Working with a forex prop firm allows you to practice your trading method using the company’s capital, which might result in substantially more significant returns than using only your cash. For traders with prior experience in the currency market, as well as sound risk management and a thriving trading plan, forex-funded accounts are valuable tools. These Forex proprietary trading companies typically impose an evaluation procedure, which frequently consists of a one- or two-step challenge. This test measures your skill as a forex trader and, upon passing, gives you access to a funded account. You are responsible for managing the Forex prop firm’s capital within this funded account, which sporadically reaches enormous sums exceeding a million dollars. The merchants’ profit-sharing agreement may be as lucrative as 90%. There are several prop trading companies as well, and they provide hassle-free immediate funding for Forex.

What are Prop Trading Firms?

Financial entities known as proprietary trading businesses, or “prop trading firms,” trade financial instruments such as stocks, bonds, commodities, currencies, and derivatives with their capital instead of on clients’ behalf. By utilizing market inefficiencies, price differences, and a variety of trading tactics, these businesses make money with their resources. Prop trading firms frequently use cutting-edge technology and algorithms to execute transactions quickly and effectively. These firms also employ professional traders. They can be very profitable, but because regulations and market swings govern them, they also come with inherent hazards.

How does it function?

Proprietary trading firms, often known as prop trading firms, invest their own funds in a variety of financial markets, such as stocks, bonds, currencies, and derivatives, to turn a profit. They frequently use cutting-edge technology and algorithms used by expert traders who build and implement trading strategies to analyze market data and make trading decisions. These businesses exploit price differences, market inefficiencies, and transient trading opportunities. Prop businesses may provide traders with a revenue cut, resulting in a performance-based compensation structure. Prop trading can be highly profitable, but it also entails dangers, which traders must successfully manage to survive in this cutthroat industry.

Which Forex prop company offers the most value?

Because costs and advantages differ, choosing the least expensive forex prop firm might take much work. According to the cost of the access charge for an account with $50,000 in funding, you may identify the most affordable prop businesses in this link. Examining the value provided in addition to the initial cost is critical. The emphasis should be on balancing affordability and the resources contributing to effective trading. A company may provide reduced commissions but need more resources, act unprofessionally, pay benefits on time, give lousy customer support, etc. You can choose a business that fits your budget and trading goals by evaluating them according to their cost structure, trading tools, capital availability, and support.

You may also check through our Prop Companies Discounts section to get the finest deals, discounts, offers, etc., that will enable you to save a lot of money when you buy the entry fees to the top prop companies’ challenges.

Pros and Cons:

Private trade companies have both benefits and drawbacks.

Pros:

- Gain Potential: Prop trading businesses can offer substantial profit opportunities because traders may receive a cut of the money made from profitable deals. Expert traders may benefit financially significantly from this.

- Independence: Prop companies’ traders frequently exercise greater independence and autonomy in their trading decisions than do institutional traders who manage client money. This may appeal to those who value having more control over their trading tactics.

- Getting to Resources: Trading professionals often have access to cutting-edge trading technology, data, research, and capital through prop trading businesses. This can help traders implement complex tactics and maintain a competitive market edge.

- Learning Setting: Prop businesses frequently provide a collaborative and instructive environment where traders can learn from experts. The development of trading techniques and methods may benefit from this.

- Multiple Markets: Traders can diversify their portfolios and adjust to shifting market conditions because of the many prop businesses that trade in various financial marketplaces.

Cons:

- Loss Prospect: Prop trading businesses involve a lot of risk. Significant losses can occur for traders, and in some situations, they may have to use their own cash to pay these losses.

- Competition Stress: To keep their positions within the company, prop traders may feel pressure to continually produce profits because of the intense competition in the trading sector.

- Having little job security: There might be a different level of job stability available at a prop trading firm than at conventional financial institutions. Traders who perform poorly may lose their jobs in firms with performance-based compensation plans.

- Strong Capital Needs: Some prop firms demand that traders provide their capital, which can be a considerable financial outlay. This takes up personal finances that could be used for other things.

- Regulatory Obstacles: Regulatory scrutiny of proprietary trading activities and corporate compliance with financial regulations can result in administrative burdens and restrictions on certain trading activities.

- Pressure and Stress: For some people, the high-stress, fast-paced nature of trading in prop firms can cause burnout and mental health issues.

Features:

- Prop trading businesses do trades using their funds. Usually, they don’t deal with client money or provide outside clients with investment management services.

