Life insurance for seniors in 2026 looks very different than it did even five years ago. Longer life expectancy, rising funeral costs, tighter underwriting rules, and the expansion of simplified and guaranteed-issue products have reshaped the market.

For seniors, life insurance is no longer just about “coverage.” It’s about risk management, liquidity, and peace of mind, often in retirement years where income is fixed and health variables matter more than ever.

This guide breaks down life insurance for seniors in 2026 using practical explanations, real cost logic, and provider comparisons so you can make a decision based on how policies actually perform, not marketing promises.

Why Life Insurance Still Matters for Seniors in 2026

Many seniors assume life insurance is unnecessary later in life. In reality, financial exposure often increases with age, not decreases.

1. Final Expenses Are Rising Faster Than Inflation

As of 2025, the median funeral cost in the U.S. exceeds $9,500, and that figure rises above $15,000 when burial plots, transportation, and memorial services are included. Cremation costs are rising as well due to energy, regulatory, and service fees.

Life insurance ensures:

-

Family members don’t rely on credit cards

-

Assets don’t need to be liquidated quickly

-

Survivors avoid emotional + financial stress simultaneously

2. Retirement Debt Is More Common Than People Admit

According to recent retirement finance studies (2024–2025):

-

Over 40% of seniors carry some form of debt

-

Mortgages, HELOCs, medical bills, and personal loans are common

Life insurance provides immediate liquidity, which is critical because estates often take months to settle.

3. Dependents Don’t Disappear After Retirement

Seniors may still support:

-

A spouse with lower retirement income

-

Adult children with disabilities

-

Grandchildren

-

Aging parents

Life insurance acts as income continuation, not just inheritance.

4. Estate & Legacy Planning Benefits

Life insurance payouts are:

-

Generally income-tax free

-

Paid quickly

-

Useful for balancing inheritances or charitable giving

For seniors with illiquid assets (property, businesses), insurance prevents forced sales.

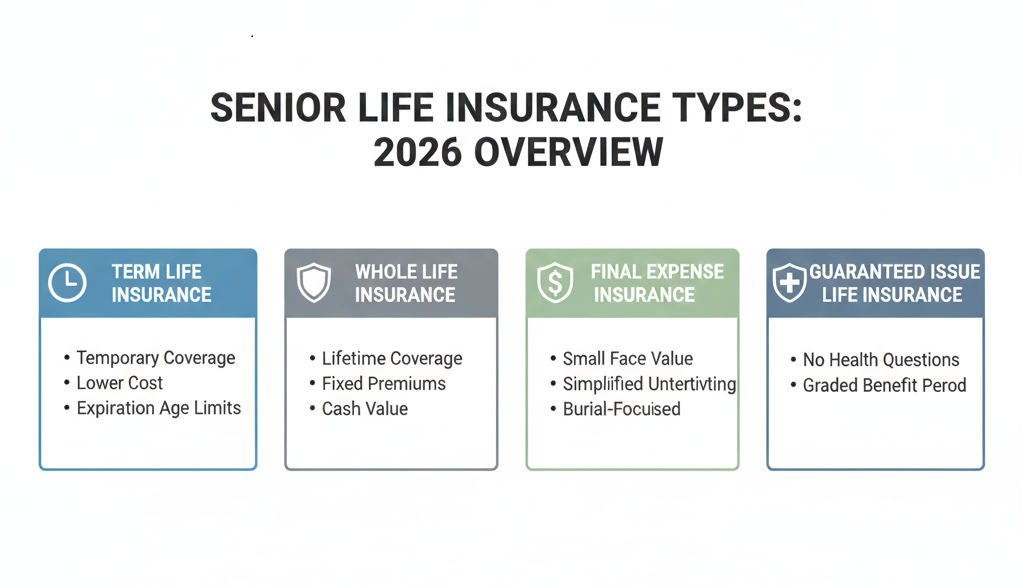

Types of Life Insurance for Seniors (Explained Clearly)

Choosing the right policy depends less on “what’s popular” and more on how risk, cost, and longevity interact.

Term Life Insurance (Limited but Strategic)

How it works: Coverage for a fixed number of years (10–20).

Why it exists for seniors:

Term insurance is best when there’s a specific financial exposure with an end date, such as:

-

Short-term income replacement

-

Temporary debt coverage

Key limitation: Availability typically ends around ages 75–80, and premiums rise sharply.

Best for: Healthy seniors needing short-duration coverage.

Whole Life Insurance (Stability & Guarantees)

How it works: Lifetime coverage with fixed premiums and guaranteed death benefit.

Why seniors choose it:

Whole life removes uncertainty no expiration, no rate increases, no market dependency.

Added value: Cash value grows conservatively and can be borrowed against.

Trade-off: Higher monthly premiums.

Best for: Seniors who want certainty and permanence.

