Many exchanges agreed to include KYC verification to reduce money laundering and fund loss. Some cryptocurrency exchanges do not, however, still demand KYC. We are particularly interested in these. According to research, here are the best no-KYC crypto exchanges to use in 2023.

What is KYC?

Know Your Customer (KYC), also known as “know Your Client,” is a required procedure used to identify and confirm that clients are actual people who are not involved in financial crime or money laundering.

Many organisations, especially those that operate internationally, According to anti-money laundering (AML) and countering the financing of terrorism (CFT) rules, are subject to KYC verification standards, much like bitcoin exchanges.

Can I buy cryptocurrency without a KYC?

Can you purchase cryptocurrency from centralized exchanges (CEXs) without providing your KYC? Most online articles will inform you that it is feasible in some exchanges. They frequently omit the fact that it is conditional and has restrictions, though.

The preferred locations for traders that value their anonymity are decentralized exchanges. DEXs have less volume than centralized exchanges, but traders prefer them since they get to keep custody of their cryptocurrency all to themselves.

In the recent instance of FTX’s insolvency, the adage “Not your keys, not your crypto” has proven accurate.

Why might a crypto user evade KYC?

For several reasons, cryptocurrency investors choose non-KYC exchanges.

- Privacy rights: The importance of anonymity and the right to privacy have long been fundamental principles of the cryptocurrency ecosystem.

- More cryptocurrency availability: Newer cryptocurrencies still unavailable on authorized exchanges are frequently accessible on non-KYC exchanges.

- Unwilling to wait for confirmation: Verifying your identification may take some time. Investors can frequently have immediate access to trading on non-KYC exchanges.

Pros and Cons:

Pros:

- Risk Reduction: KYC assists organizations in identifying and controlling customer-related hazards. Institutions can spot and stop potentially fraudulent or high-risk behaviors by validating identities and comprehending the nature of client connections.

- Compliance with laws and regulations: As part of their legal and regulatory requirements, many jurisdictions mandate financial institutions to conduct KYC. Institutions can avoid fines and reputational harm by adhering to KYC laws.

- Financial crime avoidance: Money laundering, terrorist financing, and other financial crimes can all be stopped with the help of KYC. It is difficult for criminals to justify their illicit riches through the financial system.

- Protection of the client: KYC aids in defending clients from identity theft and other fraudulent practices. KYC protects people’s financial security by guaranteeing that only legitimate consumers can access financial services.

- Increased Security: By lowering the possibility of fraudulent transactions and unauthorized account access, proper KYC procedures help to create a more secure financial environment.

- Reputation control: Effective KYC procedures can improve financial firms’ reputations.

Cons:

- Privacy issues: Privacy concerns may arise when personal information is gathered and stored for KYC purposes. Customers might be concerned about how their private information is used or exposed to data breaches.

- Cost and complexity: A complete KYC program can be resource-intensive to implement and manage. It requires significant investment in technology, employee development, and constant supervision.

- Client Experience: Transactions and customer onboarding can be delayed due to rigorous KYC requirements. Lengthy verification procedures may irritate clients, who may go elsewhere for services.

- True Negatives: Automated KYC systems may produce false positives due to data flaws or inconsistencies, classifying legitimate consumers as possible hazards.

Features:

- Important client data must be gathered and verified as part of KYC, including name, date of birth, address, and identification documents (such as a passport, driver’s license, or national ID). The customer’s identity is established in this phase.

- Customers are often asked to present appropriate identification documents to prove their identity and residence. To guarantee their authenticity, these documents have been checked.

- Each customer’s level of risk is assessed by the institution based on details, including their financial situation, line of work, and location. Institutions can evaluate the necessary level of diligence thanks to this assessment.

- CDD entails compiling more thorough data regarding the client’s history, financial transactions, and professional connections. Institutions can use this information to understand customer interactions better and spot any potential red flags.

- Institutions carry out increased due diligence for customers who pose a higher risk, such as politically exposed persons (PEPs) or those from high-risk regions. This necessitates a more thorough analysis and observation of these customers’ behavior.

- Institutions continuously keep an eye on the activities and transactions of their customers. This aids in the detection of odd or suspicious trends that could point to possible money laundering or other criminal activity.

- The analysis of transactions looks for any suspicious or unusual behavior, such as significant transactions that don’t fit the customer’s profile, frequent deposits that are just below the threshold for reporting, etc.

