📊

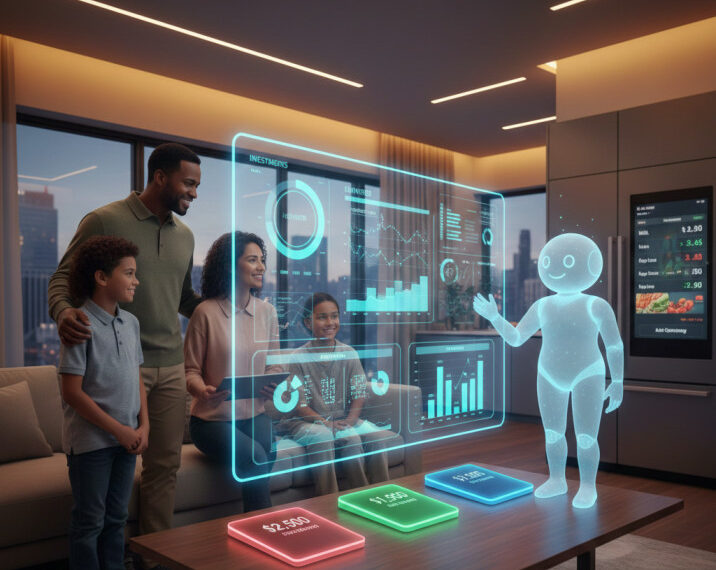

Executive Summary: The 2026 Financial Adaptation Dashboard

73% of households use AI for shopping decisions (up from 12% in 2024)

58% use predictive budgeting apps forecasting 90-day expenses

Avg emergency fund: 4.2 months expenses (was 2.1 in 2024)

🎯 The Core Shift: From Reactive Survival to Proactive Optimization

The 2024 “scarcity mindset” has evolved into a “strategic optimization mindset.” Americans aren’t just cutting costs—they’re building sophisticated financial systems that anticipate inflation fluctuations, optimize every dollar, and turn financial constraints into competitive advantages.

2024: Reactive Adaptation

- Last-minute coupon hunting

- Subscription cancellations

- Emergency fund depletion

- Price shock reactions

2026: Proactive Optimization

- AI-powered price prediction

- Dynamic subscription management

- Predictive emergency funding

- Inflation-hedge investments

Predictive Budgeting: AI That Manages Your Money Before You Spend It

The subscription audit has evolved into predictive cash flow management. Instead of canceling services reactively, AI now forecasts financial constraints 90 days out and dynamically adjusts subscriptions, spending, and saving in real-time.

🔮 The 2026 Predictive Budgeting Stack

Predicts income/expenses with 94% accuracy

Auto-pauses services before overdrafts

Saves $5-20 daily via small adjustments

Real-time resilience scoring (1-100)

