Due to its benefits to both parties, financial institutions and prop traders increasingly use proprietary or prop trading as an investment strategy. Using the funds or capital of the business, Shares, derivatives, and currencies are just a few of the financial instruments the investor or prop trader deals in. Financial institutions benefit directly from the financial market, instead of predominantly relying on trade commissions from clients, while prop traders profit from commissions or profit splits.

What are Forex Prop Firms?

Financial organizations called Forex Prop Firms, sometimes called Forex Proprietary Trading Firms, let traders trade the foreign currency market (Forex) using the firm’s money rather than their own. These businesses hire and support competent traders who trade on their behalf, sharing profits or being paid based on performance.

The main goal of Forex Prop Firms is to use the firm’s capital to reduce risk while leveraging the trading abilities of individual traders. This arrangement allows skilled traders to access significant trading capital and generate sizable gains without wasting money.

Pros and cons of Forex Prop Firms:

Pros:

- Access to cash: Offering traders access to sizeable cash is one of the essential advantages of Forex Prop Firms. Talented traders can do this without risking their own money, increasing their potential gains.

- Risk reduction: Since traders use the firm’s money, their risk is the possibility of making or losing money. The Trader and the company share the risk, offering some protection measures.

- Professional Support and Training: Many Forex Prop Firms provide their traders mentorship, instructional materials, and training. This can be helpful for traders wishing to develop their abilities and pick the brains of seasoned experts.

- Performance-Based Compensation: Traders are compensated according to how well they perform in their trades. Successful traders can make substantial earnings and possibly more money than they would in traditional trading.

Cons:

- Rigid Selection Criteria: Forex Prop Firms often have strict criteria for choosing traders, so getting admitted into one can be difficult. Only some applicants will be chosen.

- Profit Sharing: Although it can be advantageous, certain businesses may take a sizable chunk of the earnings traders make. The profit-sharing conditions must be carefully examined to ensure reasonable and fair.

- Limited Autonomy: Forex Prop Firm traders must abide by the firm’s risk management policies so that they may have less autonomy over their trading decisions.

- Potential Losses: Even though the firm’s capital is at stake, traders still run the danger of suffering losses that could force the firm to end its contract.

Features of Forex Prop Firms:

- Forex Prop Firm traders frequently receive compensation based on their trading results. They might get a cut of their profits, which would encourage them to be profitable traders.

- Forex Prop Firms use risk management practices to safeguard both the capital of the company and the Trader. They might include precise rules for risk management, maximum drawdowns, and position sizing.

- Prop firms often provide cutting-edge trading platforms and analytical tools for practical trading and market analysis.

- Several Forex Prop Firms offer educational resources and training programs to help traders improve their skills and keep current on market trends and techniques.

- Real-time performance metrics are frequently available to traders, enabling them to monitor their trading progress and pinpoint areas for development.

- Some Prop Firms provide guidance and assistance from seasoned traders or other trading experts. This advice can be helpful for traders trying to improve their tactics and thought processes.

- Depending on the risk tolerance of the firm, prop firms may promote or let traders utilize a range of trading techniques, such as day trading, scalping, swing trading, or long-term investing.

- Since they frequently operate in a competitive setting, traders in Forex Prop Firms may be inspired to enhance their performance and advance their trading abilities.

- As their performance and expertise increase, successful traders can expand their trading operations and get access to larger trading accounts.

How Can I Select the Best Forex Trading Company?

Consider the following factors while choosing the best forex trading firm:

- Finding a forex trading firm with a solid reputation takes hard research.

- Considering the team size, client referrals, and company history is also a good idea.

- Look for a Forex prop trading business with a proven track record and a lengthy history in the sector.

- It is essential to consider the company’s workforce level and financial health.

- You ought to choose a business that provides comprehensive forex trading education.

- Make sure the business you choose will answer any questions regarding the currency trading procedure.

- You must factor in the firm’s expenses and commissions.

Top 7 Forex Trading Companies:

The secret to success in prop trading is selecting companies that satisfy certain crucial conditions, such as a cheap fee structure, accessibility to a diverse market, or tradable assets and trading platforms. The risk contribution and the profit split must be appropriate because they affect how much leverage is provided.

1. Funded Traders:

The Funded Trader must be cited when describing proprietary businesses that are industry leaders. The company is well-known and deserves to be among the top five.

Most prop traders favor the company for various reasons, including its verified payouts, significant leverage, reasonable profit targets, and excellent drawdown. The company’s extraordinary flexibility in trading regulations is another significant factor. For instance, unlike most prop firms, Funded Trader permits trading breaking news and trades to be held overnight.

Trades to be held overnight, unlike most prop firms. Additionally permitted for the royal account is trade copying.

Many types of trading instruments exist, such as FX pairs, indices, cryptocurrencies, and metals. Funded Trader provides the standard, quick, and royal challenge funding options or programs. Each option consists of two phases designed to recognize and reward skilled traders. For phase 1 of the standard challenge, you must maintain a 6% daily and 12% overall drawdown while generating a 10% profit target over 35 days. After accomplishing this objective, you go on to the validation phase, which includes a 5% profit target within 60 days.