List of the 8 BEST No KYC Crypto Exchanges:

Here is a list of the top exchanges available if you want to start trading on an anonymous cryptocurrency exchange:

1. PrimeXBT:

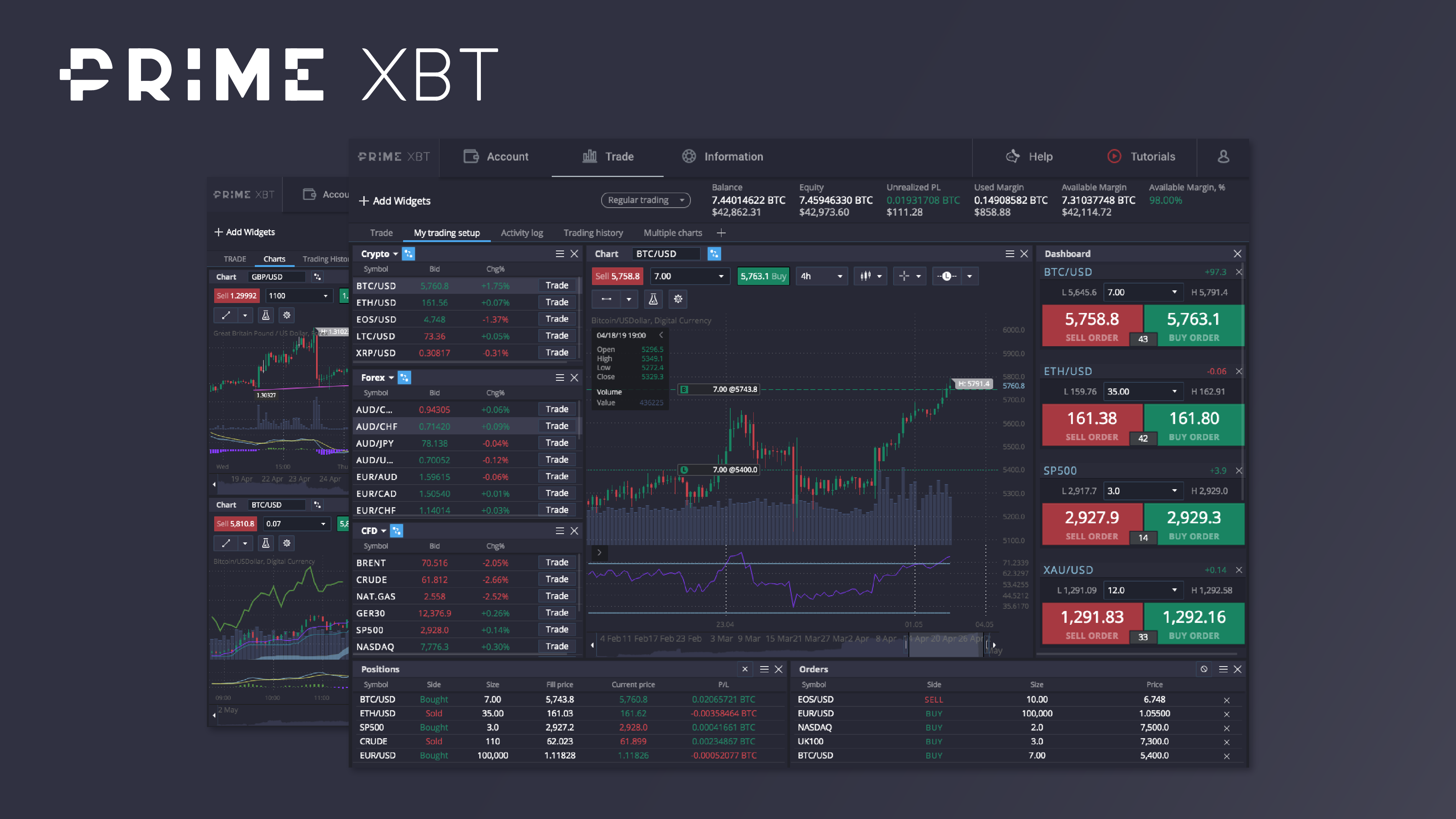

One of the few Bitcoin-based cryptocurrency exchanges is PrimeXBT. Only 46 trading pairs and several cryptocurrencies are featured on the platform—just over $280 million in reported daily trading volume. The platforms have more than $1 billion in open interest, which indicates that they are a venue to trade even though they only list a small number of tokens and coins. Its giant trading pair is BTC/USD.

Founded in 2018, PrimeXBT is a well-known cryptocurrency trading platform providing cutting-edge trading capabilities for cryptocurrencies and conventional assets. All levels of traders can use PrimeXBT because of its simple interface. Access to conventional markets, including FX, commodities, and indices, as well as several cryptocurrency trading pairings, are made available by the platform. PrimeXBT distinguishes itself for its ability to trade with leverage, allowing customers to increase prospective profits. Features like two-factor authentication and cold storage place a strong emphasis on security. The platform is a top pick for traders looking for extensive trading options because it emphasizes professional-grade trading tools, strong liquidity, and various assets.

