What are Crypto Trading Bots?

You can automate your trading tactics with a cryptocurrency trading bot. In other words, without your manual involvement, crypto trading bots at your crypto exchange automatically execute orders depending on your trading strategy. You gain an advantage over manual traders due to the risk reduction.

Bitcoin traders created scripts to buy and sell bitcoin during the Mt. Gox era to maximize earnings. These cryptocurrency bots evolved throughout time. Today, you may trade any altcoin utilizing trading bots, including Ethereum, Dogecoin, Litecoin, and others. More than 90% of cryptocurrency trading presently takes place via these bots.

To give their customers better trading tools and boost trade volume so that they may charge higher fees, exchanges are now entering the trading bot market and developing Grid bots and DCA bots. For instance, Huobi, Gate.io, and KuCoin all include built-in trading bots. So you should think about employing these tools if you want to maximize your results. However, using a cryptocurrency trading bot can initially be complex and daunting. As a result, we have chosen the best and most user-friendly trading bots for you. The free and open-source software described below includes some top trading bots for cryptocurrencies.

To reduce the chance of error when automating your strategy, I advise beginners to start with pre-built, ready-to-use trading strategy templates.

Pros of crypto trading bots:

- Absence of emotional involvement: Investors have feelings about the bitcoin market because they are people. Trading cryptocurrencies is complicated when dealing with emotional attachments because the market is volatile. As a result, one advantage of using cryptocurrency trading bots is that they are machine-centric and mechanical, lacking any passionate commitment.

- Trading cryptocurrencies more effectively: Due to their multitasking capabilities, trading bots have made cryptocurrency trading more effective. They also give investors plenty of possibilities and data analysis to make wise judgments when it counts.

- Simple investment: For novice investors, the bitcoin market is challenging to understand. They struggle to comprehend detailed charts, data analysis, price analysis, and many other concepts. However, with automation, cryptocurrency trading bots can reduce the complexity of investment in a specific investment. One of the main benefits of employing cryptocurrency trading bots is this.

Cons of crypto trading bots:

- Limited cryptocurrency options: The cryptocurrency market has access to over a thousand cryptocurrencies for effective trading. However, one drawback of these cryptocurrency trading bots is their limited access to cryptocurrencies. These are specialized computer programs that only function with a few digital exchanges.

- Unexpected outcomes: Crypto trading bots operate automatically around the clock, 365 days a year. But this is typically one of the drawbacks of cryptocurrency trading bots; they make unforeseen decisions on behalf of investors, which may result in a modest gain or loss depending on the price of cryptocurrencies.

- Time-consuming process: Although the functionality of automating jobs might save time, setting up the entire process of adopting cryptocurrency trading bots requires learning to manage the tools effectively without making any potential mistakes.

Five Best Crypto Trading Bots:

Critical Factors Affecting Automated Trading

Before selecting a cryptocurrency trading bot, consider the following:

Paid or Unpaid Service:

- Most cryptocurrency bot services on the market offer layered subscription plans with capabilities that may be added to or removed at each level.

- For a novice, it’s crucial to pay attention to whether or not a free trading bot is included in the features of the zero-fee plans.

Trading Fees on the Exchange:

- You should rethink your strategy if the trading fee offsets the profit made using the crypto profit bot.

- While certain Crypto Bot Platforms with subscriptions may levy performance fees, most do not have trading costs per se.

Coding requirements:

- Be sure to take notice if the platform requires any coding expertise.

- There are three methods for automating the creation of crypto bots.

- One is the drag-and-drop method, which eliminates the need for coding.

- The code editor is the second method.

- The preset strategies are the last thing.

