The popularity of investing applications has increased recently, and for a good reason: Everyone can access the stock market with only a few taps on their phone.

Investment applications are convenient and economical for new investors to accumulate money. In a recent poll of 1,006 U.S. adults, Select and Dynata discovered that younger investors are more inclined to use investment apps to guide their decisions.

The good thing is that there are lots of options available. We examined more than 30 applications from robo-advisors, fintech startups, large banks, and traditional brokerage firms to help you select the best one for your needs. We prioritized the investor experience level when ranking the top four apps.

By micro-investing with an app like Acorns, which invests users’ spare change, beginners may choose to start modestly. While more experienced investors can trade stocks and options using Robinhood, beginners, and intermediate investors can automate their investment with robo-advisor software like Betterment.

Our top four options stand out because they enable investors of all stripes to accumulate money while on the go, regardless of where they are in their investing path. Below, you can see our complete ranking of the best investment apps, along with responses to frequently asked questions regarding investing apps.

What types of Investments may you trade using an app?

Each broker offers a different mobile trading experience and a different selection of investments. An app from an established online broker often provides the broadest array of investment possibilities, whereas smaller applications or startups tend to have a limited selection. Acorns are the only app from the list above that exclusively offers ETFs, while TD Ameritrade offers individual stocks, mutual funds, bonds, ETFs, options, and currency (or forex). Access to cryptocurrencies is also available on several investment apps.

Best Investment Apps

Here is our list of the best ten investment apps and the essential statistics you need to know before investing.

1. Personal Capital:

https://www.personalcapital.com/

Personal Capital provides neither a brokerage account nor a robo-advisor. Instead, it’s a platform for financial advice, measuring your net worth, and supporting your investing strategy. Your financial accounts, including those with banks, brokerages, and even an employer’s 401(k), can be linked (k). The app displays all aspects of your financial life on a single screen. It provides outstanding analytical features and retirement planning tools for free. The business generates revenue by charging clients for the assistance of its human, financial advisors. Yet, the company’s free offering, which includes the app, is excellent on its own.

2. Acorns:

With the help of the financial software Acorns, you may access a bank account, an IRA, and a robo-advisor. It made our list because it’s an excellent option for new investors wanting to start modestly with micro-investing. Micro-investing refers to continually making tiny market investments to grow your Capital over time. It’s a smart move for newcomers who want to test the waters before jumping in headfirst.

Acorns’ Round-Ups® function, which invests users’ spare change in diverse ETFs, enables users to make micro-investments. When a transaction is made, the app will sweep both accounts to round up the price Users can link their credit or debit card account to their Acorns account. Your linked cards’ spare change is saved until you reach $5, which is put into your Acorns Invest account. The website for Acorns claims that with its Round-Ups feature, the typical customer makes monthly investments totaling more than $30.

Starting at just $5 monthly, you can invest the difference after rounding up to the closest dollar.

An investor’s risk tolerance determines the managed portfolios (composed of different ETFs) the Acorns Invests account recommends. Via Acorns, investors cannot purchase or sell specific equities.