- Proper trading decisions are frequently made with a considerable degree of autonomy by traders at prop businesses. They are in charge of capital management and profit generation for the company.

- Many prop trading companies provide profit-sharing plans that give traders a cut of their money. This encourages traders to perform well and make money for the company.

- To help traders effectively execute strategies, prop firms invest in cutting-edge trading technology, such as high-speed trading platforms, data feeds, and analytics tools.

- Prop trading businesses may transact in various financial markets, including those for derivatives, commodities, currencies, equities, and bonds. This enables traders to diversify and customize their trading approaches for various market circumstances.

Best Prop Trading Companies of 2023:

The top 10 forex prop trading companies for 2023 are shown below.

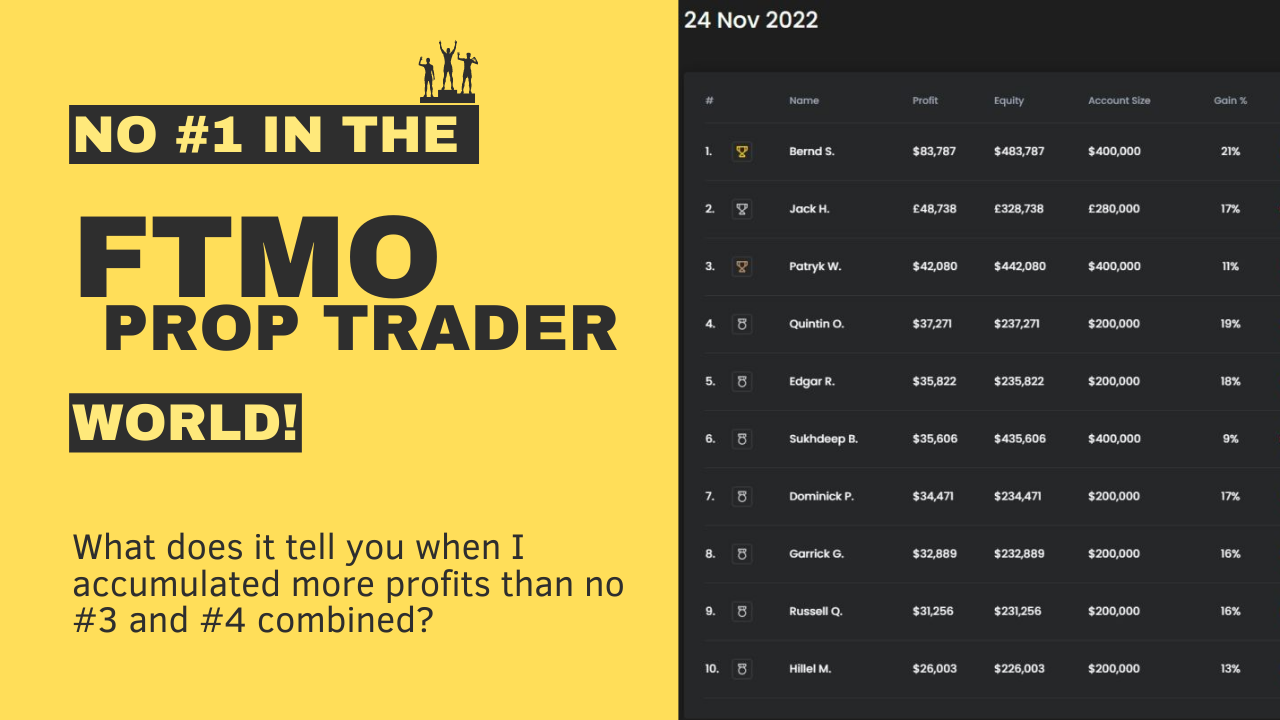

1. FTMO:

People can improve their forex trading abilities with the help of the FTMO Challenge and Verification course, which FTMO offers. After completing the course, participants must join the proprietary trading firm and run a trading account with the company. To help clients after they start trading, the company also hires performance coaches and does account analytics, among other things. Additionally, customers receive training on managing trading risks. As a result, it is considered to be among the top proprietary trading firms.

2. E8 Finance:

E8 Funding has created a user-friendly experience with the crucial data every trader needs and the most significant technology in the sector to support it. With their creative concepts, they strive to offer their traders the most significant funding experience. They provide traders with a choice between the E8 Evaluation, E8 Track, and ELEV8 funding programs. E8 Evaluation accounts are a two-part challenge distinguishable into conventional and extended varieties based on particular trading goals. The E8 Track, a three-step review, is the second funding initiative. The ELEV8 account is the final challenge, which likewise entails two steps. The scaling strategy is more aggressive, enabling users to increase their account balances to a maximum of $1,000,000. E8 Funding is currently one of the top proprietary trading companies in the market, and with their creative strategy, they will keep progressing for years to come!

