets or on the spot using Tradelize Crypto Terminal.

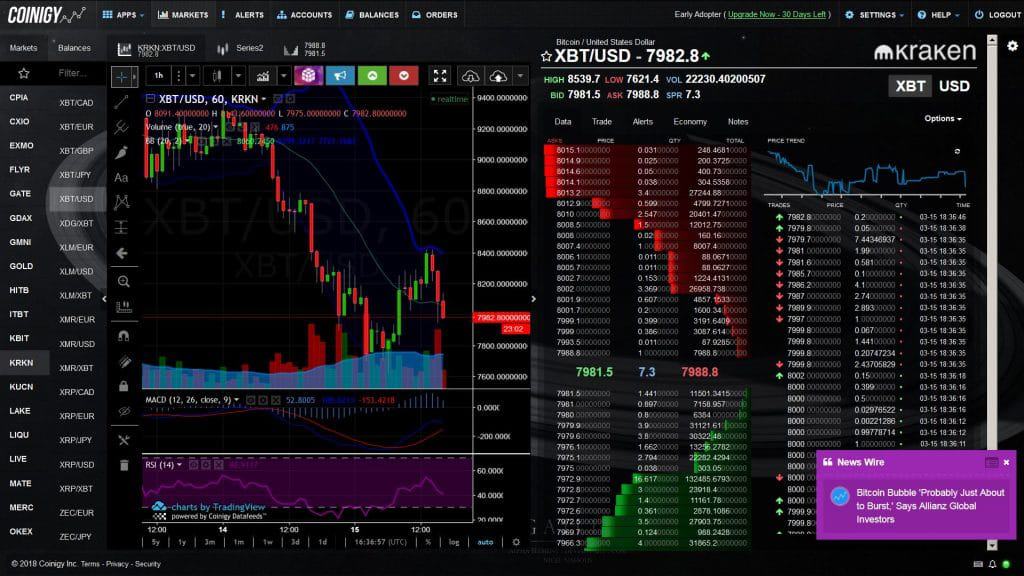

7. Coinigy

Additionally, Coinigy provides a wide range of indicators, chart makers, and real-time price updates. These data can be narrowed down to a specific period for monitoring. Indicators can also be created by the user and saved to the platform for later use, though Coinigy limits sharing such indicators.

It enables users to connect their trading accounts to Coinigy through an application programming interface (API). It offers a unified trading and investment planning system rather than requiring users to switch between separate sites to facilitate trading.

The ArbMatrix app and the Newswire website, which provides cryptocurrency news and updates, are two of Coinigy’s key features. ArbMatrix displays a grid-like representation of several exchanges of various traders to show traders the finest arbitrage chances. New users receive free accounts that provide them access to the provided indicators and charts for 30 days, but customers who purchase Coinigy’s Pro edition can prolong this access for as long as they choose. A year of subscription is less expensive than a single month.

Conclusion:

In conclusion, TradingView is a solid and straightforward online trading and investing platform. In addition to a wealth of features for technical analysis and decision-making, it provides:

- Cutting-edge charting tools.

- Real-time market data.

- A vibrant community for idea sharing.

- She advanced charting capabilities.

Although its price and emphasis on technical analysis may appeal to only some traders, it is a valuable tool for individuals looking to understand and analyze the financial markets well, thanks to its customizable interface, integrated brokerage options, and extensive library of indicators and tools.

FAQs:

Is it free to use TradingView?

In addition to a paid version with more complex features like extra indicators, data sources, and alert settings, TradingView also offers a free version with only the most basic functions.

Which financial markets is TradingView able to track?

TradingView supports various financial instruments, including stocks, cryptocurrencies, FX, commodities, indices, and more.

Is TradingView a direct trading platform?

You can conduct trades straight from the platform if TradingView is associated with your brokerage account.

What trading-view.com technical indicators are offered?

The extensive collection of technical indicators offered by TradingView includes moving averages, RSI, MACD, Bollinger Bands, and many more.

I’m Maxwell Warner, a content writer from Austria with 3+ years of experience. With a Media & Communication degree from the University of Vienna, I craft engaging content across tech, lifestyle, travel, and business.