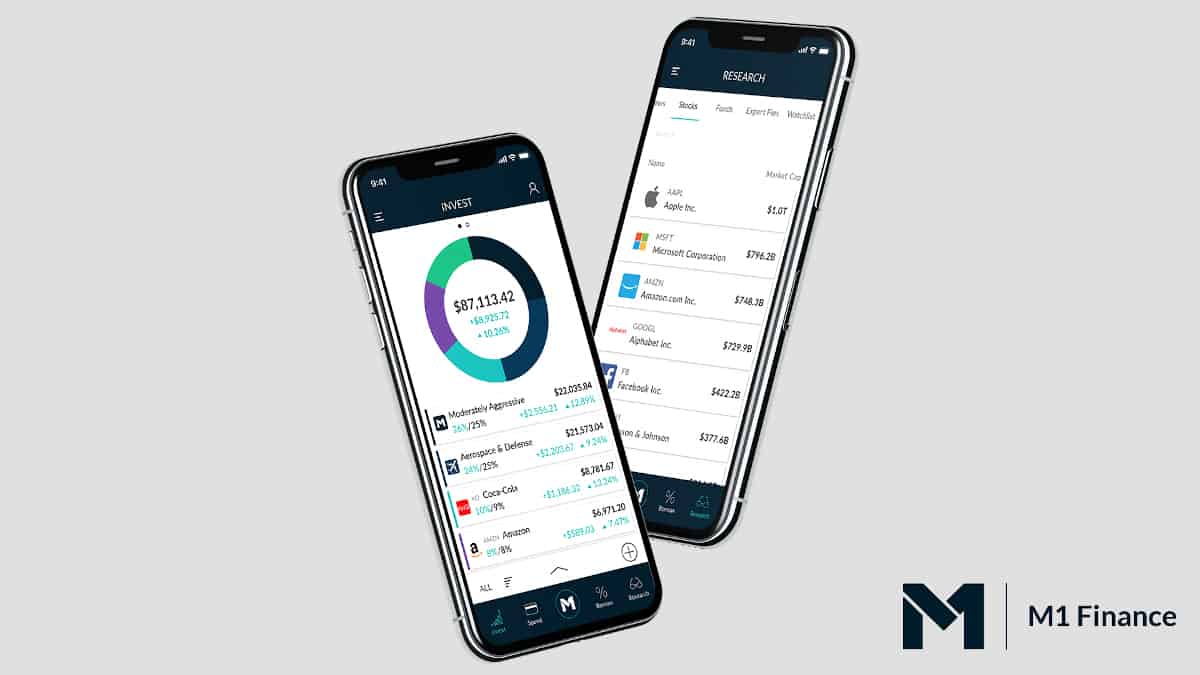

3. M1 Finance:

M1 Finance was designed with independent investors in mind. You begin by selecting an expertly-designed portfolio or customizing it with stocks (including fractional shares) and ETFs. You can use M1’s tools to choose investments and answer questions about your financial objectives. With its “Pie” interface, M1 allows you to quickly view the performance of any stock or ETF while also displaying the overall balance of your portfolio. Starting requires a $100 minimum first investment. After that, you can add money to your account in $10 increments. M1 also provides a checking account called M1 Spend, which is FDIC-insured and has no monthly fees or minimum balance requirements.

