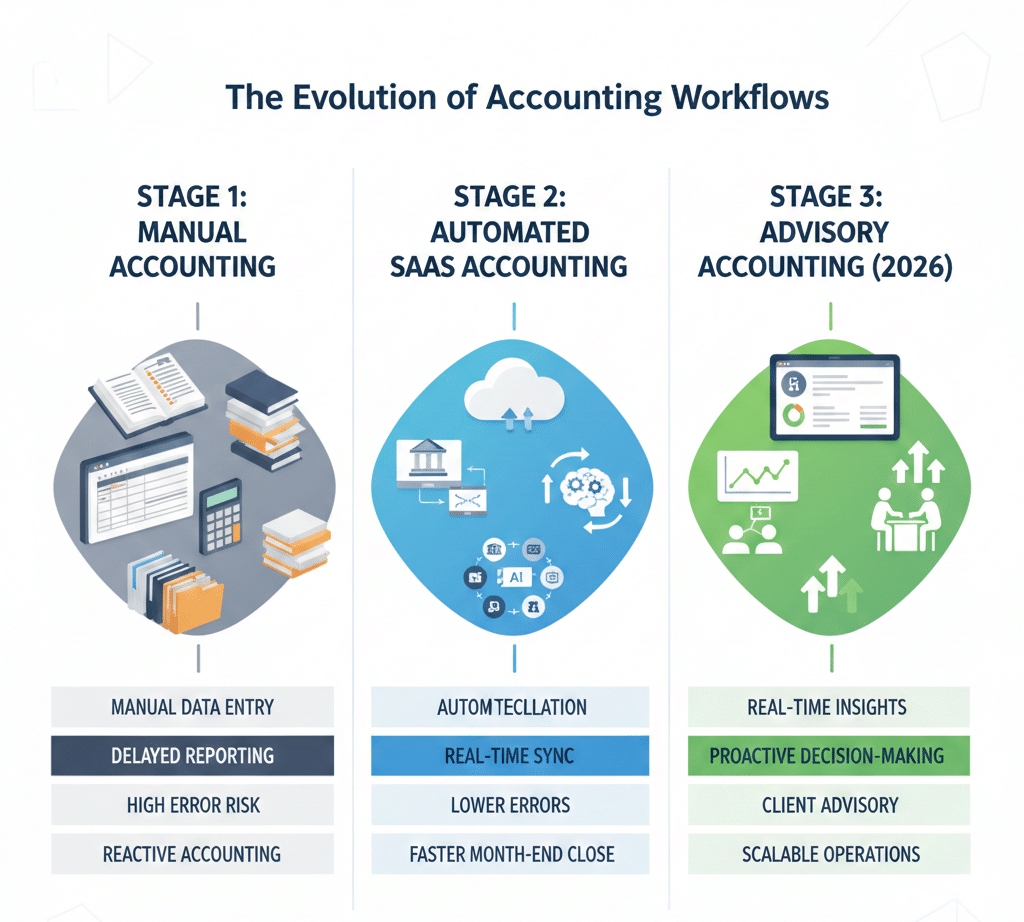

As of 2026, small accounting firms are no longer competing only on accuracy, they’re competing on speed, insight, and advisory value. Clients now expect real-time financial visibility, proactive tax guidance, and seamless digital collaboration. Traditional desktop accounting software simply cannot support these expectations without heavy manual work and IT overhead.

This is why Accounting SaaS tools have become the operational backbone of modern small firms. Cloud-native platforms now combine automation, AI-driven categorization, real-time reporting, and deep integrations allowing accountants to spend less time reconciling data and more time advising clients.

In this expert guide, we analyze the Best Accounting SaaS Tools for Small Firms in 2026, based on:

-

Real-world firm workflows

-

Automation depth (not just features)

-

Scalability under growing client loads

-

Advisory-readiness for modern accounting services

Unlike generic “top software” lists, this guide explains why each tool works, how it performs in real firm scenarios, and where it falls short.

Why Accounting SaaS Tools Matter More in 2026 (Not Just “Cloud Access”)

1. AI-Driven Bookkeeping Is Now a Baseline

By late 2025, multiple accounting studies highlighted that over 65% of small firms now rely on AI-assisted categorization and reconciliation. In 2026, SaaS tools that don’t offer intelligent transaction matching or anomaly detection actively slow firms down.

Why this matters:

AI reduces month-end close time, flags inconsistencies early, and minimizes human error directly improving margins for small firms.

2. Real-Time Advisory Is Replacing Retrospective Reporting

Clients no longer want reports weeks after month-end. SaaS platforms now enable:

-

Live cash flow forecasting

-

Rolling P&L insights

-

Automated variance alerts

This shift supports advisory-first accounting, which is where higher-value retainers come from in 2026.