3. SurgeTrader:

Forex, commodities, indices, oil, virtual currencies, and equities can all be traded on SurgeTrader. SurgeTrader charges $25k for a typical prop trading account with a 75:25 profit split, 10% profit target, 4% daily loss, and 5% maximum trailing drawdown. Cost of this package is $250. An intermediate account can be funded up to $50,000 for $400, a seasoned trader account can be funded up to $100,000, and an advanced trader account can be funded up to $250,000 for $1,800.

As a result, SurgeTrader is among the prop trading firms with the most varied account options available. However, traders must retain up to 75% of their capital and gains. Similarly to many prop trading firms, the account limitations are altered in response to a trader’s success.

You must abide by regulations that include reducing risks, closing positions before the weekend, and restricting the number of open lots to no more than 1/10,000 of the account’s total value. For instance, up to a beginning balance of +5%, you cannot suffer a loss of more than 5%.

4. Finotive Funding:

Oliver Newland established Finotive Funding as a private company on April 23, 2021. Nevertheless, they began working on the idea far earlier. They have offices in Budapest, Hungary, and allow traders to pick between three funding programs: direct funding, one-step evaluation, and two-step assessment. In addition to their already appealing products, they have combined their technologies with an internal brokerage firm called Finotive Markets, enabling them to offer all their traders the finest possible trading circumstances.

5. Audacity Capital:

Professional forex traders are financed by Audacity Capital, giving them access to additional trading resources. Traders apply for employment, provide information about their trading background and methods, and are invited to London for a face-to-face interview. Following approval, it’s time to start trading for profit.

The Funded Trader Programme or the Hidden Talents program are your options; each offers different characteristics. Every time a trader hits their 10% profit target, their accounts are improved progressively. Instead of using individual brokers, the company leverages institutional liquidity providers.

6. My Forex Funds:

My Forex Funds, a proprietary trading company established in 2020, provides traders with three alternative funding options. You can select from the Rapid, Evaluation, and Accelerated funding programs depending on your trading background. To help new traders gain expertise while trading in a demo environment and earning small percentages of profits, rapid accounts were created.

On the other hand, assessment accounts follow an industry-standard two-step evaluation process that necessitates passing two evaluation stages before allowing you to get profit splits. Last but not least, you can start making money immediately with the direct funding program known as the expedited funding program. Their services enable traders of all levels of expertise to join the proprietary trading company and begin pursuing forex market gains!