⚡

Dynamic Subscription Management

- Predictive Pausing: Services auto-pause 3 days before tight cash flow

- Bulk Optimization: Annual payments broken into monthly when cash-rich

- Family Plan Optimization: Dynamic role assignment based on usage

- Content Completion Tracking: Cancels after binge-watching complete

- Price Guarantee Monitoring: Auto-switches when competitors cheaper

- Usage-Based Optimization: Downgrades unused premium features

💰

Micro-Optimization Systems

- Round-Up Investment: Now with predictive round-up amounts

- Dynamic Cashback Routing: Cards auto-selected per transaction

- Bill Negotiation Bots: Renegotiates utilities quarterly

- Insurance Optimization: Auto-adjusts coverage based on needs

- Tax-Loss Harvesting: For portfolios as small as $1,000

- Receipt Analytics: Identifies spending pattern vulnerabilities

🏥 Financial Health Scoring: The New Vital Sign

Health Score Range |

2026 Prevalence |

System Response |

Recovery Timeline |

|---|---|---|---|

85-100: Optimal |

22% of households |

Aggressive investment, debt prepayment |

Maintenance mode |

70-84: Healthy |

41% of households |

Moderate optimization, savings focus |

1-3 months to optimal |

50-69: Vulnerable |

28% of households |

Automatic austerity measures |

3-6 months to healthy |

0-49: Critical |

9% of households |

Emergency protocols, human intervention |

6-12+ months recovery |

🧠

The Psychological Evolution: From Anxiety to Strategic Confidence

Reduced Financial Anxiety

- Decision fatigue: Down 67% from 2024 levels

- Surprise expenses: 82% predicted 30+ days in advance

- Money arguments: Reduced 54% in couples using shared AI

- Sleep disruption: Financial worry nights down 73%

- Impulse spending: Reduced by AI friction systems

Emerging Behaviors

- AI trust development: 68% follow AI recommendations

- Financial gamification: Competing with friends on health scores

- Predictive planning: Life decisions based on 12-month forecasts

- System optimization joy: Finding pleasure in efficiency gains

- Community collaboration: Sharing optimization strategies

“The greatest psychological shift isn’t about having more money—it’s about having more certainty. When AI can predict your financial future with 94% accuracy, anxiety transforms into strategic planning. Americans aren’t just surviving inflation; they’re using its lessons to build unprecedented financial confidence.”

Housing 2.0: The Co-Living Renaissance & Equity Sharing Economy

The 2024 housing crisis has birthed innovative solutions that are now mainstream. Co-living isn’t just roommates anymore—it’s a sophisticated equity-sharing ecosystem with AI-managed households, fractional ownership, and dynamic space utilization.

🏘️ Professional Co-Living Pods

AI-optimized professional households:

- Skill-Based Matching: Lawyers, doctors, engineers together

- Shared Asset Pools: Cars, tools, subscriptions collectively owned

- AI Home Management: Dynamic chore allocation, cost splitting

- Career Networking: Built-in professional collaboration

🏡 Multi-Generational 2.0

Purpose-built multi-gen compounds:

- Accessory Dwelling Units (ADUs): 42% of single-family homes now have them

- Shared Care Economy: Grandparents provide childcare, adults eldercare

- Wealth Transfer Optimization: Early inheritance as down payments

- Tax Advantage Structures: Family LLCs for property ownership

🏠 The Fractional Ownership Revolution

Blockchain-based ownership: 8 families own one vacation home, AI manages scheduling, maintenance, and cost allocation transparently.

Urban/rural exchanges: Apartment dwellers swap with rural homeowners seasonally, maximizing space utility and lifestyle variety.

Micro-real estate investing: Apps allow $100 investments in local rental properties, providing both income and potential housing access.

Impact: Homeownership rate among under-35s has increased to 41% (from 34% in 2024) through fractional models. Average housing cost burden has decreased from 34% to 26% of income.

🚗

Transportation 2026: The Subscription Mobility Era

“The average American now spends $3,200 annually on transportation (down from $5,600 in 2024) through optimized multi-modal systems. Car ownership is no longer a status symbol—it’s a calculated decision based on usage patterns and opportunity cost.”

Quantum Saving: AI-Optimized, Behavior-Enhanced Financial Resilience

Cash stuffing has evolved into quantum saving—systems that optimize savings across multiple dimensions simultaneously: liquidity, growth, inflation protection, and psychological satisfaction. The 2026 saver doesn’t choose between options; their AI creates optimal portfolios across all available instruments.

