In 2026, customer success (CS) is no longer a support function, it’s a revenue lever. As acquisition costs remain volatile and buyer scrutiny increases, SaaS startups that outperform their peers share one trait: they operationalize customer success early and intelligently.

Recent SaaS benchmarks published across 2024–2025 consistently show that startups with structured CS tooling achieve:

-

10–25% higher net revenue retention (NRR)

-

Faster time-to-value (TTV)

-

Lower churn driven by early risk detection, not reactive firefighting

But the tooling landscape is crowded, and what works for a 1,000-account SaaS will crush a 50-customer startup under cost and complexity.

This 2026 guide goes beyond listing tools. It explains:

-

Why certain tools work better at specific stages

-

How modern CS platforms actually detect churn

-

Which tools fit product-led vs sales-led SaaS

-

Where founders waste money and how to avoid it

Why Customer Success Tools Matter More in 2026

Customer success tooling has evolved from dashboards into decision engines. Three structural shifts explain why startups can’t ignore this anymore:

1. AI-Driven Buying Behavior

Customers expect proactive guidance. If your product doesn’t surface value quickly, they churn silently often before a human ever intervenes.

2. Longer Sales Cycles, Higher Scrutiny

Mid-market and SMB buyers now demand measurable ROI within weeks, not months. CS tools help monitor whether customers are realizing promised outcomes.

3. Expansion Revenue Is Now a CS Responsibility

In 2026, customer success teams increasingly own:

-

Renewals

-

Expansion triggers

-

Usage-based upsells

Without tooling, this becomes guesswork.

Expert Take:

Startups that delay CS tooling often mistake “low churn” for “healthy customers.” In reality, risk accumulates quietly and surfaces too late.

What to Look for in Startup-Friendly Customer Success Tools (2026 Criteria)

Not all CS platforms are built for startups. In fact, many actively hurt early teams. Use this 2026-specific checklist:

Core Requirements (Non-Negotiable)

-

Fast onboarding (days, not months)

-

Native SaaS data model (accounts, subscriptions, usage events)

-

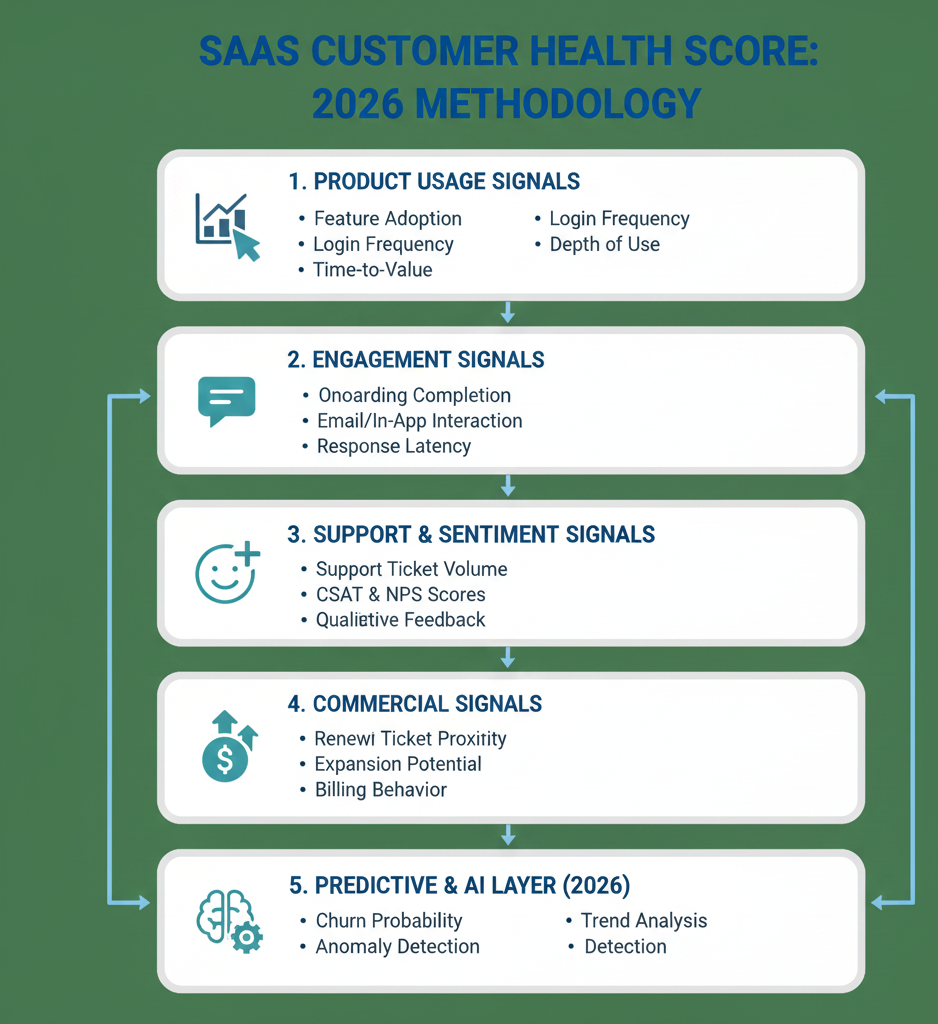

Health scoring that blends behavior + sentiment

-

Automation that reduces manual follow-ups

-

Clean integrations with CRM, billing, and analytics

Startup-Specific Differentiators

-

Modular pricing (pay for what you use)

