Access to financing remains one of the most decisive factors in small business survival and growth. As of 2026, small business lending has entered a more complex but opportunity-rich phase shaped by post-rate-hike normalization, AI-driven underwriting, embedded finance, and performance-based lending models.

Unlike earlier years where credit score alone dictated approval, lenders in 2026 increasingly focus on cash-flow resilience, revenue predictability, and sector-specific risk models. This shift benefits many small businesses but only if owners understand how to navigate the modern lending ecosystem.

This guide to Small Business Loans: Best Options in 2026 goes beyond surface-level comparisons. It explains how and why lending decisions are made, compares real-world options, highlights current data-backed trends, and offers expert frameworks to help business owners choose financing that supports long-term stability not short-term survival.

Why 2026 Is a Defining Year for Small Business Financing

Several structural changes make 2026 different from previous lending cycles:

1. Interest Rates Have Stabilized but Borrowing Is Still Selective

After aggressive tightening in 2023–2024, interest rates have largely plateaued in 2025–2026. However, lenders are no longer competing on rate alone. Approval depends more on business fundamentals, not optimism-driven projections.

What this means:

Businesses with steady revenue and clean financial records can secure competitive terms, while weaker businesses face higher risk premiums.

2. AI Underwriting Is Now Standard, Not Experimental

By 2026, most fintech lenders and many banks use machine-learning underwriting models that evaluate:

-

Bank transaction data

-

Revenue volatility

-

Customer concentration risk

-

Expense discipline

-

Seasonal performance patterns

Why this matters:

A business with average credit but strong cash flow can now outperform a high-credit, low-margin business in loan approval decisions.

3. Embedded Finance Has Changed How Businesses Borrow

Platforms like Shopify, Square, Amazon, and PayPal now offer native financing based on sales performance.

Key difference from banks:

Loans are contextual and frictionless but often more expensive long-term.

4. Governments Are Targeting Productivity, Not Survival

New government-backed programs emphasize:

-

Automation

-

Export growth

-

Green upgrades

-

Workforce training

This marks a shift from pandemic-era relief toward economic competitiveness funding.

How to Compare Small Business Loans in 2026 (What Actually Matters)

1. True Cost of Capital (Not Just Interest Rate)

In 2026, APR alone is misleading. Business owners should calculate:

-

Origination fees

-

Weekly vs monthly repayment impact

-

Early repayment penalties

-

Revenue-based repayment upside cost

Expert insight: A 12% loan repaid daily can strain cash flow more than a 15% loan repaid monthly.