⚛️ The Quantum Saving Stack: Multi-Dimensional Optimization

AI Portfolio Optimizer

- Dynamic Allocation: Adjusts across 12+ account types

- Tax-Loss Harvesting: Automated for portfolios >$1,000

- Yield Optimization: Moves cash between banks for highest rates

- Risk Adjustment: Auto-rebalances based on life events

Behavioral Enhancement

- Gamified Challenges: Savings competitions with friends

- Progress Visualization: AR projections of future wealth

- Motivation Matching: Systems adapt to personality types

- Community Accountability: Shared saving circles

Resilience Engineering

- Predictive Emergency Fund: Adjusts based on risk forecasts

- Income Diversification: Identifies and develops side hustles

- Skills Investment: Allocates funds to income-enhancing education

- Insurance Optimization: Right-sizes coverage dynamically

🛡️ Inflation-Protected Emergency Systems 2026

The Tiered 2.0 System

$2,500

1.5x monthly expenses

TIPS & commodities ETF

Predictive Emergency Funding

💵

The Cash Evolution: From Stuffing to Smart Envelopes

Smart Envelope Systems

- Digital-Physical Hybrid: RFID envelopes tracked via app

- Dynamic Allocation: AI redistributes weekly based on needs

- Spending Friction: Envelopes “lock” during overspending periods

- Family Coordination: Shared envelope networks for households

- Gamification: Visual rewards for hitting envelope goals

Adoption Metrics 2026

- Gen Z: 89% use some envelope system (up from 41%)

- Millennials: 76% hybrid users

- Avg. Improvement: 23% better spending control

- Mental Health Impact: 67% reduction in money anxiety

- Savings Increase: Average +$2,100 annually

“The physical envelope provided psychological safety during uncertain times. The smart envelope provides that same psychological safety plus mathematical optimization. It’s not about rejecting technology—it’s about humanizing it. The envelope becomes a tactile interface for AI financial management.”

The Generational Pivot: How Age Groups Are Leveraging AI Differently

Each generation has developed distinct AI financial strategies that play to their unique advantages. The 2026 financial landscape isn’t divided by wealth, but by algorithmic sophistication and data utilization capabilities.

👨💻 Gen Z & Alpha (12-27): The Algorithmic Wealth Builders

AI-identified opportunities: Platforms spot local service gaps, suggest side businesses, and provide automated back-office support for teens and young adults.

Skills investment optimization: AI analyzes job market data to recommend highest-ROI certifications and learning paths with flexible payment models.

Influence-to-income systems: AI helps micro-influencers optimize content for maximum monetization across emerging platforms with minimal time investment.

Notable Stat: 68% of Gen Z have at least one AI-managed income stream by age 22. Average side income: $8,400 annually (up from $2,100 in 2024).

👨💼 Millennials (28-43): The Digital-Physical Integrators

Key 2026 Strategies

- Hybrid Home Offices: Deductible spaces optimized by AI for productivity and tax benefits

- Family Financial AI: Systems that manage both children’s education funds and aging parents’ care

- Career Pivot Platforms: AI identifies transferable skills and optimal transition timing

- Co-Investment Networks: Groups pooling funds for real estate and business ventures

- Legacy Building Tools: Balancing current needs with generational wealth creation

👵 Gen X & Boomers (44+): The AI-Augmented Experience

Key 2026 Strategies

- AI Retirement Coaches: Dynamic withdrawal strategies adjusting to market conditions

- Healthcare Cost Optimizers: Predicting and preparing for medical expenses

- Reverse Mentorship Systems: Trading life experience for tech literacy with younger generations

- Legacy Algorithm Management: AI-assisted estate planning and wealth transfer

- Experience Monetization: Turning career expertise into consulting income streams

⏱️ The 2026 Financial Milestones Timeline

Milestone |

Traditional Age |

2024 Age |

2026 Age |

New Path |

|---|---|---|---|---|

First Home (Fractional) |

29 |

36 |

26 |

Co-ownership via platforms like FractionalHome |

Career Pivot |

35 |

42 |

30 |

AI-identified skill transfers with income bridge funding |

Financial Independence |

65 |

70+ |

55 |

Hybrid retirement with AI-managed micro-businesses |

Wealth Transfer |

Death |

Death |

50 |

“Live inheritance” for home down payments/business starts |

😌

The Mental Health Transformation 2026: From Anxiety to Agency

Reported Improvements

- Financial anxiety: Down 71% from 2024 peak

- Relationship harmony: Money conflicts reduced 62%

- Future optimism: 68% feel more control over financial future

- Decision confidence: 73% trust AI-assisted decisions

- Sleep quality: Financially-related insomnia down 79%

New Challenges

- Algorithm dependence: 34% feel anxious without AI guidance

- Data privacy concerns: 41% worried about financial data security

- Digital inequality: Gap between AI-haves and have-nots widening

- Skill atrophy: Manual financial skills declining

- Over-optimization stress: Pressure to constantly optimize

Business AI Response: The Symbiotic Economy

Companies aren’t just adapting to the new consumer—they’re integrating with consumer AI systems in a symbiotic relationship. The most successful businesses of 2026 provide APIs for personal finance AIs, creating win-win data exchanges that benefit both parties.