-

Strong defaults (prebuilt playbooks & health models)

-

API access for future extensibility

-

Clear data export paths (avoid vendor lock-in)

What to Avoid Early

-

Over-engineered forecasting

-

Heavy admin overhead

-

Enterprise-only pricing tiers

-

Black-box AI with no explainability

Best Customer Success Tools for SaaS Startups (2026 Comparison)

Quick Comparison Table

Tool |

Best For |

Key Strength |

When It’s Not Ideal |

|---|---|---|---|

Custify |

Lean SaaS teams |

Balanced power + simplicity |

Very large enterprise needs |

Totango |

Modular scaling |

Flexible SuccessBLOCs |

Deep custom logic |

Vitally |

Product-led growth |

In-product signals & automation |

Early-stage simplicity |

ChurnZero |

Churn prediction |

Real-time risk alerts |

Cost at scale |

ClientSuccess |

Early-stage startups |

Fast setup, low friction |

Advanced analytics |

Gainsight |

Aggressive scaling |

Enterprise-grade CS |

Cost & complexity |

Planhat |

Data-driven CS teams |

Strong analytics & reporting |

Setup effort |

SmartKarrot |

Midmarket B2B SaaS |

AI journeys & orchestration |

Heavier onboarding |

Akita |

Usage-focused startups |

Lightweight, clear metrics |

Full lifecycle CS |

Deep Dive: Tools That Stand Out in 2026

Custify — Best Overall for SaaS Startups

Custify continues to shine in 2026 because it models customer health the way SaaS actually works: usage patterns first, everything else second.

Why it works:

-

Health scoring tied directly to feature adoption

-

Clean automation without overwhelming admins

-

Built for SaaS from day one

Expert Insight:

Custify’s biggest advantage is not features, it’s clarity. Teams act faster because signals are understandable.

Totango — Best Modular Platform

Totango’s SuccessBLOCs allow startups to adopt CS in phases, which aligns well with limited resources.

Where it excels:

-

Gradual rollout

-

Prebuilt onboarding & renewal workflows

-

Strong ecosystem & community

Trade-off:

As your logic becomes highly customized, you may need workarounds.

Vitally — Best for Product-Led Growth

Vitally leans heavily into in-product success, which matters as PLG models dominate in 2026.

Strengths:

-

Deep usage visibility

-

Automated nudges

-

Event-driven playbooks

When to choose it:

If activation and feature adoption are your main churn drivers.

ChurnZero — Best for Predictive Risk Detection

ChurnZero is still one of the strongest platforms for real-time churn detection, especially in subscription-heavy SaaS.

Caution:

Costs rise quickly as account volume grows.

ClientSuccess — Best for Early-Stage Simplicity

If you’re pre-Series A and need something now, ClientSuccess is often enough.

Limitations:

You’ll likely outgrow it once you need predictive modeling.

Gainsight — For Startups on an Enterprise Trajectory

Gainsight remains the gold standard but only when justified.

Use it when:

-

You already have CS ops

-

You sell to enterprise

-

You need forecasting & advanced analytics

Otherwise: It’s overkill.

How to Choose the Right Tool (Decision Framework)

Step 1: Identify Your Stage

-

Seed (0–100 customers): simplicity > features

-

Growth (100–1,000): automation & segmentation

-

Scale (1,000+): forecasting & cross-team alignment

Step 2: Score Tools by Weighted Importance

Focus on:

-

Time to value

-

Automation ROI

-

Integration depth

-

Cost scalability

Step 3: Pilot With Real Data

Test onboarding flows, health alerts, and renewals not demo dashboards.

Implementation Playbook for SaaS Startups

Phase 1: Data Hygiene

Define 2–3 health signals. Ignore the rest.

Phase 2: Basic Automation

Trigger alerts for inactivity, support spikes, or onboarding failures.

Phase 3: Segmentation

Different playbooks for free, SMB, and power users.

Phase 4: Predictive Signals

Introduce churn prediction only after validating basic health logic.

Phase 5: Continuous Optimization

Review false positives monthly. Iterate aggressively.

Common Mistakes SaaS Startups Make

-

Choosing brand prestige over fit

-

Over-automating before validating workflows

-

Ignoring data cleanliness

-

Locking into tools with poor export options

FAQs (2026)

When should a startup adopt a CS tool?

As soon as churn becomes non-obvious or manual tracking breaks.

Can spreadsheets work early?

Yes briefly. But they fail at real-time detection.

What metrics matter most?

NRR, TTV, feature adoption, churn risk trends, expansion signals.

Trends Shaping Customer Success in 2026

-

AI copilots recommending next-best actions

-

In-product success replacing email-heavy outreach

-

CS teams owning revenue expansion

-

Tighter integration between product analytics & CS

Final Takeaway

The best customer success tools for SaaS startups in 2026 are not the most powerful, they’re the most stage-aware. Start small, validate signals, automate what matters, and evolve deliberately.

Customer success is no longer optional infrastructure. It’s how modern SaaS companies protect growth.