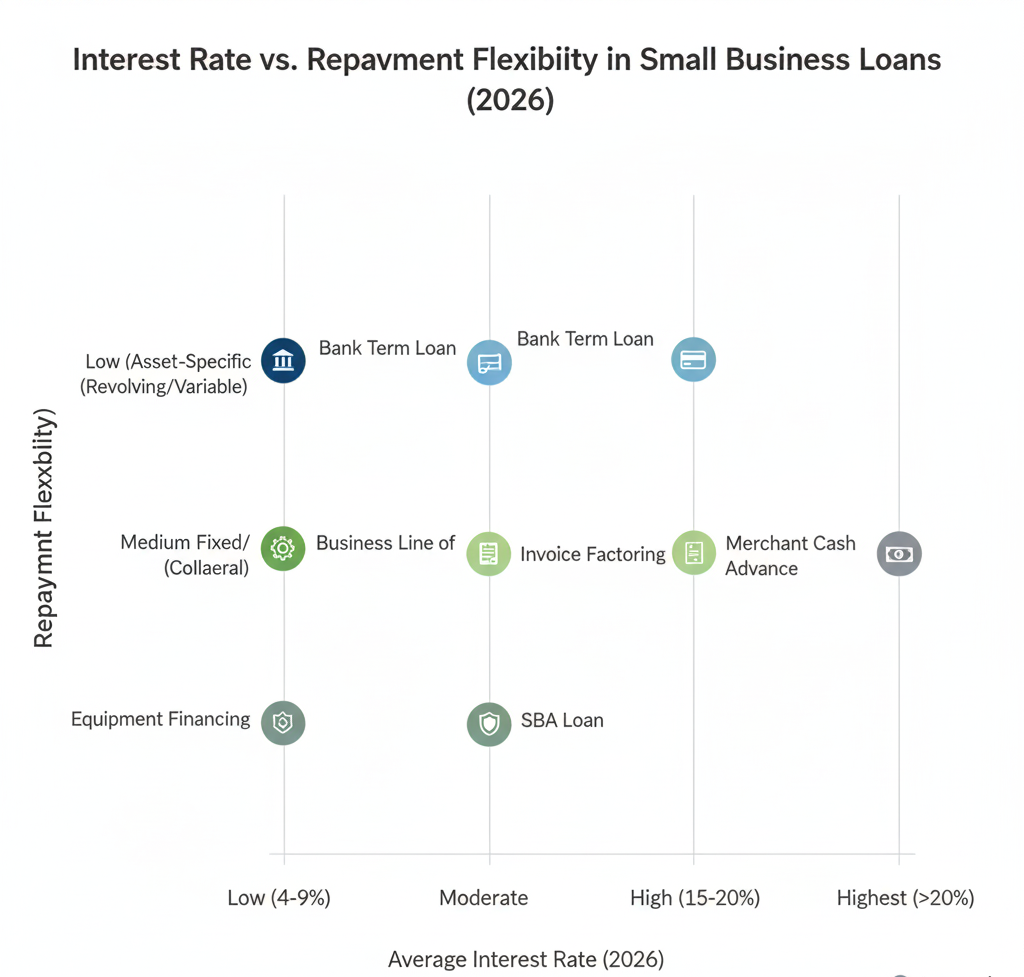

2. Repayment Alignment With Cash Flow

The best loan is one that matches how your business earns money.

Revenue Pattern |

Best Loan Type |

|---|---|

Seasonal |

Line of credit |

Predictable monthly |

Term loan |

High-growth SaaS |

Revenue-based financing |

Transaction-based |

Embedded finance |

3. Flexibility Under Stress

In 2026, lenders increasingly offer payment deferrals or restructuring, but only on certain products. Short-term loans and MCAs rarely offer flexibility.

Small Business Loan Types Explained (2026 Reality Check)

