Buying your first home in 2026 is both exciting and challenging. While homeownership remains one of the most reliable ways to build long-term wealth, first-time buyers today face higher interest rates than the ultra-low era of 2020–2021, tighter affordability, and more complex lending rules.

At the same time, lenders have introduced new buyer-focused programs, digital underwriting tools, and expanded assistance options to keep first-time buyers in the market. Choosing the right lender in 2026 is no longer just about the lowest rate, it’s about flexibility, guidance, and total cost over time.

This guide breaks down:

-

The best mortgage lenders for first-time homebuyers in 2026

-

How lenders differ in rates, assistance, and approval flexibility

-

Which loan programs work best depending on your financial profile

-

Common mistakes that still cost buyers thousands

-

Updated trends shaping the mortgage market as of 2026

Why Choosing the Right Mortgage Lender Matters More in 2026

Mortgage rates stabilized somewhat in late 2024–2025, but affordability remains stretched. According to housing finance data from 2024–2025, first-time buyers are more sensitive to lender fees, PMI costs, and down payment requirements than interest rate alone.

The right lender can:

-

Offset higher rates with grants, credits, or reduced PMI

-

Approve borrowers using alternative credit data

-

Help buyers navigate state and local assistance programs

-

Speed up closings in competitive markets using digital underwriting

Expert insight: In today’s market, two buyers with the same credit score can end up with very different total mortgage costs depending on lender fees, insurance structure, and assistance eligibility.

Best Mortgage Lenders for First-Time Homebuyers (2026)

1. Rocket Mortgage

Best Overall Online Lender for First-Time Buyers

Rocket Mortgage continues to dominate online lending due to its automation, transparency, and speed.

Why it stands out in 2026

-

AI-assisted pre-approvals reduce uncertainty early

-

Clear breakdown of interest rates vs lender fees

-

Strong FHA, VA, and conventional offerings

Best for: Tech-comfortable buyers who want speed and clarity

Trade-off: Slightly higher fees can offset competitive rates

2. Wells Fargo

Best for Low Down Payment & In-Person Support

Wells Fargo remains a strong option for buyers who want face-to-face guidance, especially those navigating the process for the first time.

2026 advantage

-

Conventional loans with 3% down

-

Financial education programs tied to approval readiness

Best for: Buyers who value branch access and structured guidance

Trade-off: Credit standards may be stricter than fintech lenders

3. Bank of America

Best for Down Payment & Closing Cost Assistance

Bank of America’s assistance programs remain among the most generous nationwide.

Key benefits

-

Up to $10,000 in down payment grants

-

Up to $7,500 in closing cost assistance

-

Fixed-rate options designed for budget predictability

Expert note: These grants can effectively lower your real down payment to near zero in some markets.

4. Chase

Best for Flexible Credit Profiles

Chase’s DreaMaker Mortgage continues to target first-time buyers who don’t fit perfect credit models.

Why it matters

-

Accepts non-traditional credit indicators

-

Reduced PMI compared to standard conventional loans

Best for: Buyers with solid income but thin credit files

Trade-off: Slower processing compared to online-only lenders

5. Fairway Independent Mortgage

Best for FHA, VA, and USDA Loans

Fairway specializes in government-backed loans, which remain critical for affordability in 2026.

Why Fairway wins here

-

Loan officers experienced with complex eligibility rules

-

Faster underwriting for FHA/VA compared to large banks

Best for: Buyers using low-down-payment or zero-down programs

6. Ally Bank

Best for No Lender Fees

Ally’s biggest advantage remains fee transparency.

Why this matters

-

No lender fees can save $2,000–$4,000 at closing

-

Competitive rates for borrowers with strong credit

Best for: Cost-conscious buyers comfortable with online-only support

7. Navy Federal Credit Union

Best for Military & Veteran First-Time Buyers

Navy Federal continues to be one of the strongest VA lenders.