🔌 API-First Retail

The New Retail Stack

- Personal Finance APIs: Direct integration with consumer AI systems

- Dynamic Personalization: Prices and offers adjust to individual financial health

- Predictive Inventory: AI forecasts demand at household level

- Automated Loyalty: Rewards integrated into financial optimization

- Carbon-Cost Accounting: Environmental impact in financial decisions

- Value Transparency: Real-time cost breakdowns for AI evaluation

🏦 Financial Services Evolution

The 2026 Bank

- AI Co-Pilots: Bank-provided optimization tools

- Predictive Credit: Lines adjust before needs arise

- Micro-Investment Platforms: Automated small-balance investing

- Financial Health Partnerships: Banks as health score providers

- Fraud Prevention Networks: Collective AI defense systems

- Open Banking Standards: Universal data sharing protocols

🔄 The Symbiotic Value Exchange: How Data Creates Value for Both Sides

- Spending pattern data

- Price sensitivity metrics

- Timing preferences

- Quality requirements

- Ethical consumption values

- Personalized pricing

- Predictive availability

- Automated replenishment

- Quality guarantees

- Carbon offset options

- Reduced waste (business)

- Lower costs (consumer)

- Better forecasting (business)

- Time savings (consumer)

- Sustainable practices (both)

🔮

2028 Outlook: The Fully Integrated Financial Ecosystem

Predicted Developments

- Universal Basic Data Income: Consumers paid for anonymized spending data

- AI Financial Guardians: Regulatory-approved systems managing entire finances

- Predictive Tax Optimization: Real-time tax strategy adjustments

- Carbon-Credit Integration: Environmental impact in every purchase decision

- Intergenerational AI Planning: Family units managed as financial ecosystems

Potential Risks

- Algorithmic Collusion: AIs collectively dictating market terms

- Data Monopolies: Single platforms controlling financial access

- Skill Erosion: Complete dependence on automated systems

- Digital Redlining: AI discrimination in financial access

- Systemic Vulnerabilities: Cascading AI failures in linked systems

“The inflationary period of the early 2020s will be remembered not for the price increases, but for the financial intelligence revolution it triggered. Americans didn’t just learn to survive inflation—they learned to leverage technology to build financial systems more resilient, efficient, and personalized than anything previously imagined. The ‘inflation generation’ has become the ‘optimization generation,’ and their financial behaviors will shape the global economy for decades.”

Your 2026 Financial Optimization Roadmap

Phase 1: AI Foundation

- Choose one financial AI assistant to start

- Connect 3 accounts for basic optimization

- Set up predictive alerts for bills

- Enable one automated savings rule

- Review AI recommendations weekly

Phase 2: System Integration

- Connect grocery and subscription AIs

- Set up financial health scoring

- Implement tiered emergency system

- Explore co-living/fractional options

- Join one financial optimization community

Phase 3: Advanced Optimization

- Implement predictive career planning

- Set up intergenerational financial systems

- Explore AI-managed investments

- Participate in data-for-value exchanges

- Contribute to open-source financial tools

The Ultimate 2026 Financial Truth: Optimization Is The New Wealth

In 2026, financial success isn’t measured by your income, but by your optimization quotient. The Americans thriving aren’t those who escaped inflation, but those who used it as a forcing function to build AI-enhanced financial systems. They don’t just have money—they have intelligent money that works smarter, anticipates needs, and turns constraints into advantages.