Trading bots are one weapon in the toolbox of experienced cryptocurrency traders interested in algorithmic trading and data-informed automation to increase profits while lowering risk and limiting losses.

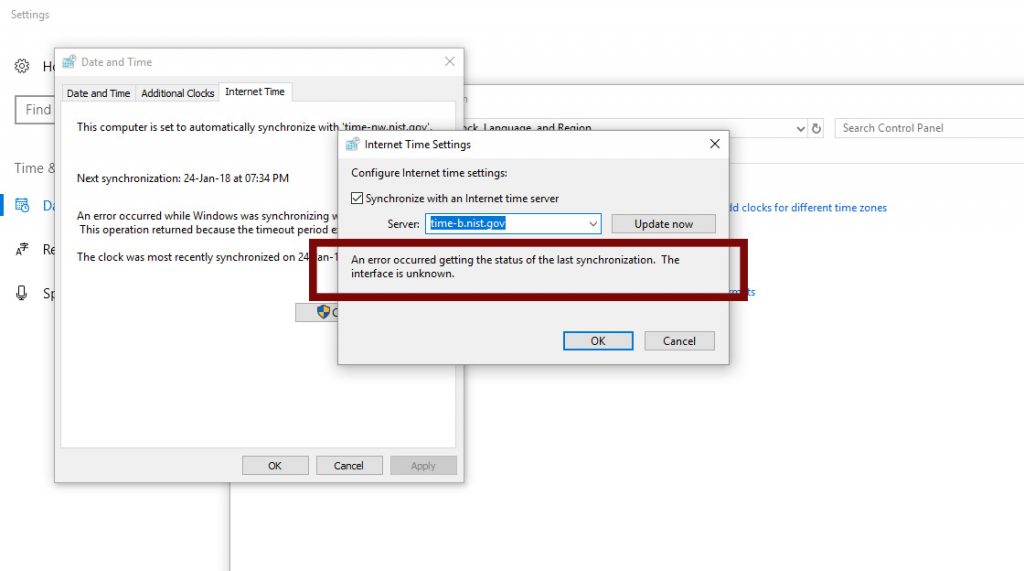

A cryptocurrency trading bot is just a computer program that works online and completes tasks faster than a human could. Bots are thought to make up more than half of all Internet traffic. They interact with websites and users, scan material, and perform other functions like trading cryptocurrency on behalf of knowledgeable people.

What is Binance Trading?

The act of purchasing and selling cryptocurrencies on the Binance platform is referred to as “Binance Trading.”Binance offers trading in various digital assets and is one of the world’s biggest and most well-known cryptocurrency exchanges. Users must first register for a Binance account, fund it with money, then choose a trading pair before they can begin trading.

Different orders, such as market orders or limit orders, can be placed by users to carry out their trades on the trading pairs, which are made up of two cryptocurrencies. The trading platform offers a simple user interface for handling transactions, including setting stop-loss and take-profit levels. Due to market volatility, cryptocurrency trading on Binance carries risks similar to those associated with other forms of trading. Users consequently require due diligence and prudence and should only invest money they can afford to lose.

How Does a Trading Bot Work?

Okay, now we know what a cryptocurrency trading bot is. Let’s describe how it operates.