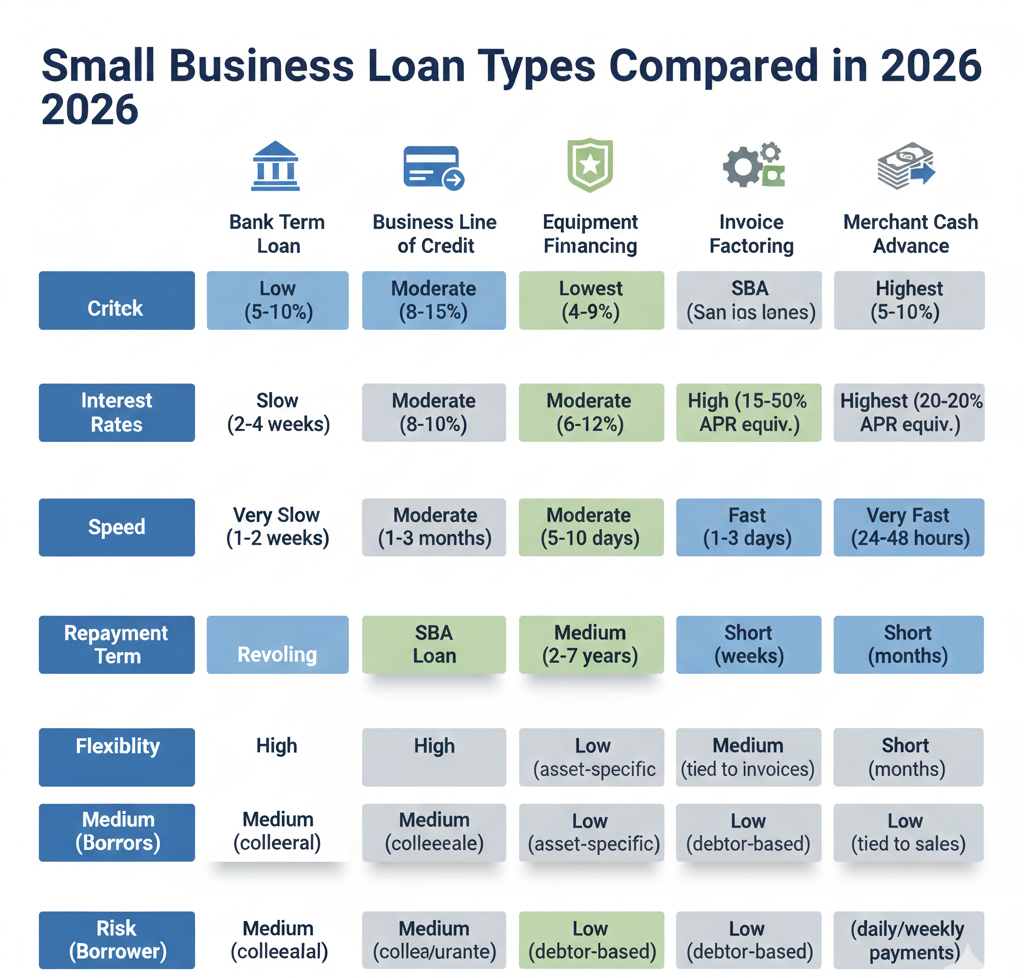

Term Loans

Best for: Expansion, acquisitions, real estate

-

Fixed structure, predictable payments

-

Rates typically 9%–14% for qualified borrowers

-

Strong underwriting required

Expert take:

Term loans reward discipline. Businesses with stable margins benefit most.

Business Lines of Credit

Best for: Working capital, cash gaps

-

Interest charged only on usage

-

Rates often higher than term loans

-

Revolving access is valuable in uncertain markets

Equipment Financing

Best for: Machinery, vehicles, automation

-

Asset-backed = lower risk for lenders

-

Often easier approval

-

Long-term ROI matters more than rate

Invoice Financing & Factoring

Best for: B2B companies with slow-paying clients

-

Improves liquidity fast

-

Effective but expensive

-

Can signal distress if overused

SBA & Government-Backed Loans

Best for: Established SMEs seeking low-cost capital

-

Long terms, lower rates

-

Documentation-heavy

-

Approval timelines still slow in 2026

Revenue-Based Financing (RBF)

Best for: SaaS, eCommerce, subscription models

-

Repayment tied to revenue

-

No fixed monthly burden

-

Can become costly during high-growth phases

Merchant Cash Advances (MCA)

Best for: Last-resort funding only

-

Extremely fast access

-

Very high effective APR

-

High default risk

Expert warning:

MCAs are liquidity tools not growth tools.

Best Small Business Lenders in 2026 (By Use Case)

United States

-

SBA 7(a) – Best for long-term, low-cost financing

-

BlueVine / OnDeck – Speed and flexibility

-

Bank of America – Traditional strength for established firms

Canada

-

CSBFP – Equipment and expansion-focused

-

BDC – Innovation and growth-stage financing

International & Cross-Border

-

Funding Circle – SME peer lending

-

Wise Business Financing – Trade-focused working capital

Emerging Lending Trends in 2026

-

Cash-flow-first underwriting

-

Green and ESG-linked loans

-

Sector-specific lending models

-

Embedded credit ecosystems

-

Dynamic pricing based on performance

Smart Loan Selection Framework (Expert Method)

-

Define why you need capital

-

Map repayment to cash flow reality

-

Compare total cost, not just APR

-

Stress-test repayment under low-revenue months

-

Prioritize flexibility over speed (unless urgent)

Risks Business Owners Still Underestimate

-

Overleveraging during stable revenue periods

-

Misjudging daily repayment impact

-

Accepting speed at the cost of long-term cash health

-

Using short-term debt for long-term investments

Alternatives to Loans in 2026

-

Government grants

-

Strategic equity

-

Crowdfunding

-

Supplier financing

-

Customer prepayments

Frequently Asked Questions (2026)

What is the best small business loan in 2026?