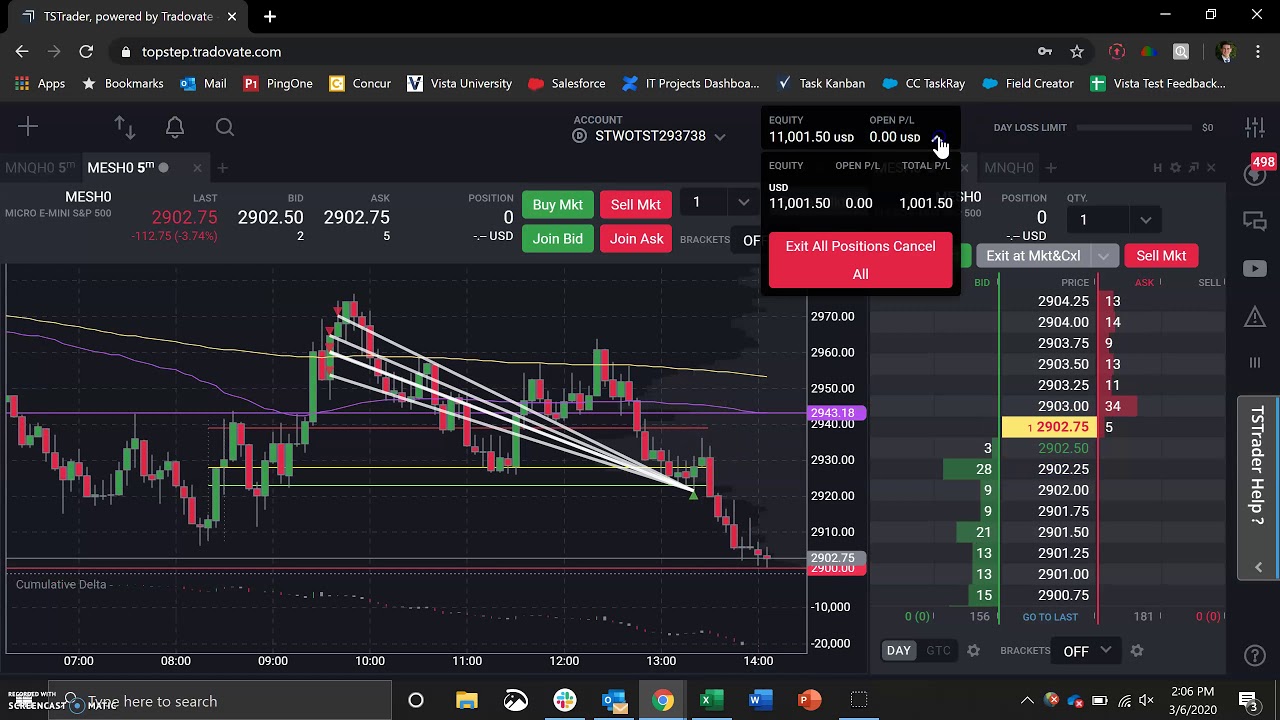

7. Topstep:

Topstep engages traders in the stocks, futures, and indices markets and provides money, guidance, and coaching to help them trade profitably, similar to many other prop trading organizations, according to monthly pricing, purchasing power, and profit goals. Participants in the programs will learn profitable trading techniques while avoiding unsuccessful ones.

You must first show that you can manage trade and risk before getting a funded account; after that, you will get more funding based on how well you trade. A trader picks any from three account sizes based on the number of steps, contracts, loss limits, and trailing maximum drawdown. A $50,000 budget has the lowest purchasing power, while a $150,000 budget has the highest. Contracts for Difference are the company’s business.