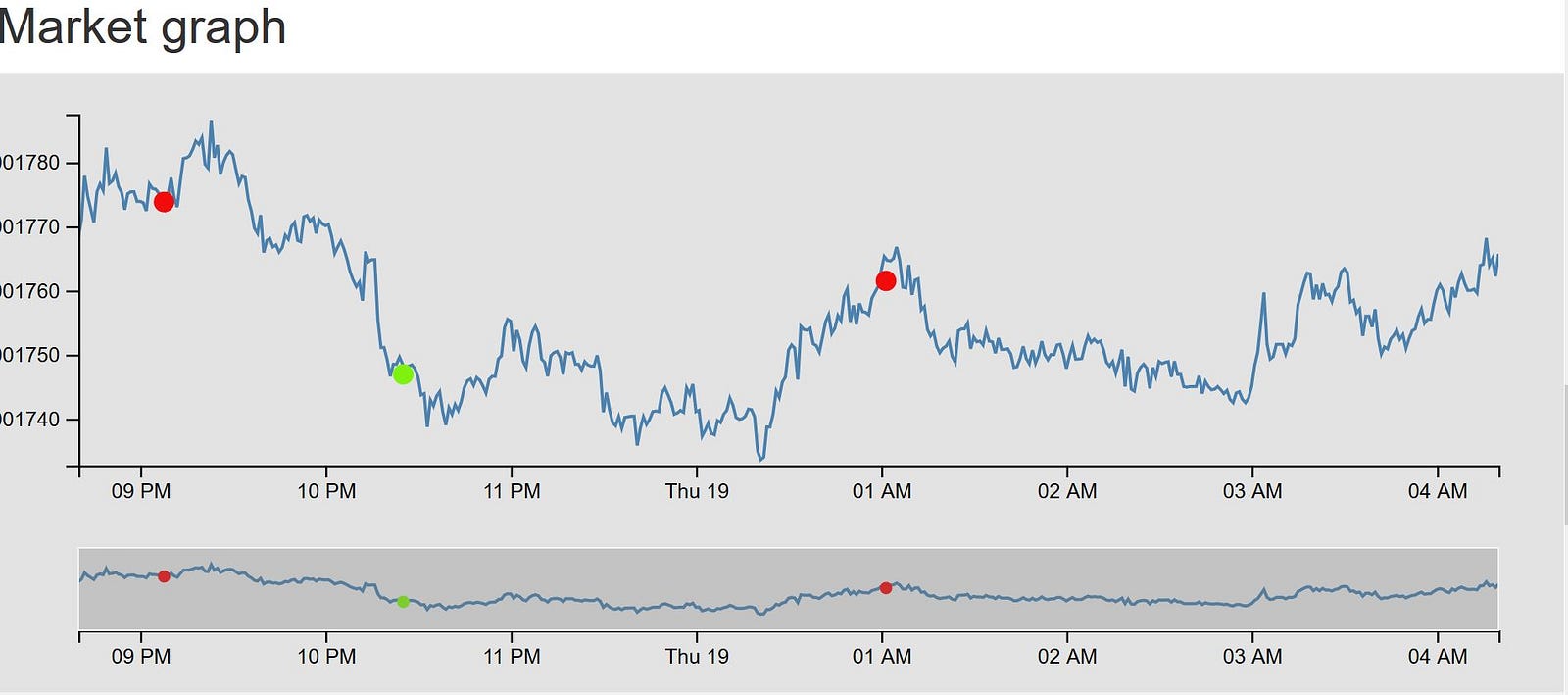

To write the trading strategy’s code, a group of traders and coders pool their thoughts. According to the approach, the code automatically enables the bot to trade, open, and close positions.

The most significant benefit of cryptocurrency bots is that they ignore entirely human emotions, which can occasionally be risky for traders. Like most other things in the crypto realm, these bots aren’t 100% dependable, but they can frequently help you save money or even make money.

You can only work briefly, even if you are an excellent cryptocurrency trader. Thus, this is where cryptocurrency trading bots start to shine.

Pros and Cons of Binance Trading:

Pros:

Various Cryptocurrencies: Binance users can access various trading choices, including several cryptocurrencies and trading pairs.

Liquidity: Since Binance is one of the biggest exchanges in the world, it frequently has high liquidity, enabling users to buy or sell assets quickly and at attractive prices.

Friendly User Interface: Both novice and expert traders may easily navigate and complete trades on Binance because of its user-friendly design.

Low costs: The average trading charge on Binance is competitive, especially if customers pay with the native Binance Coin (BNB), which can result in lower transaction costs.

Security Measures: Binance uses robust security mechanisms, like two-factor authentication (2FA) and cold storage for most customer funds, to protect user cash and data.

Cons:

Regulatory Concerns: Since the regulatory environment for cryptocurrencies is still developing, exchanges like Binance may come under heightened scrutiny from regulators in various countries, which might cause compliance problems.

Customer Service: When there is a lot of demand or technical difficulties, customer assistance on Binance can be delayed and occasionally challenging to get a hold of.

Security dangers: Although Binance takes security diligently, hacking attempts happen on exchanges, and users’ assets may be in danger if security is breached.

Limited Fiat Options: Despite having more currency choices than before, Binance may still only allow a small portion of direct fiat deposits and withdrawals compared to other financial platforms.