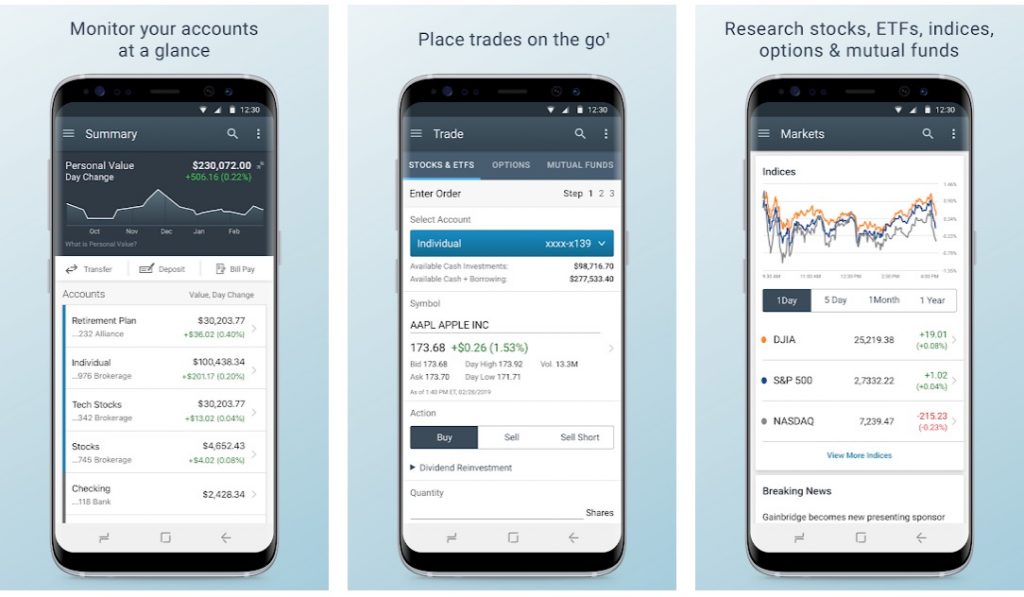

4. TD Ameritrade:

Customers can link their accounts to one or both of the two mobile apps that TD Ameritrade offers. The simplest of the two and recommended starting point is the TD Ameritrade basic app. It is an easy-to-use tool for checking accounts and buying and selling stocks. The alternative, thinkorswim, is intended for active traders and offers nearly all of the features of the renowned desktop program of the same name.

The extensive feature set of TD Ameritrade rivals that of the industry’s top stock brokers. Clients have access to a massive library of instructional materials and stock research and the ability to open nearly any sort of account. One of the top robo-advisor platforms is offered by TD Ameritrade for passive investors. It also offers close to 2,000 mutual funds with no transaction fees. Also, the thinkorswim platform features a fantastic “paper money” practice feature.

5. Webull:

Webull offers no-minimum commission-free trading on stocks, options, ETFs, and cryptocurrency. Users can also purchase fractional shares and IPOs. Although both Robinhood and Webull are excellent solutions for active traders, only Webull supports IRAs (traditional, Roth, and rollover), allowing customers to manage their retirement money and their equities in one location.

If you prefer to trade on a larger screen, Webull offers users a desktop version of its platform that can be customized. Investors can also take advantage of Webull’s extensive extended trading hours, which are to create a recurring payment from your linked bank account to your Acorns investment accounts (daily, weekly, or monthly) from

The Webull app is free to download and has received 4.7/5 stars in the App Store for iOS and 4.4/5 stars on Google play for Android as this article was written.

6. Betterment:

Betterment pioneered the robo-advisory industry and is still one of the top choices today. To assist you in achieving your long-term objectives, Betterment will create an age- and risk-appropriate portfolio.

It has no minimum balance requirement and a minimal maintenance fee. For low-balance brokers, it provides tax-loss harvesting, which is uncommon. A cash management account can also earn income from your unused funds. Betterment is a terrific option for novice and intermediate investors, and its user-friendly interface has some of the best reviews in the industry.

7. Charles Schwab:

Charles Schwab provides a reliable app for all your standard banking and investment needs. You can handle a wide range of account requirements while on the move. Contrast that with numerous other stock brokers, who provide apps with condensed feature sets that necessitate managing your account online to get all capabilities. You can make annual deposits into your IRA account and withdrawals for your required minimum distributions (RMD) or other obligations and pay taxes on those withdrawals.