Universal Life Insurance (Flexibility with Risk)

How it works: Permanent coverage with adjustable premiums and interest-based cash value.

Why it’s controversial:

While flexible, underfunding or low interest rates can erode performance over time.

Best for: Financially savvy seniors who actively monitor policies.

Final Expense Insurance (Most Popular for Ages 70+)

How it works: Small whole-life policies designed specifically for burial and end-of-life costs.

Why it dominates the senior market:

-

Low face amounts

-

Simplified underwriting

-

Predictable premiums

Coverage range: Typically $5,000–$50,000

Best for: Seniors prioritizing simplicity and fast approval.

Guaranteed Issue Life Insurance (Last-Resort Coverage)

How it works: No health questions, no exams, guaranteed acceptance.

Hidden cost:

-

Higher premiums

-

2-year graded benefit (limited payout early)

Best for: Seniors with serious or multiple health conditions who’ve been declined elsewhere.

Top Life Insurance Providers for Seniors (2026 Review)

These companies stand out based on financial strength, underwriting fairness, and senior-focused products.

MassMutual – Best Overall Stability

-

A++ financial rating

-

Strong dividend-paying whole life

-

Excellent for estate planning strategies

Best for: Seniors wanting long-term reliability.

Mutual of Omaha – Best for Final Expense

-

Industry leader in burial insurance

-

Simplified underwriting up to age 85

-

Competitive pricing for smaller policies

Best for: Seniors focused on end-of-life costs.

New York Life – Best for Customization

-

Coverage up to age 90

-

Strong agent network

-

Multiple permanent policy options

Best for: Seniors wanting tailored plans with hands-on guidance.

AIG (Corebridge Financial) – Best Guaranteed Issue

-

Simple applications

-

Reliable payouts

-

Clear graded benefit structure

Best for: Seniors with significant health challenges.

State Farm – Best Customer Experience

-

High satisfaction ratings

-

Local agents

-

Transparent policy explanations

Best for: Seniors who value in-person support.

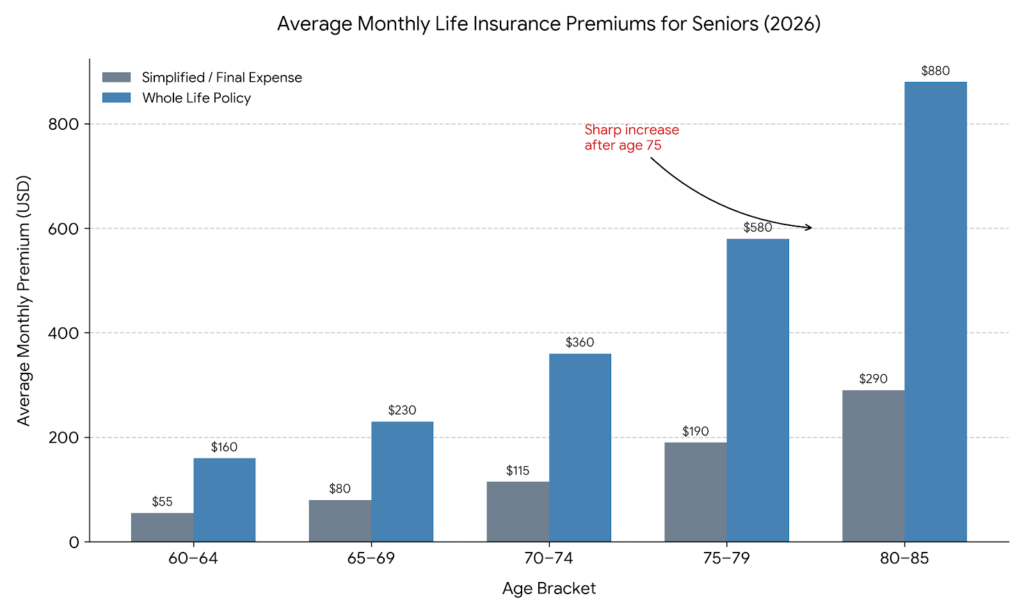

Cost Breakdown: What Seniors Actually Pay in 2026

Life insurance pricing depends on risk, longevity, and policy structure.