Key strengths

-

Zero-down VA loans

-

Lower-than-average interest rates

-

Strong member support

Limitation: Membership eligibility required

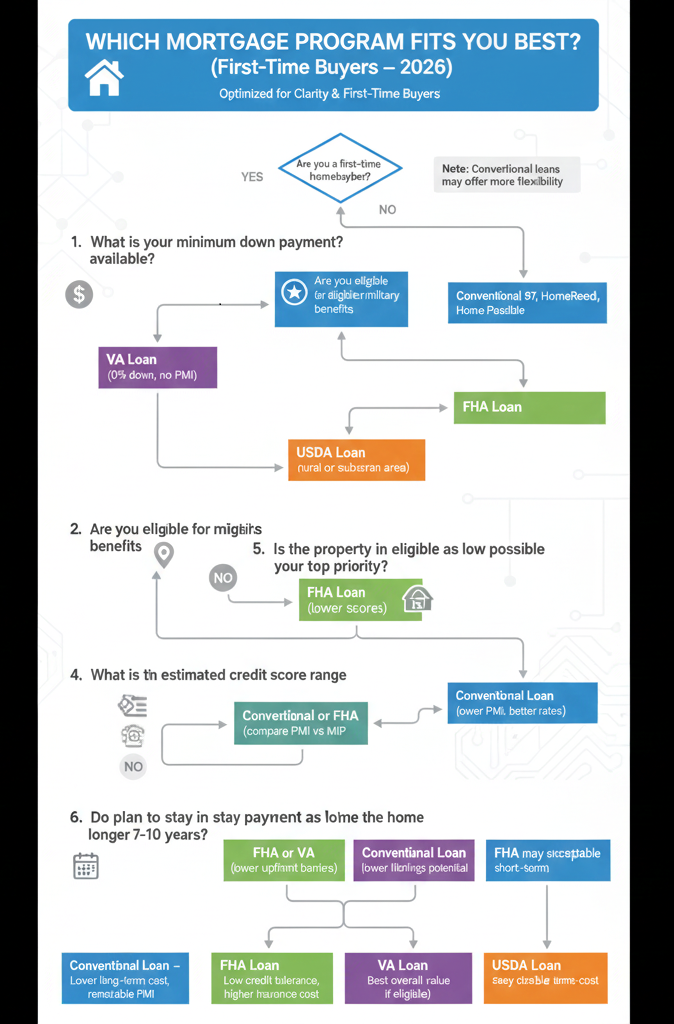

Mortgage Loan Programs First-Time Buyers Should Know (2026)

Conventional 97 Loan

-

3% down

-

PMI required (but removable)

-

Best for buyers with 620+ credit

FHA Loans

-

3.5% down

-

Credit scores as low as 580

-

Higher lifetime insurance costs

VA Loans

-

0% down

-

No PMI

-

Ideal for eligible military families

USDA Loans

-

0% down

-

Location and income limits apply

-

Often overlooked but powerful

HomeReady & Home Possible

-

3% down

-

Reduced PMI

-

Income limits apply

Strategic insight: Many buyers start with FHA or HomeReady loans, then refinance into conventional loans once equity and credit improve.

State & Local First-Time Buyer Assistance (Often Missed)

As of 2025–2026, billions in assistance funds go unused annually because buyers don’t apply.

Examples:

-

California (CalHFA): Deferred-payment junior loans

-

Texas: Low-interest loans + down payment help

-

New York (SONYMA): Reduced rates and assistance

Always check your state housing finance agency before finalizing a lender.

Step-by-Step Mortgage Process (First-Time Buyer View)

-

Pre-Approval – Establish realistic budget

-

Home Search – Stay below max approval for safety

-

Application – Submit income, assets, credit

-

Underwriting – Appraisal + verification

-

Closing Disclosure – Final costs revealed

-

Closing Day – Ownership begins

Comparison Table: Top Lenders at a Glance

Lender |

Best For |

Min Down |

Assistance |

Access |

|---|---|---|---|---|

Rocket Mortgage |

Online speed |

3%+ |

FHA, VA, USDA |

Online |

Wells Fargo |

In-person help |

3%+ |

Education programs |

Branch + online |

Bank of America |

Grants |

3%+ |

Up to $17,500 |

Branch + online |

Chase |

Flexible credit |

3%+ |

DreaMaker |

Branch + online |

Fairway |

FHA/VA |

0–3.5% |

Govt loans |

Regional |

Ally Bank |

No fees |

3%+ |

Conventional |

Online |

Navy Federal |

Military |

0% |

VA loans |

Branch + online |

Common First-Time Buyer Mistakes (Still Costly in 2026)

-

Not comparing APR, not just interest rate

-

Ignoring PMI and insurance lifetime costs

-

Skipping assistance programs

-

Buying at maximum pre-approval

-

Not preparing credit 6–12 months ahead

FAQs (People Also Ask)

Do first-time buyers still need 20% down in 2026?

No. Most first-time buyers put 3–5% down, and some put nothing.

Is PMI always bad?

Not necessarily. Temporary PMI can be cheaper than waiting years to save 20%.

Are online lenders riskier?

No, as long as they’re NMLS-licensed and transparent.

Can student loans block approval?

They affect DTI, but income stability matters more than balance alone.

Final Thoughts (2026 Perspective)

The best mortgage lenders for first-time homebuyers in 2026 aren’t just those with the lowest advertised rates. They’re the ones that reduce upfront costs, offer flexibility, and guide buyers through a complex market.

Whether you choose a digital-first lender like Rocket or Ally, a large bank like Bank of America, or a specialized lender like Fairway or Navy Federal, success comes down to preparation and comparison.

A well-chosen lender doesn’t just help you buy a home, it helps you buy sustainably, without stretching your finances thin.