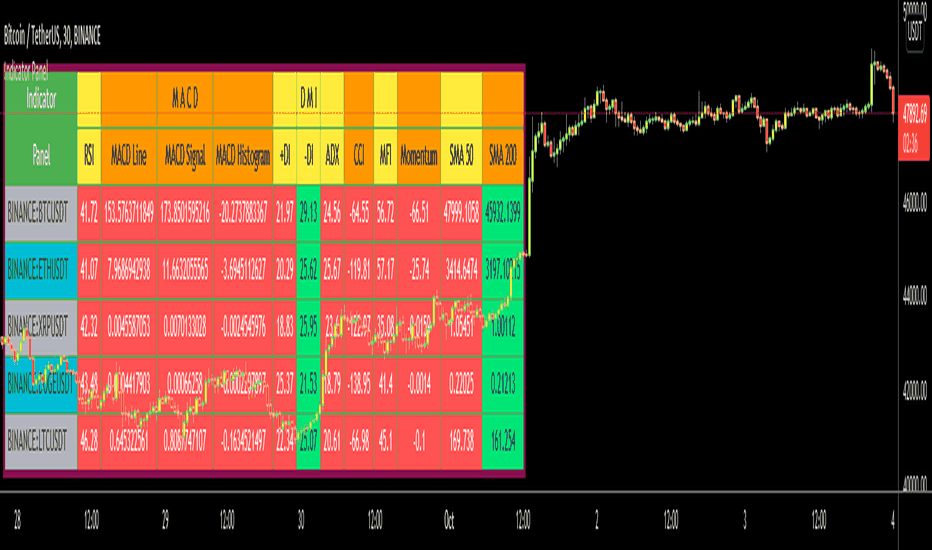

- Technical indicators, signals, and trading robot strategies

- These principles are what give a bot and its platform their greatness.

Signals:

- Industry experts provide buy/sell signals for cryptocurrencies and discuss their strategies for making money.

- Technical indicators are measurements that use mathematical analysis to predict future market trends.

- The methods used to ensure that the Bot generates income. Depending on the market, these strategies change.

Security:

- Placing the money on the exchange rather than with the service provider is the safest way to deal with automated crypto bots. Your money will also be as secure as the security offered by the exchange.

- The majority of suppliers use encrypted API keys to connect to the businesses. Your money is secure both ways in this way.

- In addition to those above, you should consider factors such as backtesting techniques, paper trading, copy trading, and cloud-based or not (all terms explained in the article)

Top 10 Best Crypto Trading Bots in 2022:

Here is an explanation of the Top 10 Best Crypto Trading Bots in 2022.

1. KuCoin:

KuCoin is a well-known, user-friendly, and secure cryptocurrency exchange. However, KuCoin only supports a few integrated trading bots, including a DCA bot and Grid bots for both the spot and futures markets. Because Kucoin is an exchange, these bots will significantly more effectively carry out trades than any third-party bots linking your cryptocurrency exchange utilizing API credentials.

This offers the best results compared to the other trading bots discussed in this post. We believe that Pionex provides a superior user experience and bot coverage. You can also take advantage of free trading methods with the KuCoin trading bot.

To give their customers better trading tools and boost trade volume so that they may charge higher fees, exchanges are now entering the trading bot market and developing Grid bots and DCA bots. For instance, Huobi and Gate.io both include built-in trading bots.

2. WunderTrading:

A cryptocurrency automation software combining mirror trading and portfolio management features is WunderTrading. With TradingView PineScript, users may build fully autonomous cryptocurrency trading bots, follow highly talented traders to generate passive revenue from cryptocurrency trading or execute manual trades using the sophisticated Trading Terminal. WunderTrading stands out from its rivals thanks to its wide range of trading options.

On the WunderTrading platform, you may use the Trailing-stop and Swing-trade features. You may also employ more sophisticated trading tools like Take-profit and Stop-loss to enhance trading tactics. The TradingView integration enables you to include a wide range of trading algorithms and technical indicators in your bots. They can also leverage their unique built-in Terminals to create DCA and Spread strategies.

You may manage several exchange accounts using WunderTrading from a single dashboard. After adding your exchange accounts via API, you can replicate trades across all accounts with a single click. For traders to monitor profits and execute trades more successfully, the platform offers comprehensive information calculated and displayed on the Dashboard.

3. Pines:

You have free access to 12 different training bots on Pionex, a cryptocurrency exchange with built-in trading bots. You may automate your trading approach with these bots, eliminating the need for regular market monitoring.

This instrument is an excellent choice for traders on the go and doing a lot of business. Even though it offers human trading utilizing crypto-to-crypto conversions, Pionex’s core product is its collection of trading bots. Without human intervention and under predetermined market conditions, this Bot executes buy and sell orders from traders.

Pionex uses a maker-taker fee structure. Placed trades “create” the market with liquidity while also “taking” liquidity away from the market. You must deliver the maker charge if your transaction is not immediately matched by standing order in the books. You are required to pay the taker charge if your order is checked.