Key Cost Drivers

-

Age (largest factor)

-

Gender (women pay less)

-

Health & medications

-

Policy type

-

Coverage amount

Example Monthly Premiums (2026 Estimates)

Age |

Gender |

Health |

Policy Type |

Coverage |

Monthly Cost |

|---|---|---|---|---|---|

65 |

Male |

Good |

Whole Life |

$25,000 |

$95–$115 |

70 |

Female |

Average |

Final Expense |

$15,000 |

$80–$100 |

75 |

Male |

Poor |

Guaranteed Issue |

$10,000 |

$140–$170 |

80 |

Female |

Good |

Term (10 yr) |

$20,000 |

$155–$180 |

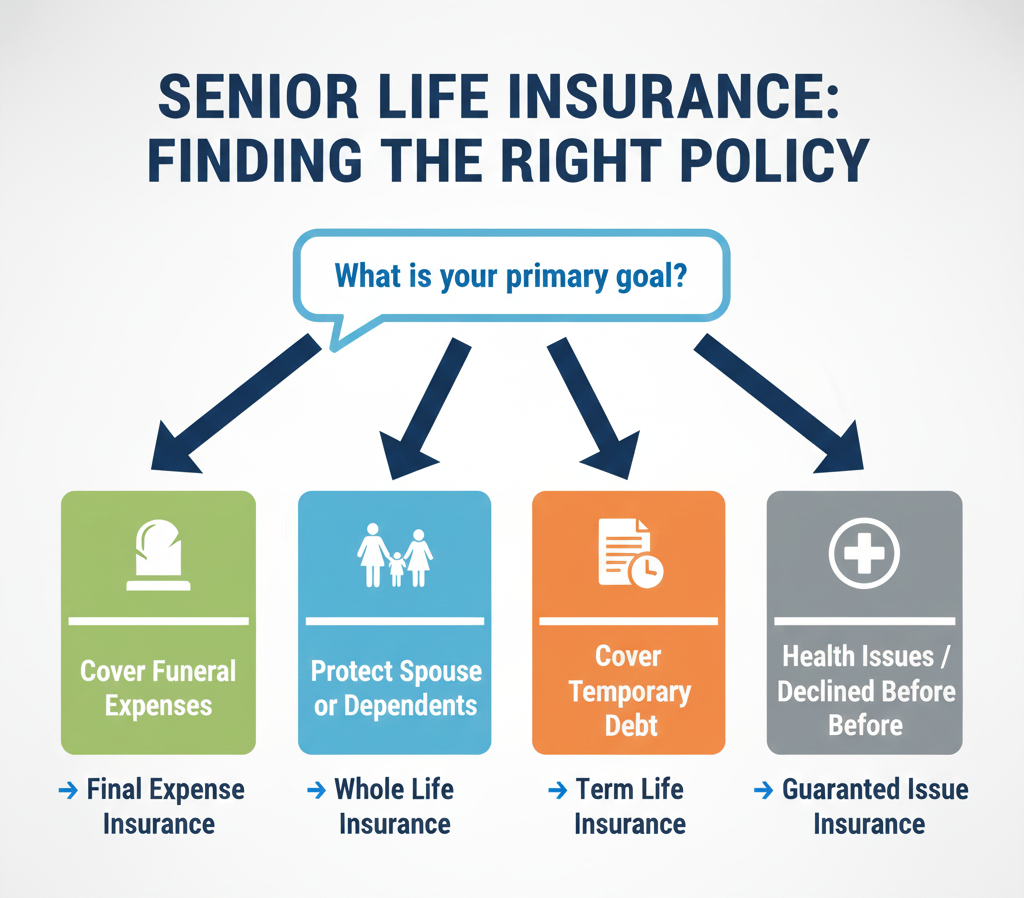

How to Choose the Right Policy (Expert Framework)

Instead of guessing, ask these questions:

-

What problem am I solving? (funeral, debt, income, legacy)

-

How long does this risk exist?

-

Can my budget handle permanent premiums?

-

Do I need guaranteed acceptance?

Expert insight:

Most seniors overspend on coverage they don’t need or underinsure final expenses. The sweet spot is matching coverage duration to actual financial risk.

Application Process: What to Expect

-

Quote request (online or agent)

-

Health questionnaire or exam (depending on policy)

-

Underwriting review

-

Approval and policy delivery

Timeline:

-

Simplified issue: 2–7 days

-

Fully underwritten: 2–4 weeks

Common Mistakes Seniors Should Avoid

-

Waiting too long (costs rise sharply each year)

-

Ignoring graded benefit periods

-

Buying coverage without defining a purpose

-

Not comparing multiple providers

-

Overlooking riders like accelerated death benefits

Frequently Asked Questions (2026)

What is the best life insurance for seniors over 85?

Final expense and guaranteed issue policies are usually the only options.

Can seniors get life insurance without medical exams?

Yes simplified and guaranteed issue policies don’t require exams.

Is whole life better than term for seniors?

For most seniors, yes because it doesn’t expire.

How fast can coverage start?

Some policies activate within days of approval and payment.

Final Thoughts: Making the Right Choice in 2026

Life insurance for seniors in 2026 is about precision, not volume. The best policy isn’t the biggest, it’s the one that:

-

Solves a specific financial problem

-

Fits a fixed retirement budget

-

Pays out when your family needs it most

With the right approach, life insurance becomes less of an expense and more of a financial safety net and legacy tool.