There is no universal best. SBA loans lead for cost, fintech for speed, and RBF for growth alignment.

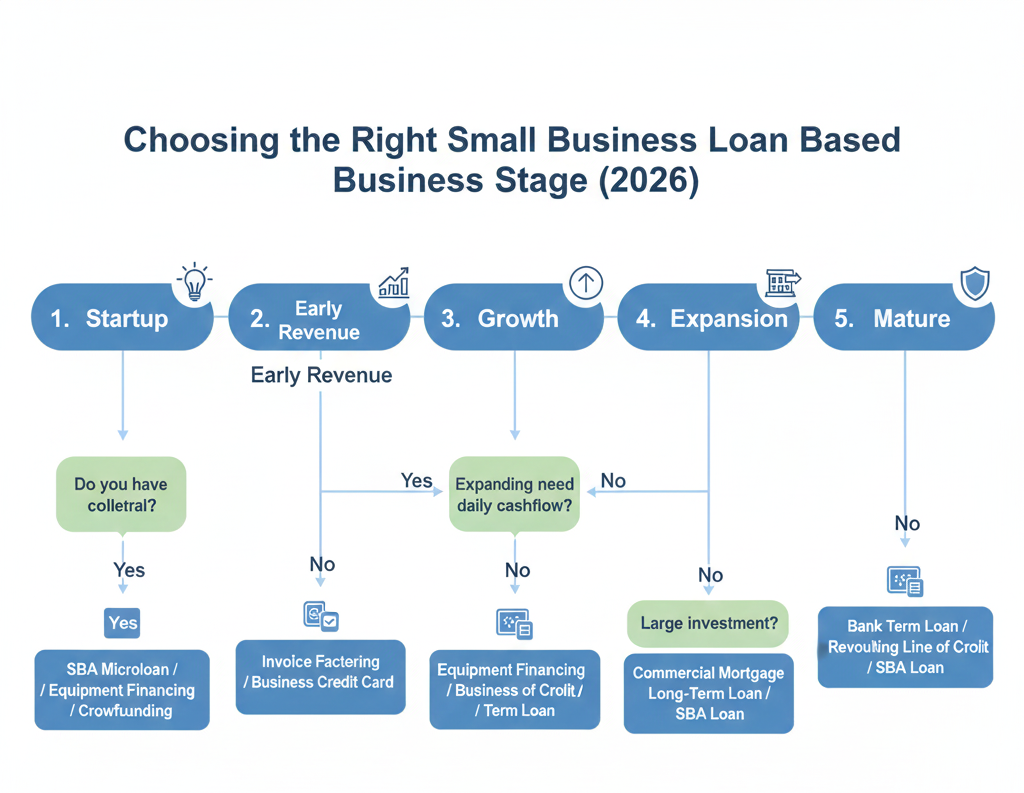

Can startups get loans without credit history?

Yes through microloans, RBF, or collateral-backed programs.

Is refinancing smart in 2026?

Only if it improves cash flow or flexibility, not just interest rate.

Final Thoughts

Small business financing in 2026 rewards preparation, transparency, and strategic thinking. The era of easy money is over but smarter money is available to businesses that understand how lenders think today.

By aligning loan structure with business fundamentals, entrepreneurs can turn financing from a risk into a growth accelerator.

This updated guide to Small Business Loans: Best Options in 2026 equips business owners with the insight needed to borrow responsibly and competitively in today’s evolving financial landscape.