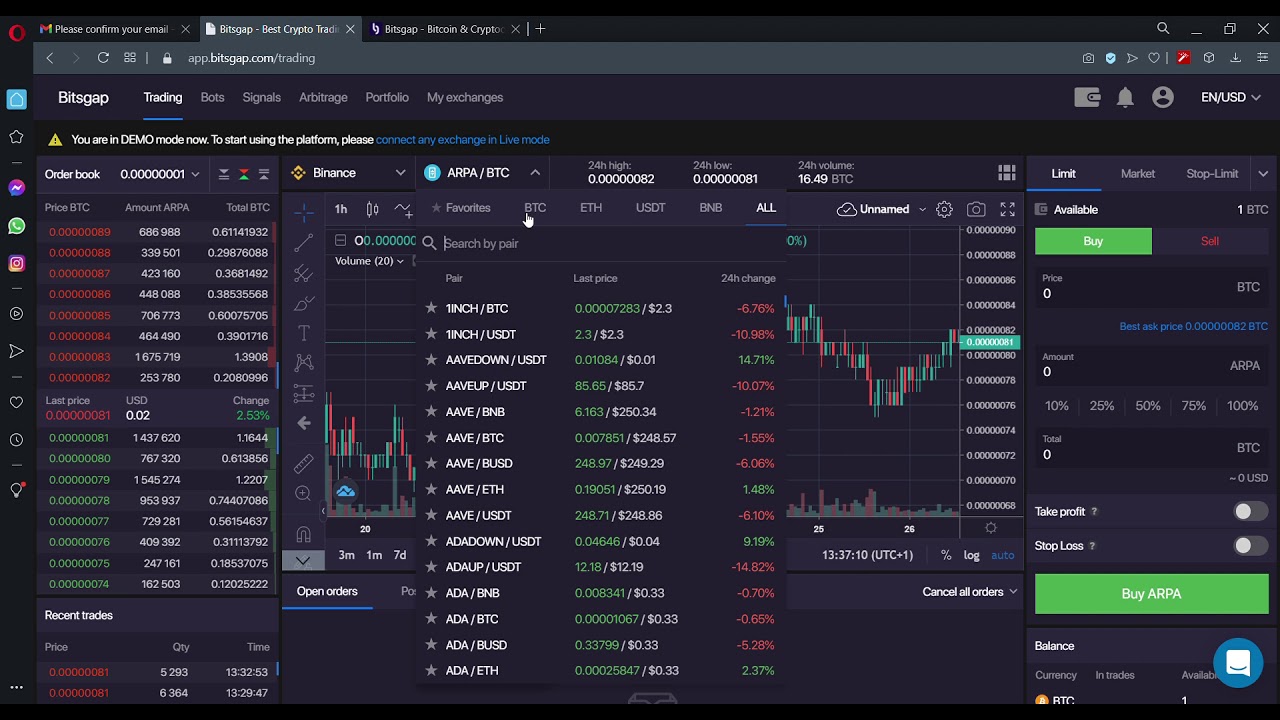

4. Bitsgap:

As an “all-in-one trading automation platform for Bitcoin and other Cryptocurrencies,” Bitsgap is an altcoin trading robot, according to its developers.

When you invest in Bitsgap, you gain access to the robot’s automatic algorithms and a platform built to work with more than 15 of the most well-known cryptocurrency exchanges, including Binance, Kraken, and Coinbase. Traders can apply predefined strategies or design their algorithms using the Bitsgap Bot. Since the Bot is cloud-based and secure, there is no need for you to download any software.

More than 100 of the most prominent indicators are available in the Trading Terminal, with various customizable chart styles (including the quick TradingView chart) and the ability to create simple and complex order types, such as stop loss and take profit and even shadow orders.

A straightforward and user-friendly dashboard that collects all of your trades and balances across exchanges so you can keep track of performance is included with the Bitsgap Bot, and Trading Termina utilizes the portfolio, and it also lets you track and keep track of more than 1,800 cryptocurrencies.

5. Coinrule:

Coinrule, one of the most well-liked bots available, has the most preset trading strategies. Customers can customize their investing using more than 150 trading templates automatically executed when market conditions satisfy predefined parameters. Coinrule frequently updates its platform with new templates, such as those for long-term holding strategies, stop-loss settings, and accumulating. also, look

Another alternative to cryptocurrency trading bots is this. Templates you can access with free and paid programs vary. The subscription option includes advanced charting features, unlimited template usage, and even one-on-one trade tuition and tutorials, whereas the free plan only provides seven free template methods. Check the list of cryptocurrency exchanges as well.

6. 3Commas:

You may create a strategy using more than 20 different trading indicators with one of the best bitcoin bots available, which helps you boost profits. With 3Commas, you may buy and sell using a single window, lower your chance of losing money, and duplicate the settings of other bots.

Another alternative to cryptocurrency trading bots is this. You may effectively maintain your profit and corn ratios while maintaining portfolio balance thanks to the utility of this software. This cryptocurrency trading bot sends you to deal notifications through email, mobile app, and browser. It offers basic, advanced, and pro plans and can be accessed on iOS and Android.