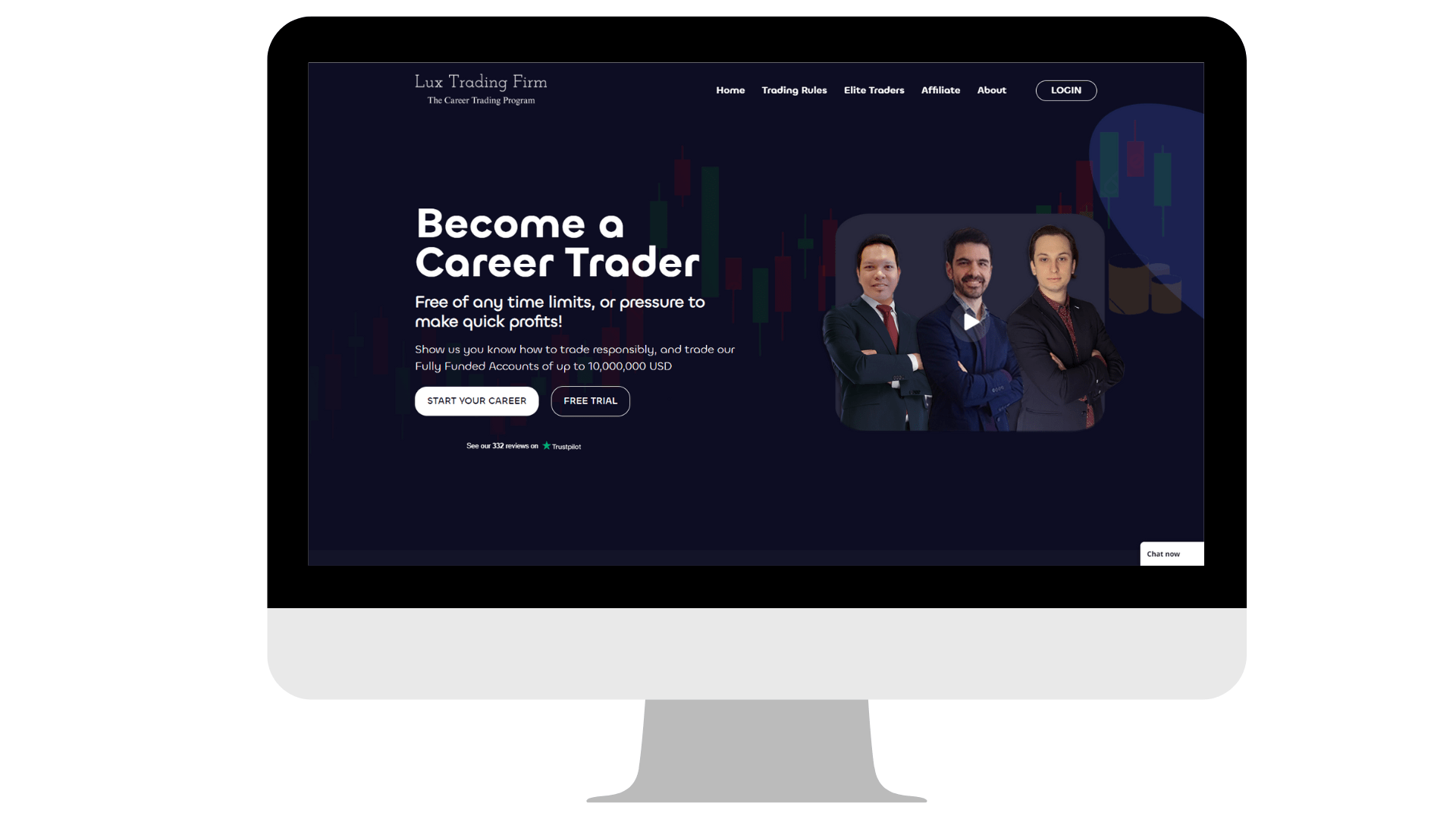

8. Lux Trading Firm:

The Lux Trading Firm employs career traders for Forex, cryptocurrencies, and other financial assets and deposits up to $2.5 million into each of their accounts. When a trader accomplishes a 10% target, the account is gradually upgraded until it reaches the $2.5 million cap. For fund managers, stage 8 is the highest. Trading professionals can demonstrate their value by employing evaluation accounts, which start at $5,000 (least).

Trading systems providing in-depth trading tools from Lux include TradingView, Trader Evolution, and MetaTrader 4. The dashboard lets traders see their trading activity, including the amount, total deals, total value or balance, and other information.

9. FunderPro:

One of the most well-known forex prop companies, FunderPro, offers a distinctive product. FunderPros provides a software stack for prop firms; many top prop companies use it to manage their operations.

All different types of forex traders will find FunderPro a perfect home because of its actual capital funding of up to $5,000,000, infinite periods on challenges, 80% profit split, and 1:100 leverage.

Check out our complete FunderPro reviewers in a new tab. To determine whether it’s the right prop firm for you because we recently received money from them!

10. Traders with Edge:

Traders with Edge prop trading company offer trading in more than 1172 assets. They will allow you to keep more than 80% of the profits made while helping you trade with over $3 million of their own money. You must trade on a demo account to prove your worthiness to join Traders with Edge.

The company will fund your account if they are pleased with your trading abilities. Two scaling strategies are available to you, and you’ll always have goals to reach.

Upon accomplishing these goals, the company will continue to finance your account up to $3 million. After two years of successful trading with the firm, you will be introduced to larger institutions that can fund you up to $30 million.

Conclusion:

In conclusion, proprietary trading companies are distinct businesses in the financial sector that employ their resources and trading know-how to make money in various marketplaces. These companies give traders freedom, access to cutting-edge technology, and the chance to profit. Prop trading is a complex and stressful job because of the fierce competition, risk of losses, and regulatory supervision. Successful risk management and the capacity to flourish in a fast-paced, high-stress workplace are prerequisites for success.

FAQs:

How do prop trading companies generate income?

Executing a profitable trading strategy is how prop trading companies make money. They examine market information, spot trading opportunities, and conduct transactions using the company’s funds. The company’s income is influenced by the profits made from these transactions.

Do prop trading firms manage client funds?

No, most prop trading companies don’t handle customer money. They trade with their own money and don’t provide investment management to outside clients.

Which traders do prop trading companies employ?

Prop trading companies employ knowledgeable traders with a variety of backgrounds and specialties. Traders may know about multiple asset classes and employ diverse trading techniques.

In prop trading firms, how are traders paid?

Profit-sharing contracts are frequently used to pay traders in prop firms. They receive a portion of the revenue they generate for the business. Performance criteria like trading volume and risk-adjusted returns may also impact compensation.

Are there dangers in working for a prop trading company?

Prop trading does indeed include hazards. Significant losses can occur for traders, and in some situations, they may have to use their cash to pay these losses. Additionally, the industry’s fierce competition might pressure workers to deliver.

I’m Maxwell Warner, a content writer from Austria with 3+ years of experience. With a Media & Communication degree from the University of Vienna, I craft engaging content across tech, lifestyle, travel, and business.