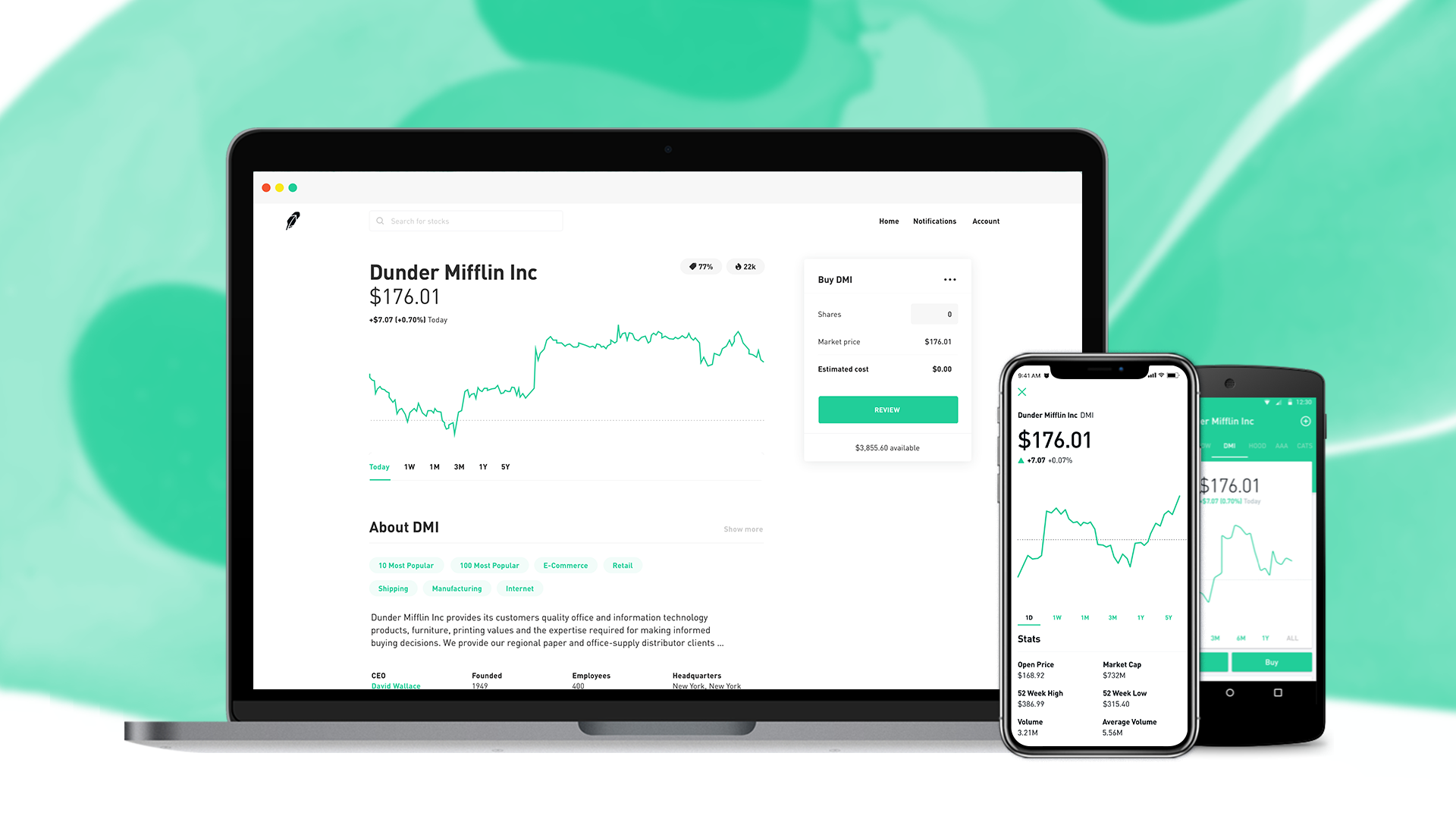

8. Robinhood:

Since Robinhood was the first investing app to offer commission-free stock purchases and sales, other brokerages eventually followed Monday through Friday suit. Robinhood, like the other applications on this list, doesn’t require users to meet any minimums to register an account or begin investing.

It’s simple for investors to trade stocks, options, ETFs, and cryptocurrencies. Since mutual funds and bonds aren’t offered, you might need another investing software to diversify your portfolio more effectively. Because Robinhood does not offer tax-advantaged retirement accounts, users must search elsewhere for IRAs. Through Robinhood, investors get access to IPO and commission-free fractional shares, allowing them to participate in expensive, well-known stocks without purchasing a whole share.

Since Robinhood allows users to create their portfolios, the platform may be best suited for active stock traders who have done their homework and understand how the market functions. Beginner traders are welcome to participate in the market, but ensure you’re comfortable with the dangers.

The Robinhood app may be downloaded for free on Google Play (for Android) and the App Store (for iOS), where it currently has 3.8/5 ratings and a rating of 4.1/5 stars (based on more than 3 million reviews).