No Deposit Protection: The money housed on a cryptocurrency exchange is typically not insured like in traditional banks, making it vulnerable to theft or loss.

Features of Binance Trading:

- Spot trading is supported by Binance, allowing users to purchase and sell cryptocurrencies at the market’s going rate. Users can establish purchase or sell prices by placing market or limit orders.

- For more seasoned traders, Binance provides futures and margin trading options, letting users leverage their positions and multiply their winnings or losses.

- With the help of this function, customers can participate in flexible or locked savings accounts or generate passive income by staking their cryptocurrency.

- Users can participate in new token offers through Binance Launchpad, which hosts Initial Coin offers (ICOs) and token sales for new projects.

- To earn dividends on their holdings, members of Binance Earn can explore various investment products, including staking and DeFi (Decentralised Finance) projects.

- Users of Binance’s Binance Card debit card can utilize their cryptocurrencies at businesses that accept Visa payments.

- Binance generally has reasonable trading fees, and customers can lower their costs by paying for transactions using Binance Coin (BNB).

BEST Binance Trading Bots:

Let’s first discuss trading bots more generally before discussing the top Binance bots, in our opinion.

1. Gunbot:

Popular Binance trading bot Gunbot is renowned for its adaptability and programmable trading methods. It contains trailing stops and stop-loss orders and supports various technical analysis indicators. Gunbot is a good option for traders of all levels because of its user-friendly design and vibrant community.

Gunbot is a respected site that provides dependable Binance trading bots created exclusively to satisfy the requirements of cryptocurrency traders. Thanks to its dependable and user-friendly interface, Gunbot allows consumers to automate their trading methods on the Binance exchange. Gunbot enables traders to execute trades automatically, maximizing their potential earnings by utilizing cutting-edge trading algorithms and real-time market data.

The software offers a variety of customizable options that enable users to add indicators to their trading bots, tactics, and risk management tools in line with their unique preferences and goals. Gunbot also prioritizes security, using procedures like API key encryption and multi-factor authentication to guarantee the security of user payments and private data.

Pros:

- Purchased once (with optional add-ons)

- Extensive control for technical users

- A reputable website with a sizable user base

Cons:

- Incline learning curve

- Rude smartphone application monitors activity

2. TradeSanta:

A cloud-based trading bot called TradeSanta focuses on grid and trend trading techniques on Binance. It provides a straightforward, user-friendly interface for developing and implementing automated trading bots. To improve trading success, TradeSanta supports a variety of pairs and offers tools like brilliant order execution and stop-loss orders.

TradeSanta prioritizes user data and financial security by implementing two-factor authentication and API-critical encryption safeguards. TradeSanta is dedicated to remaining on the cutting edge of market developments because it is a reputable service in the bitcoin trading market.

Users can access dependable and cutting-edge trading bot solutions on Binance because of the platform’s constant updating of its features and tools. With TradeSanta, traders can easily and with peace of mind automate their trading tactics, discover new possibilities, and move through the dynamic world of cryptocurrencies.

Pros:

- A simple way to create a bot

- Low-cost plans

- An extraordinary level of assistance

Cons:

- For novice traders only

- A “Maximum” plan’s free trial is only valid for three days.

3. 3Commas:

Several meaningful exchanges, including Binance, are supported by the well-known trading bot 3Commas. It has an intuitive user interface and vast trading capabilities, including copy trading, portfolio management, and intelligent trading. Users of 3Commas can design their trading strategies and carry out trades based on various indicators and signals.

A well-known and reliable platform, 3Commas, provides Binance trading bots to help customers improve their cryptocurrency trading techniques. 3Commas has established a reputation as a dependable option for traders of all experience levels thanks to its simple interface and robust features. Based on user-defined parameters, these trading bots are made to execute transactions on Binance automatically.

The 3Commas platform aids customers in maximizing prospective profits by utilizing cutting-edge algorithms and real-time market data. Additionally, the platform offers customers several tools, such as tracking mechanisms, portfolio management features, stop-loss, and take-profit orders. By strongly emphasizing security and user control, 3Commas ensures that traders can automate their trading methods confidently on Binance and feel secure knowing that their money and personal information are secure. To give users the most trustworthy and efficient trading bot solutions, 3Commas, a dependable partner of Binance, continues to develop and innovate.