2. My Forex Funds:

My Forex Funds, a proprietary trading company established in 2020, provides traders with three alternative funding options. You can select from the Rapid, Evaluation, and Accelerated funding programs depending on your trading background. To help new traders gain expertise while trading in a demo environment and earning small percentages of profits, rapid accounts were created. On the other hand, assessment accounts follow an industry-standard two-step evaluation process that necessitates passing two evaluation stages before allowing you to get profit splits.

Last but not least, you can start making money immediately with the direct funding program known as the expedited funding program. Their services enable traders of all levels of expertise to join the proprietary trading company and begin pursuing forex market gains!

3. FXIFY:

FXIFY is a brand-new proprietary trading company that grants users who pass the site’s test access up to $400,000. You can build your account up to $4 million with profit shares as high as 90%.

If you’re interested, you need to choose if you want to finish the One-Phase or Two-Phase evaluation. Before starting, go over the terms and conditions of each examination to be sure you’re heading in the correct direction.

The company’s relationship with FXPIG makes trading possible on MT4 or MT5 and several trading platforms possible. Commission-free trading is the rule when you trade on FXIFY, giving you access to stock indexes, foreign exchange, precious metals, etc. Spreads are small, no trading limits, you can choose your leverage, and more. You can also engage professional advisors or other automated solutions to achieve the best results.

FXIFY appeals to people wishing to enter into prop trading because it offers immediate payouts, no consistency rules, unlimited trading days, and a 125% refund on your assessment charge with your first payout.

