In today’s digital age, managing your money has never been easier. One of the smartest financial moves you can make is to open a high-yield savings account online. Unlike traditional savings accounts that often offer disappointing returns, high-yield options can earn you 10x more interest—all while giving you the convenience of banking from home.

In this guide, we’ll walk you through everything you need to know, from choosing the right bank to completing your online application. Whether you’re saving for an emergency fund, vacation, or a down payment, this guide will help you get started the smart way.

What Is a High-Yield Savings Account?

A high-yield savings account (HYSA) is a type of savings account that offers a significantly higher interest rate than a standard one. While the national average savings rate hovers around 0.40%, high-yield options can range from 3% to 5% or more, depending on the bank and current economic conditions.

These accounts are typically offered by online banks, which have lower overhead costs and can pass those savings on to you in the form of higher returns.

Why Open a High-Yield Savings Account Online?

Here are the top benefits of opening an HYSA online:

-

Higher Interest Rates – Grow your savings faster.

-

Lower Fees – Online banks usually don’t charge maintenance fees.

-

24/7 Access – Manage your account anytime, anywhere.

-

FDIC Insurance – Most accounts are insured up to $250,000.

-

Fast Setup – Open an account in 10–15 minutes.

Step-by-Step: How to Open a High-Yield Savings Account Online

1. Research Banks and Compare Rates

Start by comparing annual percentage yields (APYs), fees, and terms. Some of the most reputable high-yield savings providers include:

-

Ally Bank

-

Marcus by Goldman Sachs

-

Capital One 360

-

Discover Online Savings

-

SoFi Bank

Look beyond just the APY—consider minimum balance requirements, transfer limitations, and customer reviews.

💡 Tip: Use a savings comparison website or aggregator like NerdWallet or Bankrate to get up-to-date comparisons.

2. Check the Fine Print

Before signing up, make sure to review:

-

Monthly fees or hidden charges

-

Withdrawal limits (some accounts limit transfers to 6 per month)

-

Minimum deposit requirements

-

Access to customer service

Even small fees can erode your earnings, so it’s worth digging into the terms and conditions.

3. Gather Your Personal Information

To open an account, you’ll typically need:

-

Full legal name

-

Address and phone number

-

Social Security Number or Tax ID

-

A government-issued photo ID (like a driver’s license)

-

Bank account information for funding

Make sure your information matches your legal documents to avoid delays.

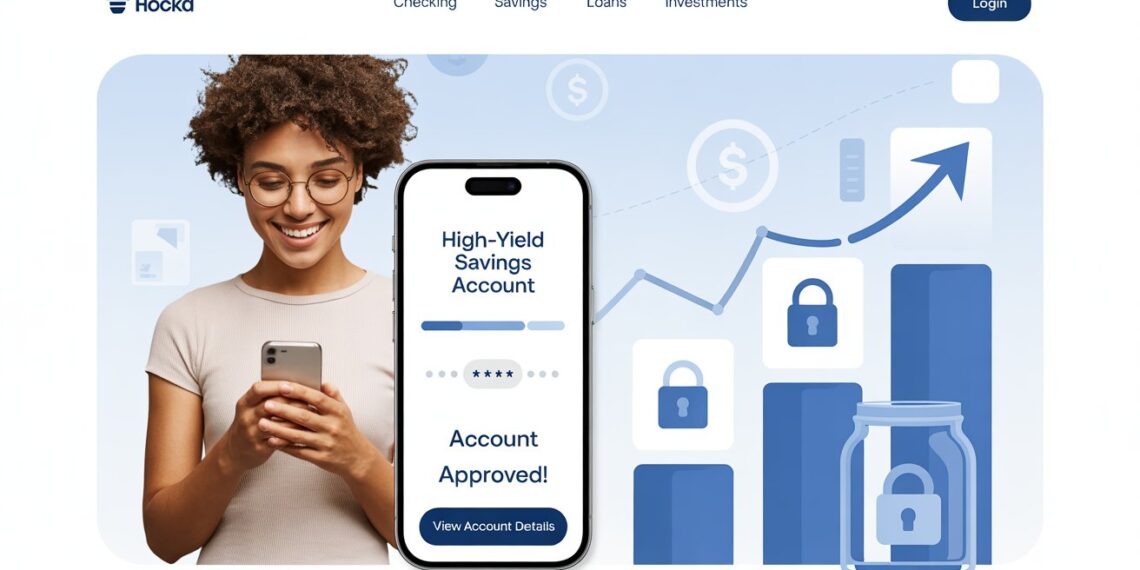

4. Fill Out the Online Application

Visit the bank’s official website and click “Open Account” or “Apply Now.” The application usually takes 10–15 minutes to complete and includes:

-

Entering your personal and contact details

-

Verifying your identity (via ID upload or verification questions)

-

Selecting your account preferences

-

Funding your account (you can transfer funds from your current bank)

5. Fund Your Account

Most banks require an initial deposit, which could be as low as $1 or as high as $1,000. You’ll typically transfer money from another bank account using:

-

ACH transfer

-

Wire transfer

-

Mobile check deposit

Note that some banks may hold initial deposits for a few days before allowing full access.

6. Set Up Online and Mobile Banking

After approval, set up:

-

Username and password

-

Two-factor authentication (2FA)

-

Mobile banking app access

This will let you check your balance, make transfers, and track interest growth on the go.

7. Enable Automatic Transfers (Optional but Recommended)

To grow your savings consistently, set up a monthly auto-transfer from your checking to your high-yield savings account. Even small, regular deposits add up over time thanks to compound interest.

Bonus Tip: Link to Other Smart Savings Strategies

While you’re optimizing your savings, consider also:

-

Bundling policies to save on home insurance

-

Using smart budgeting tools

-

Setting financial goals inside your banking app

These steps can help you save more effectively and reduce unnecessary spending—just like applying home insurance tips can reduce homeowners insurance costs.

Frequently Asked Questions (FAQs)

1. Is it safe to open a high-yield savings account online?

Yes. Most online banks are FDIC-insured, meaning your money is protected up to $250,000 per depositor.

2. Do I need to switch banks to open a high-yield savings account?

No. You can keep your current checking account and link it to your new savings account for easy transfers.

3. How quickly can I access my funds?

While transfers usually take 1–3 business days, some banks offer instant transfers or faster access with linked debit cards.

4. Will opening an online savings account affect my credit score?

No. Opening a savings account does not require a credit check and has no impact on your credit score.

5. Can I open more than one high-yield savings account?

Yes. Some people open multiple accounts to separate goals (e.g., vacation, emergency fund, house savings).

Conclusion

Opening a high-yield savings account online is one of the simplest yet most impactful steps you can take toward financial security. With just a few clicks, you can start earning significantly more interest, automate your savings, and access your funds anytime.