Features:

- The platform strongly emphasizes security, protecting user cash through two-factor authentication and cold storage.

- Users of PrimeXBT can diversify their portfolios by using the platform’s support for several cryptocurrency trading pairings.

- Customers can contact PrimeXBT for help with questions and problems.

Site URL: https://primexbt.com/

2. Paybis:

A non-KYC trading platform called Paybis offers more than 100 cryptocurrencies and stablecoins. Since it does not keep your cryptocurrency, it is secure. You have access to several exchanges through the exchange. Your hardware wallet can be linked to Paybis. When compared to conventional crypto exchanges, it is a distinctive characteristic.

There are nine languages accessible for the exchange. Both novice and seasoned traders can utilize the Paybis interface with ease. It still has no trading restrictions. Only your ID is needed for any transaction on the exchange.

Features:

- 100+ cryptocurrencies and stablecoins are supported.

- Supports over 40 payment methods, including debit and credit card transactions, wire transfers, and more.

- On significant exchanges, you can link your hardware or online wallets.

Site URL: https://paybis.com/

3. Bitrue:

Singapore-based Bitrue is a centralized exchange. It was founded in 2018 and presently provides trading in more than 590 cryptocurrencies. The exchange is the most significant choice for traders interested in yield farming because it processes more than $3 billion in 24-hour activity and has more than 1250 trading pairs.

Bitrue is a platform for trading and exchanging cryptocurrencies that offers a safe and convenient setting for buying, selling, and trading different cryptocurrencies. Bitrue, established in 2018, provides a selection of digital assets and trading pairs, enabling customers to diversify their portfolios. Through features like two-factor authentication and cold storage for a percentage of user funds, the platform places a strong emphasis on security. Additionally, Bitrue offers staking and lending alternatives so users can profit passively from cryptocurrency investments. Bitrue strives to make it easier for both new and seasoned traders to use cryptocurrencies with its user-friendly interface and emphasis on security.

Features:

- Access to the exchange’s high liquidity marketplaces enables smooth trading operations.

- Bitrue interacts with its user base in various ways, promoting openness and communication.

- Users can purchase cryptocurrencies using fiat money through the platform’s connection with conventional payment methods.

Site URL: https://www.bitrue.com/

4. MEXC:

One of the busiest cryptocurrency exchanges in 2022 is MEXC. For US citizens, the platform offers no-KYC trading alternatives. Over 1520 cryptocurrencies and over 2110 trade pairs are available on the platform. MEXC is renowned for listing new crypto tokens and microcap coins as soon as they are released.

A well-known cryptocurrency exchange platform called MEXC offers a variety of trading options for virtual assets. MEXC, introduced in 2018, has a user-friendly interface to accommodate both inexperienced and seasoned traders. The website offers users access to numerous markets and cryptocurrency trading pairings. MEXC prioritizes security, putting safeguards including cold storage, multi-factor authentication, and routine security audits to protect user cash. With various features, MEXC aims to provide users a safe and convenient environment for cryptocurrency trading and investment.

Features:

- MEXC strongly emphasizes security to safeguard customer cash, using cold storage, 2FA, and frequent security audits.

- MEXC provides access to worldwide markets and opportunities for its customer base.

Site URL: https://www.mexc.com

5. Changelly:

Currently, Seychelles is the location of Changelly’s centralized cryptocurrency exchanges. In 2020, the platform was created. It has only 63 coins and 138 trading pairs, processing over $3.5 billion in deals. Changelly places a lot of emphasis on introducing new users to cryptocurrency and onboarding them from fiat, which helps to explain the mismatch between the high volume and the small number of supported coins.

Users may rapidly trade one cryptocurrency for another with Changelly without engaging in laborious trading procedures. Novice and seasoned traders will find the platform’s layout clear and user-friendly. Assuring that users retain control over their private keys and monies throughout the exchange process, Changelly’s core feature is its capacity to offer quick and non-custodial transactions. Changelly promises to simplify the cryptocurrency trading process for a variety of users by emphasizing speed and user autonomy.

Features:

- The platform provides upfront disclosure of its fees, which are transparent and competitive.

- Changelly provides access to global cryptocurrency exchanges for users all over the world.

- The Changelly mobile app allows users to swap coins conveniently.

Site URL: https://changelly.com/

6. Kucoin:

One of the earliest exchanges in the sector, Kucoin is based in Seychelles and was established in 2014. The platform conducts over $15 billion in trading volume with 733 coins and over 1280 trading pairings. The giant pair on this centralized cryptocurrency exchange is BTC/USDT.

KuCoin offers both novice and seasoned traders a user-friendly interface. Additionally, KuCoin offers users options to make money and diversify their portfolios with cutting-edge tools like staking, lending, and futures trading. KuCoin wants a complete solution for cryptocurrency trading and investing with a global presence and dedication to user-centric services.