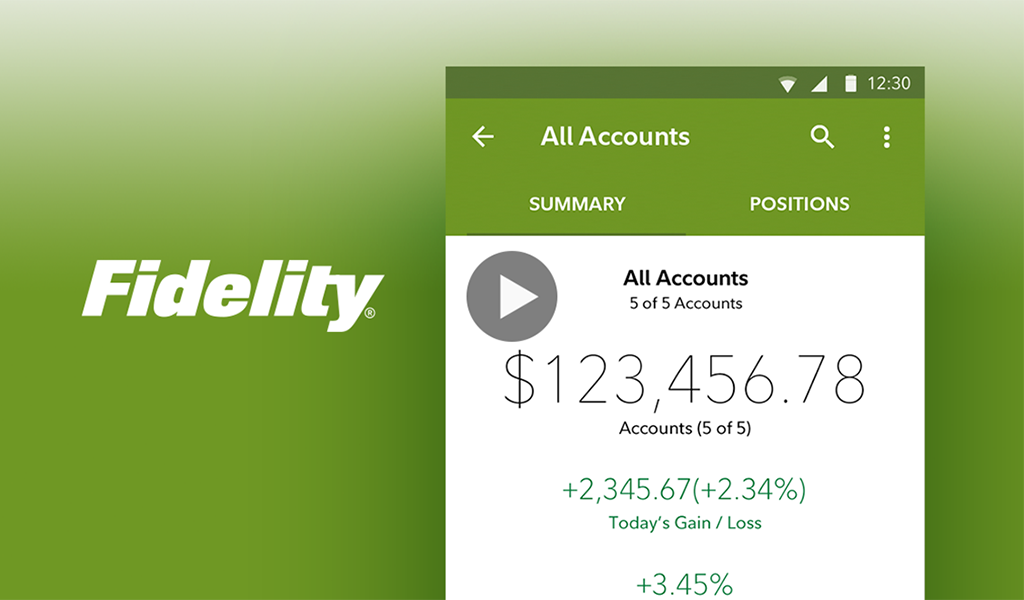

9. Fidelity Investments:

Fidelity has a solid reputation in the financial industry with a wide range of accounts suitable for both novice and experienced investors. Like most brokers in this evaluation, Fidelity offers commission-free stock trading and doesn’t charge monthly account fees. A minimum deposit is not necessary to start an account. You can invest in stocks, ETFs, bonds, options, CDs, initial public offerings (IPOs), and precious metals.

The website and app are slick, easy to use, and have financial and investing options. Fidelity’s retirement options are why I like it the best. Traditional, Roth and rollover IRAs are available through Fidelity.

Additionally, it offers helpful financial planning tools like a retirement income calculator and a 60-second test that determines whether you are saving enough for retirement.

Fidelity also offers three investment advice programs, under which you can get everything from online resources and individualized financial counselling to a thorough financial plan created by your devoted advisory team.

10. Stash:

Stash offers more features than the other investment apps on our list. Stash may be used to manage most of your financial affairs for families wanting to teach their kids about investment. You can invest in more than 3,800 different individual stocks, exchange-traded funds (ETFs), and a few different cryptocurrencies within the app.

Stash strives to make the investment decision-making process short and simple. But, if you choose to add more services or accounts, the costs could mount (up to $9 per month, depending on the type of account).

You must link Stash to a checking account to invest, but you can start with as little as $5. You can assemble your stock and ETF portfolio with specialized advice.

How much does it cost to start investing using an app?

Thanks to micro-investing applications like Acorns and Stash, you can establish an investment portfolio with little money—even just your spare change. For instance, Acorns sweeps purchases from a linked credit or debit card account, rounds them up to the next dollar, and then invests the spare change. Similar opt-in functionality is available from Stash, which deposits money into users’ accounts after rounding up transactions.

Aside from the micro-investment applications, the amount of money you’ll need to start investing after opening your account depends on the assets you want to purchase. The cost of one share of stock might vary in price from a few dollars to hundreds or even thousands. Exchange-traded funds (ETFs) are mutual funds that trade like stocks and may frequently be purchased for less than many mutual funds, although regular funds frequently have minimums of $1,000 or more. Also, remember that certain brokers impose trading fees for each investment you buy or sell. There is good news in that many brokers now provide free transactions.