Pros:

- Simple setup

- The simple user interface for navigation

- 24/7 client assistance

Cons:

- You may first take some time to get used to the intricate interface.

- Due to user preferences, it is challenging to quantify profitability.

- Average profitability is difficult to measure because most bots are user-built.

4. CryptoHopper:

Users can automate their trading on Binance with CryptoHopper, a cloud-based trading bot. There are several pre-built trading techniques and technical indicators available. The “Marketplace,” a unique feature of CryptoHopper, allows users to buy and sell trading methods, signals, and templates other traders make.

Binance trading bots are available on CryptoHopper, a well-known and reliable platform that serves the various demands of cryptocurrency traders. With its well-known user-friendliness and extensive functionality, CryptoHopper makes it simple for users to automate their trading methods on the Binance exchange. The platform offers a wide range of adaptable features enabling users to customize their trading bots based on their preferences, indicators, and risk management criteria.

CryptoHopper prioritizes security and employs strict security controls to safeguard user payments and private data, such as secure API key integration and two-factor authentication. As a reputable business partner in the cryptocurrency trading industry, CryptoHopper continuously develops its platform to meet changing market needs. As a result, consumers always have access to cutting-edge features and dependable trading bot solutions on Binance.

Pros:

- It provides Bollinger Bands, Stoch, and many other indicators.

- Using security procedures, you may safeguard your account with the Cryptohopper Binance trading bot.

- It provides a 24/7 trading bot that hosts its services on the cloud.

Cons:

- Provides incredibly little technical support

5. Gekko:

Gekko is a trading bot that supports Binance trading and is free and open-source. Although setting up and configuring Gekko needs some technical skill, it offers a variety of customized trading methods and backtesting options. Its vibrant community and thorough instructions make it a good option for traders who choose a DIY strategy.

As a reputable service provider in cryptocurrency trading, Gekko is dedicated to staying current with technological developments. Users on Binance have access to trustworthy and cutting-edge trading bot solutions because of the platform’s ongoing enhancements to its features and tools. Thanks to Gekko, traders may explore new opportunities, automate their trading techniques confidently, and navigate the constantly evolving cryptocurrency market with peace of mind.

Pros:

- Gekko is an open-source platform that enables users to customize their trading methods by accessing and modifying the source code as necessary.

- Before implementing their trading methods in real-time, users can test them using past market data thanks to Gekko’s capability for backtesting.

Cons:

- Gekko’s command-line-based user interface might not be as friendly as specific commercial trading bot platforms with graphical user interfaces.

6. Pionex:

An exchange with built-in trading bots made exclusively for Binance is Pionex. Grid trading and dollar-cost averaging are only two automated trading tools and strategies available to users. Both novice and experienced traders will find Pionex an appealing option thanks to its user-friendly interface and affordable cost structure.

Pionex, a reputable platform that serves the needs of cryptocurrency traders, provides Binance trading bots. Thanks to its user-friendly interface and versatile capabilities, Pionex effectively automates trading methods on the Binance exchange. Pionex allows consumers to make trades automatically, taking advantage of market volatility and maximizing their potential gains by utilizing cutting-edge algorithms and real-time market data.

The platform’s extensive customization features allow users to create trading bots tailored to their tastes, risk-management criteria, and indicators. Pionex prioritizes security and uses adequate safeguards to protect user payments and private data, such as API key encryption and two-factor authentication.

Pros:

- Trading with integrated trading bots

- Low transaction costs and no ongoing charges

Cons:

- The paid and free plans have fewer features than rivals.

- Fiat withdrawal is not allowed.

7. Margin.de:

A trading bot called Margin.de provides leveraged trading on Binance. Advanced services are available to users, including margin trading, short selling, and automated trading methods. For traders wishing to increase their trading potential, Margin.de is a popular option due to its user-friendly interface and risk management capabilities.

Margin.de prioritizes security and uses strict safeguards to protect user cash and private data, such as API key encryption and two-factor authentication. Margin.de, a reputable supplier in the cryptocurrency trading industry, regularly updates its platform to account for market dynamics and gives consumers access to cutting-edge trading bot solutions on Binance.