Exchanges: Gate.io, Cex.io, Exam, Bitstamp, Kraken, Poloniex, OKEx, YoBit, Binance, Binance DEX, Bitfinex, Binance.us, By bit, Balance Futures, BitMEX, Bittrex, Coinbase Pro. also look at ether mining

7. Murex:

Murex makes buying cryptocurrency bots as simple as buying mutual funds. They have a pricing structure that is by far the finest we have seen, a wide selection of bitcoin bots based on your level of risk tolerance, and they are quite open with their information. Murex, supported by Y-combinator, outperforms everyone else on the list!

Over 7000 people and $400 million worth of USD are traded on Murex. They have a vibrant and engaged community and are supported by well-known VCs and angel investors. Some of the very few on this list can also service US consumers and are connected to 8 of the leading exchanges.

Instead of developing its cryptocurrency bot, Mudrex offers a carefully vetted marketplace of automated bots made by experienced crypto traders. The platform’s best feature is that all information about a bitcoin bot’s performance is available to the public and simple to comprehend for consumers.

8. Trality:

This platform is for anyone who wants to create incredibly sophisticated, creative algorithms inside a community-driven, educational environment that promotes development and learning. Trality, one of the most popular trading bot platforms globally, serves inexperienced and seasoned cryptocurrency investors.

If you know how to create intricate trading algorithms, you can use Trality’s Rule Builder tool. Using a state-of-the-art graphical user interface, you can easily drag and drop indicators and trading methods to build the logic of your trading bot. Another alternative to cryptocurrency trading bots is this.

Their browser-based Code Editor, the most advanced of its kind, is accessible to knowledgeable users familiar with Python coding. Using the Code Editor and their coding skills, developers may quickly and safely create complicated and advanced techniques. They provide a variety of plans, both free and premium.

9. Quadency:

For both novice and experienced traders, Quadency has a large selection of built-in bots. They utilize the TradingView bot. Using this Bot, you can develop strategies on Tradingview and execute them on your broker or exchange account.

The backtesting function of the Quadency trading bot, which enables you to backtest your methods based on statistics and numbers rather than winging it, is its most vital feature.

It’s also a must for a crypto bot; before utilizing your money with the crypto trading bot, it’s excellent to be aware of the performance of previous data. The platform also comes out as one of the most OK Bittrex bots and offers a variety of features:

- Quadency also launched the QUAD token.

- You can also trade on DEXs, and there are plans to progress toward a decentralized exchange.

10. HaasOnline:

Unlike any other, HaasOnline is a paid bitcoin trading platform. They provide your typical pre-built trading bots for tactics like arbitrage, market-making, and other tools, much like the other trade bot.

However, you can now create highly complicated trading bots using a drag-and-drop designer or an intelli-sense editor, thanks to the advent of HaasScript, their scripting language. As a result, it offers some of the most excellent automatic trading tools available. Before initiating live transactions on more than 25 exchanges, you can backtest or paper trade your methods.

A locally hosted non-custodial trade server, which gives complete discretion and privacy, keeps prying eyes away from your trade data and strategies. This is how their current bitcoin trading software is now set up. Additionally, a cloud version for retail traders is planned for release. A cheap 14-day trial license is available, but no free trial is available.

FAQ,s:

Are trading bots for cryptocurrencies profitable?

As long as you can set up your trading bots correctly, they can be profitable. The most significant cryptocurrency trading bots will undoubtedly turn a profit. Thus it’s crucial to set them up for testing or to have some form of guarantee before purchasing. Then, understanding how they function is vital. Otherwise, they can suffer losses as well.

Are trading bots legal?

The use of bots and cryptocurrency trading is entirely lawful. Trading bots are technical, tried, and accurate in the stock and FX markets. However, not all brokers, even those for cryptocurrency trading, permit the use of bots.

Should I use a crypto trading bot?

To boost trading effectiveness and profitability, cryptocurrency bot trading is advised. It also increases trading speed and reduces the chance of human error.

The top crypto trading bots allow you to profit from cryptocurrency volatility by picking profits even from minute price movements. They let you keep up with the competition and effectively track markets.

10 Best Bots Available On The Internet Right Now:

- Fify

- Chatbot for OrderNow

- Meal Ideas

- Pokémon Go Necrobot

- Wellness Tap

- Language assistant DuoLingo

- Smokey

- Bly. Bly is a beneficial tool for connecting individuals because of its robust search engine.