Features:

- KuCoin provides access to worldwide marketplaces and opportunities for its user base.

- Futures trading, spot trading, and other sophisticated trading capabilities are available on the exchange.

Site URL: https://www.kucoin.com/

7. AAX:

One of the lesser-known cryptocurrency exchanges that appeared in 2018 is called AAX. The exchange, registered in Seychelles, lists 254 cryptocurrencies and offers more than 270 trading pairings. This centralized cryptocurrency exchange transacts more than $2.9 billion daily transactions, with the top pair being BTC/USDT.

Through adequate safeguards like multi-layer encryption and cold storage of user cash, the platform prioritizes security. To accommodate different trading tastes, AAX offers a wide variety of cryptocurrencies and trading pairings. AAX offers sophisticated trading capabilities, such as spot and futures trading, options trading, and over-the-counter trading, focusing on supplying institutional-grade technology. The platform aims to give traders, both individual and institutional, frictionless and effective trading experiences in the bitcoin field with its user-friendly interface and high liquidity marketplaces.

Features:

- Users of different skill levels can access AAX thanks to its user-friendly interface, which caters to novice and seasoned traders.

- Access to high-liquidity marketplaces is provided through AAX, allowing for smooth trade execution.

Site URL: https://aax.com/

8. Bitfinex:

In the cryptocurrency industry, Bitfinex has been active for some time. The exchange was founded in 2014 and has its present headquarters in the British Virgin Islands. This centralized exchange features 454 trading pairings, 186 cryptocurrencies, and more than $1 billion in trading volume. The giant trading pair on the platform is BTC/USD. Since Bitfinex has been around for a while, it is among the few reputable cryptocurrency exchanges available.

A reputable Bitcoin exchange site called Bitfinex has been in operation since 2012. It provides a wide choice of cryptocurrencies and trading pairs to meet the needs of all types of traders. With options like loan and margin trading, Bitfinex—a platform renowned for its sophisticated trading features—allows customers to leverage their positions and gain interest in their holdings. The platform strongly emphasizes liquidity and acts as a center for high-volume trading. Protecting user assets is a top priority, and security methods include two-factor authentication and cold storage. Bitfinex continues to participate significantly in the cryptocurrency trading market thanks to its durability, wide variety of cryptocurrencies, and emphasis on cutting-edge trading tools.

Features:

- Because of its high liquidity marketplaces, Bitfinex is a good choice for high-volume trading.

- With tools like two-factor authentication and cold storage for user assets, Bitfinex strongly emphasizes security.

- Since its operations in 2012, Bitfinex has established a reputation as one of the pioneering and enduring companies in the cryptocurrency exchange market.

Site URL: https://www.bitfinex.com/

Which no-KYC cryptocurrency exchange is the best for you?

Bisq stands out among our highlighted platforms because it’s a decentralized exchange and provides more anonymity. The platform ChangeNOW is flexible and supports a variety of cryptocurrencies. Gate.io is renowned for offering a wide variety of cryptos.

Furthermore, dYdX provides a decentralized trading environment for experienced traders who want to gain access to services like margin trading. The MEXC cryptocurrency exchange offers an extensive trading platform with cutting-edge features and a wide range of cryptocurrencies at low costs for newcomers and altcoin traders. However, the optimal exchange for you ultimately relies on your unique needs and tastes. Before registering, make sure the exchange’s terms and conditions suit your needs by reading them thoroughly.

Conclusion:

Remember that no centralized exchange with a brain would permit anyone to use their platform without complete “Know Your Customer” (KYC) compliance. If you’re a trader looking to purchase cryptocurrency without having your KYC verified, you might choose to utilize a DEX; if you decide to use a CEX, opt for lesser volumes below 2 BTC per day.

FAQs:

Do I need to have KYC to use Binance?

No, to utilize the platform’s trading, deposit, and withdrawal features and its more extensive ecosystem, users of Binance must complete the KYC verification process. Binance has been enforcing a strict KYC scheme since July 2022. You won’t be able to utilize any trading products as a non-verified user and will only have limited access to the Binance website. You can still investigate some products, such as Binance Gift Cards, NFTs, and fan tokens.

Exactly why would someone want to evade KYC?

Regulatory organizations will inform you that anyone who avoids KYC hides something evil. This is only sometimes the case, though. By avoiding KYC, you may be sure your money will be kept in your possession and out of regulatory agencies’ reach. Governments despise industries that they cannot regulate.

A “non-KYC” crypto exchange is what exactly?

A non-KYC exchange is a cryptocurrency exchange that doesn’t ask users to confirm their identity.