Traders may securely automate their trading tactics using Margin.de, discover fresh possibilities, and quickly and worry-free navigate the volatile world of cryptocurrencies.

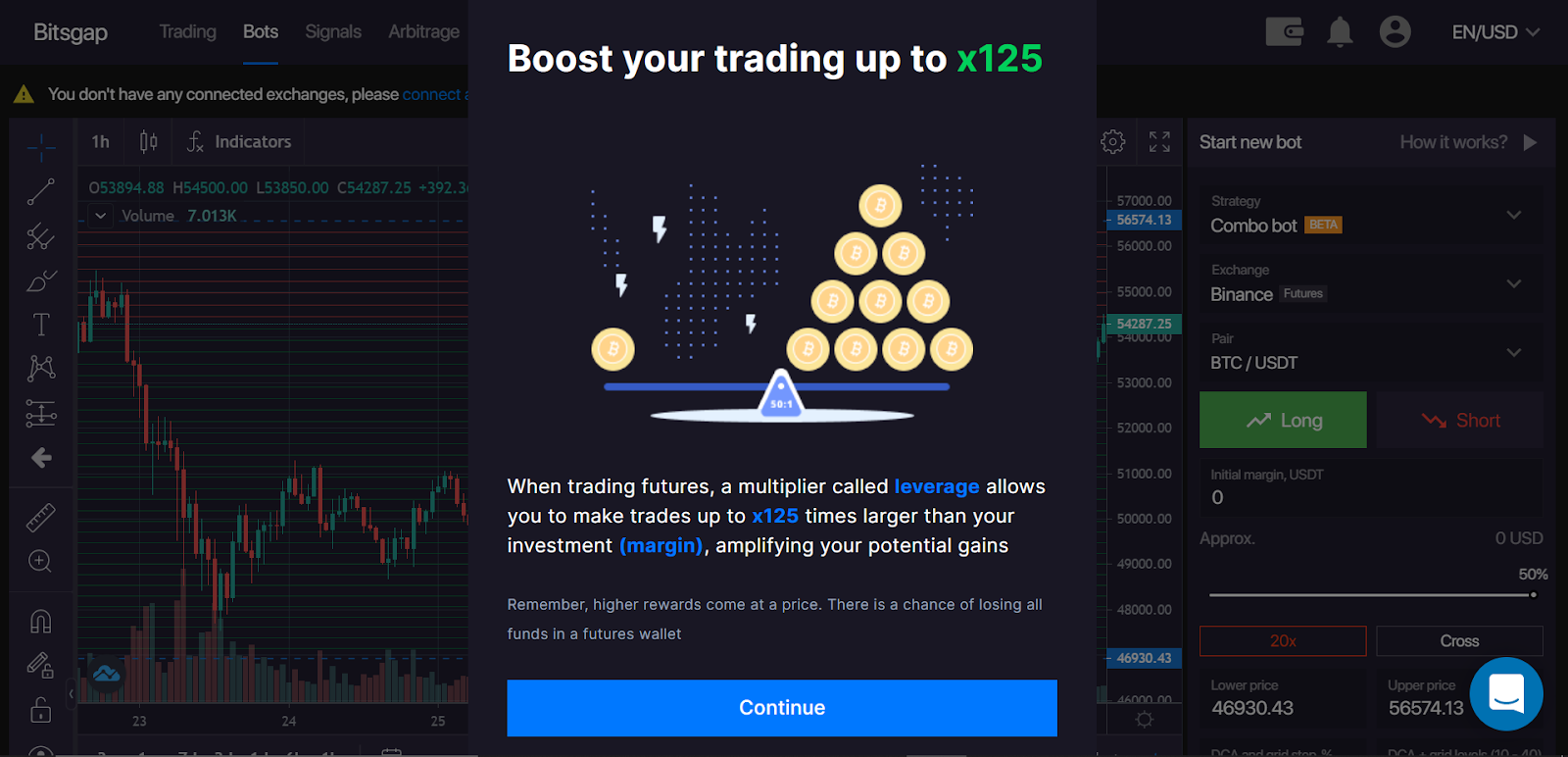

8. Bitsgap:

An all-in-one trading platform with Binance integration is Bitsgap. With functions like grid trading, trailing stops, and portfolio rebalancing, it provides automated trading bots. Additionally, Bitsgap offers customers a uniform interface for controlling numerous exchanges, which is helpful for investors with varied portfolios.