4. E8 Funding:

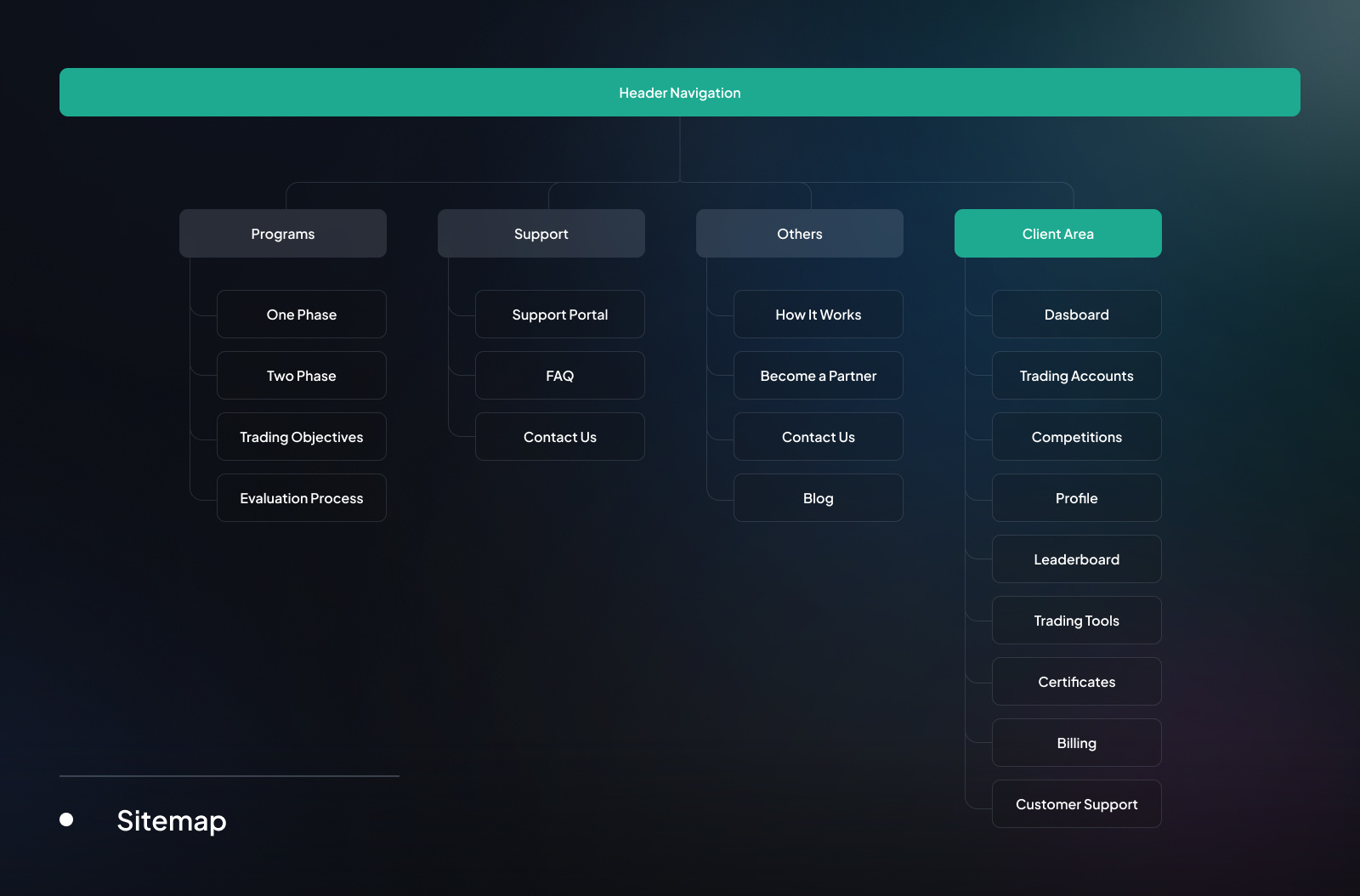

E8 Funding has created a user-friendly experience with the crucial data that every Trader needs and the most significant technology in the sector to support it. With their creative concepts, they strive to offer their traders the most significant funding experience. They provide traders with a choice between the E8 Evaluation, E8 Track, and ELEV8 funding programs. E8 Evaluation accounts are a two-part challenge distinguishable into conventional and extended varieties based on particular trading goals.

The E8 Track, a three-step review, is the second funding initiative. The ELEV8 account is the final challenge, which likewise entails two steps. The scaling strategy is more aggressive, enabling users to increase their account balances to a maximum of $1,000,000. E8 Funding is currently one of the top proprietary trading companies in the market, and with their creative strategy, they will keep progressing for years to come!

5. Topstep:

Topstep is the best prop trading platform to use if you specialize in trading futures and derivatives. It is one of the most well-known prop trading organizations because to its substantial payment and profit split (you keep 100% of your first $5,000 in earnings and 90% of your profits after that). Like most prop trading companies, Topstep provides the required capital, support, risk management strategies, and mentoring to trained or hired trading specialists in exchange for large profit splits.

The website welcomes both inexperienced and seasoned traders, which encourages the development of improved trading habits. To be qualified for a funded account, you must, however, show through the review procedures that you can trade and manage risk. Unlike other suppliers, Topstep’s review procedure, Trader Combine, is simplified into two parts traders can finish in less than a few weeks. Although there is no time limit on achieving the profit target required to pass the Trader Combine and get funded, you must continue paying the monthly fees while in the Trader Combine until funding.

6. Apex Trader Funding:

It might not be easy to know where to begin and which platform to pick when you want to get into prop trading. You can enter the futures trading market with a funded account using Apex Trader Funding, and you can become eligible in as little as seven days. During the assessment, you will trade mini or micro contracts; if the evaluation has been successful, you will switch to a funded account and be compensated for your trading abilities.

This platform offers the most of any futures prop trading account, paying traders 100% of the first $25,000 earned per account with up to 20 accounts active simultaneously. There are no daily drawdowns, trading is permitted on holidays, and you can apply your system to optimize your performance.

You will also view real-time data that can guide your decision-making, and there is no cap on rewards. Traders will use rithmic or Tradovate, and they can select from a variety of accounts with a specific amount of contracts, a profit target, a trailing threshold, and other features. With Apex Trader Funding, you can quickly set up an account if you’re prepared to enter the prop trading market.

7. FTMO:

For a good reason, FTMO is known as one of the most prosperous prop trading companies. Since beginning operations in 2014, Over 10,000 dealers in more than 180 countries have received payments from the company totaling over $97 million. According to its website, FTMO is one of the best forex prop firms due to its super-raw spread and 1:100 leverage even if a multitude of instruments (including foreign exchange, commodities, indexes, and cryptocurrencies, equities, and bonds). The platform is a great option for beginner traders because of its one-time fees, especially considering that they are waived at your first profit split. The two phases of the traditional two-phase evaluation method are the FTMO challenge and the verification. There is a 30-day time limit on the FTMO challenge.

However, if you succeed in the trading objectives earlier, Moving on to verification is possible. Remember that at least 10 trading days must have elapsed. A 10% profit target, a 5% daily loss cap, and a 10% account loss cap are important objectives for this stage. If you accomplish the other four goals but fall short of the profit goal, you can retry the FTMO challenge.

Conclusion:

Forex Prop Firms offer talented traders a beneficial chance to access substantial trading capital and boost their profits without using their money. Even though they provide alluring features like professional help and performance-based remuneration, traders must carefully consider the firm’s conditions, profit-sharing plans, and risk management guidelines. Success in a Prop Firm needs a systematic approach and ongoing trading strategy refinement. In the cutthroat environment of the forex markets, traders can use these platforms to advance their trading careers by selecting trustworthy organizations and being aware of the underlying hazards.

FAQs:

How can I sign up for a Forex Prop Firm?

You must apply and pass a demanding selection process to work with a Forex Prop Firm. Before giving you a funded trading account, the company assesses your experience, risk management skills, and trading talents.

What are the benefits of trading with a Forex Prop Firm?

Access to significant trading funds, performance-based pay, training, and assistance from seasoned traders are among the key advantages.

What are the dangers of using a Forex Prop Firm for trading?

Risks associated with trading with a Forex Prop Firm include potential losses that could impact the Trader and the firm’s capital. To reduce these risks, traders must abide by the firm’s risk management policies and procedures.

How much capital does a Forex Prop Firm provide to traders?

Different amounts of capital may be offered depending on the Forex Prop Firm and the Trader’s success over the evaluation period. It can cost anywhere between a few thousand and several hundred thousand dollars.