Users can benefit from a range of trading alternatives, such as market making, arbitrage, and portfolio rebalancing, with Bitsgap’s Binance trading bots. The bots use intelligent algorithms to analyze market patterns, track price changes, and automatically place trades based on preset criteria. In the dynamic and quick-paced world of cryptocurrency trading, traders may minimize human mistakes, eliminate manual labor, and increase their earnings by utilizing Bitsgap’s Binance trading bots.

Pros:

- With Bitsgap, users may find and take advantage of arbitrage possibilities across several exchanges, earning money from pricing discrepancies.

Cons:

- Even though Bitsgap offers a free plan with few features, some more sophisticated features and tools can call for a membership, and users might have to pay trading fees on the connected exchanges.

- Like any other cryptocurrency trading platform, Bitsgap’s operations may be affected by legislative changes and may have difficulties in some countries.

9. Zenbot:

A trading bot that supports Binance trading is called Zenbot. With the use of a variety of technical analysis indicators, it enables users to design and customize their trading strategies. For traders who seek more control over their trading algorithms, Zenbot is a flexible alternative because of its modular architecture and vibrant developer community.

Zenbot offers an effective method for automating trading methods on the Binance exchange thanks to its user-friendly interface and robust functionality. Zenbot allows consumers to make trades automatically, maximizing their potential gains and profiting from market volatility by utilizing cutting-edge algorithms and real-time market data. The platform’s extensive customization features allow users to create trading bots tailored to their tastes, risk-management criteria, and indicators.

Pros:

- Since Zenbot is open-source, users can alter and personalize the source code by their preferences and techniques.

- The ability to automate trading techniques with Zenbot, which executes trades around-the-clock depending on preset criteria, may benefit investors who want to seize any available market opportunities.

Cons:

- Zenbot is intended for more technically savvy individuals with a working knowledge of cryptocurrency trading methods and programming skills. It might not be appropriate for absolute novices.

- Zenbot’s user interface might not be as friendly as some commercial trading bots and might force customers to use the command-line interface.

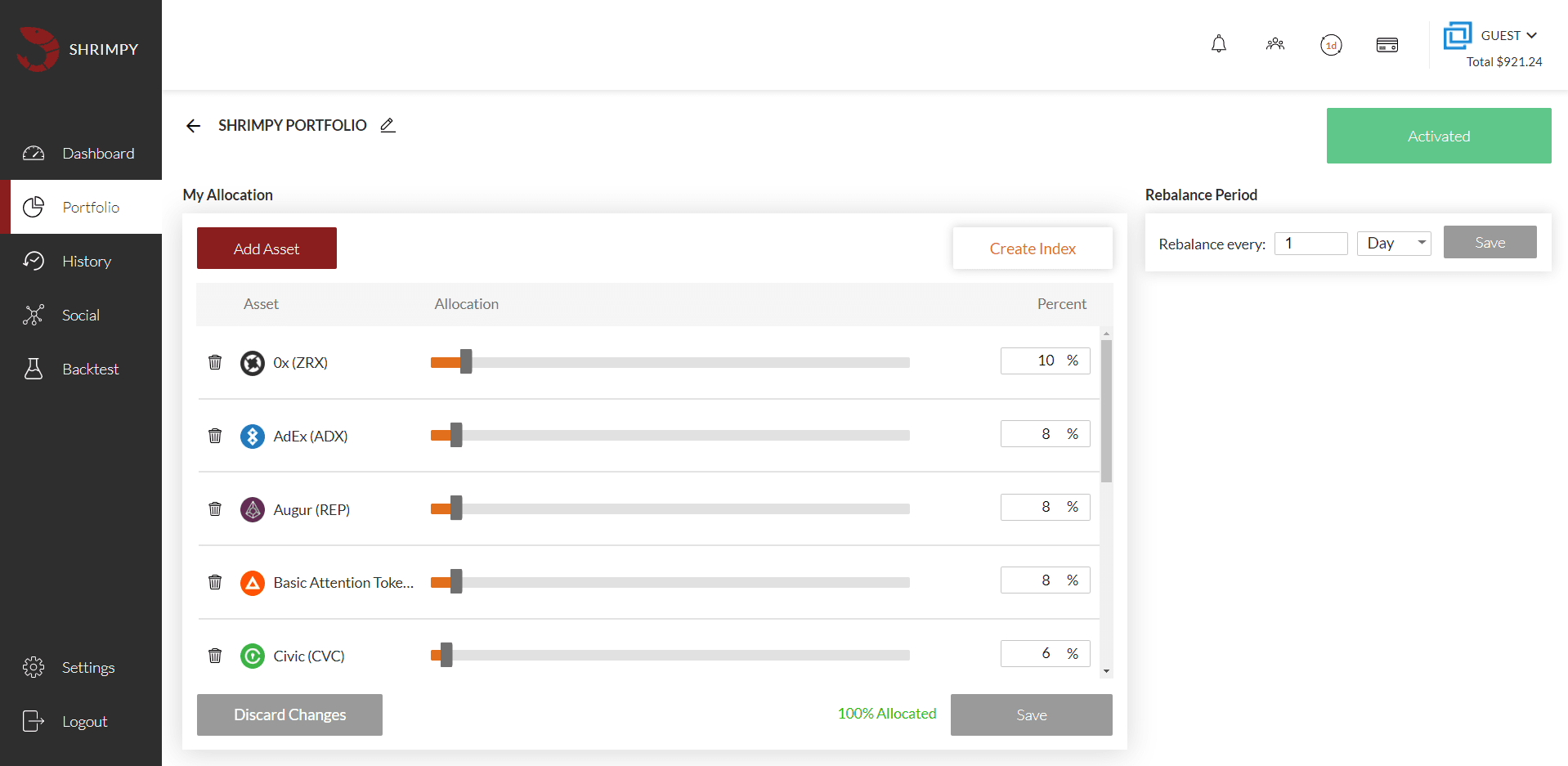

10. Shrimpy:

Binance has integrated Shrimpy, a well-known automated trading and portfolio management software. It enables users to rebalance their portfolios depending on predetermined parameters and automate their trading techniques. Shrimpy is a complete solution for cryptocurrency traders thanks to its sophisticated trading capabilities, including social trading and portfolio backtesting.

A reliable platform called Shrimpy provides dependable Binance trading bots that are made expressly to meet the requirements of cryptocurrency traders. Shrimpy allows customers to automate their trading methods on the Binance exchange with a simple and effective UI and a wealth of functionality. The platform’s extensive customization features allow users to create trading bots tailored to their tastes, risk management criteria, and indicators. Shrimpy prioritizes user data and financial security, implementing robust safeguards, including two-factor authentication and API key encryption.

Pros:

- Centered on social copy trading

- Affordable prices

Cons:

- Restricted customer service (through tickets)

- No mobile application

Conclusion:

Most trading bots discussed can connect to Binance and other exchanges, so they are always referred to as Binance trade bots. The trading techniques available to those using bot marketplaces are the most varied, but with Coinrule, you start with over 150 templates. Before connecting a Binance trading bot, create an API and secret keys. Even seasoned traders might gain from using the bots on this list to customize their trading tactics.

We advise a novice trader to look at Binance trading bots with preset methods that are ready to trade and profitable. These are available on several bots, such as Trality, Pionex, and Gunbot.

As an alternative, consider bots like Shrimpy, Cryptohopper, TradeSanta, and Kryll, to name a few, that offer social trading and copying trading methods from professional traders for free or at a low cost.

FAQs:

What is the best crypto-to-bot trade?

Generally, you’ll want your crypto trading bot to support the most liquid cryptocurrencies, such as Bitcoin or Ethereum. Regarding bot trading, liquidity implies that there aren’t any discounts or premiums associated with a particular asset when buying or selling, making it more straightforward for your bot to carry out buys and sells as necessary.

Is trading with crypto bots legal?

Yes, bot trading is acceptable in all capital markets and is legal. Trading in cryptocurrencies is unlawful in all cases. You might get into problems if you built a “pump and dump” or “spoof” bot to deceive other users or platforms. The most excellent strategy is to use crypto automation bots as they were designed to be used: to carry out trades for you under specific data-driven situations.