3. Compliance Complexity Has Increased (Globally)

Between 2024–2025, tax authorities expanded digital filing mandates, audit trails, and data retention requirements. SaaS platforms with built-in compliance logic reduce regulatory risk especially for firms serving cross-border or multi-entity clients.

4. SaaS Lowers Per-Client Cost as Firms Scale

Unlike desktop software, SaaS tools scale without adding IT staff, servers, or manual update cycles. For firms managing 20–200+ clients, this directly impacts profitability.

How We Evaluated These Accounting SaaS Tools (2026 Criteria)

We assessed each platform using firm-centric, not vendor-centric, benchmarks:

-

Automation Depth – Not just “available,” but how well it actually works

-

Multi-Client Efficiency – Dashboards, bulk actions, firm views

-

Advisory Readiness – Forecasting, insights, reporting clarity

-

Integration Ecosystem – Payroll, tax, CRM, document management

-

Cost-to-Value Ratio – True cost per client as firms scale

-

Security & Compliance – Audit trails, access controls, encryption

-

2026 Product Momentum – Active development and roadmap strength

The 5 Best Accounting SaaS Tools for Small Firms in 2026

1. QuickBooks Online

Best Overall for Scalable Small Accounting Firms

QuickBooks Online remains the industry default in 2026, not because it’s perfect but because its ecosystem depth is unmatched.

Why it stands out in 2026:

QuickBooks has heavily invested in AI transaction matching, automated reconciliation rules, and predictive cash flow tools, making it far more efficient than earlier versions.

Key Strengths

-

Firm-wide multi-client dashboard

-

AI-assisted categorization and anomaly detection

-

Deep integrations (650+ apps)

-

Strong payroll and tax software compatibility

Where It Falls Short

-

Advanced automation requires higher-tier plans

-

Costs increase quickly as features scale

Pricing (2026): Starts around $30/month, with firm bundles available

Expert Take:

If your firm wants maximum flexibility and ecosystem support, QuickBooks Online is still the safest long-term bet.

2. Xero

Best for Collaboration & Multi-Currency Clients

Xero continues to outperform competitors in collaboration design. Unlimited users across plans make it ideal for firms with distributed teams or global clients.

Why Firms Choose Xero

-

Unlimited users (no per-seat pricing pressure)

-

Real-time multi-currency handling

-

Clean, low-friction interface for clients

Limitations

-

Payroll coverage varies by region

-

Add-ons increase total cost

Pricing (2026): Starts near $15/month, premium plans higher

Expert Take:

Xero is excellent for firms prioritizing team collaboration and international clients, especially where cost-per-user matters.

3. FreshBooks

Best for Service-Based & Advisory Firms

FreshBooks is not designed for complex accounting but that’s its strength.

Why It Works in 2026

-

Best-in-class invoicing experience

-

Built-in time tracking for advisory billing

-

Simple reports clients actually understand

Trade-Offs

-

Limited advanced accounting

-

Not ideal for inventory-heavy businesses

Pricing (2026): From $18/month

Expert Take:

If your firm sells advisory, consulting, or project-based services, FreshBooks aligns perfectly with revenue models.

4. Zoho Books

Best Value for Automation on a Budget

Zoho Books quietly became one of the most automation-rich tools in the small-firm space by 2025.

Why It’s Underrated

-

Workflow automation rivals higher-priced tools

-

Strong tax and compliance logic

-

Seamless with Zoho CRM, Projects, and Analytics

Drawbacks

-

Smaller third-party ecosystem

-

Advanced features gated by plan

Pricing (2026): Free tier available; paid plans start around $15/month

Expert Take:

For firms that want maximum automation per dollar, Zoho Books offers exceptional ROI.

5. Sage Intacct

Best for Compliance-Heavy or Multi-Entity Firms

Sage Intacct sits at the intersection of small firm agility and enterprise-grade control.

Why Firms Use It

-

Advanced audit trails and compliance reporting

-

Multi-entity and consolidation support

-

Highly configurable financial controls

Challenges

-

Higher cost

-

Steeper learning curve

Pricing (2026): Custom pricing only

Expert Take:

Ideal for firms serving regulated industries or complex entities where reporting accuracy outweighs simplicity.

Side-by-Side Comparison (2026 Snapshot)

Tool |

Best For |

Starting Price |

Key Advantage |

|---|---|---|---|

QuickBooks Online |

All-around scalability |

~$30 |

Ecosystem depth |

Xero |

Collaboration & global clients |

~$15 |

Unlimited users |

FreshBooks |

Advisory & billing |

~$18 |

Invoicing UX |

Zoho Books |

Budget automation |

~$15 |

Workflow automation |

Sage Intacct |

Compliance-heavy firms |

Custom |

Advanced reporting |

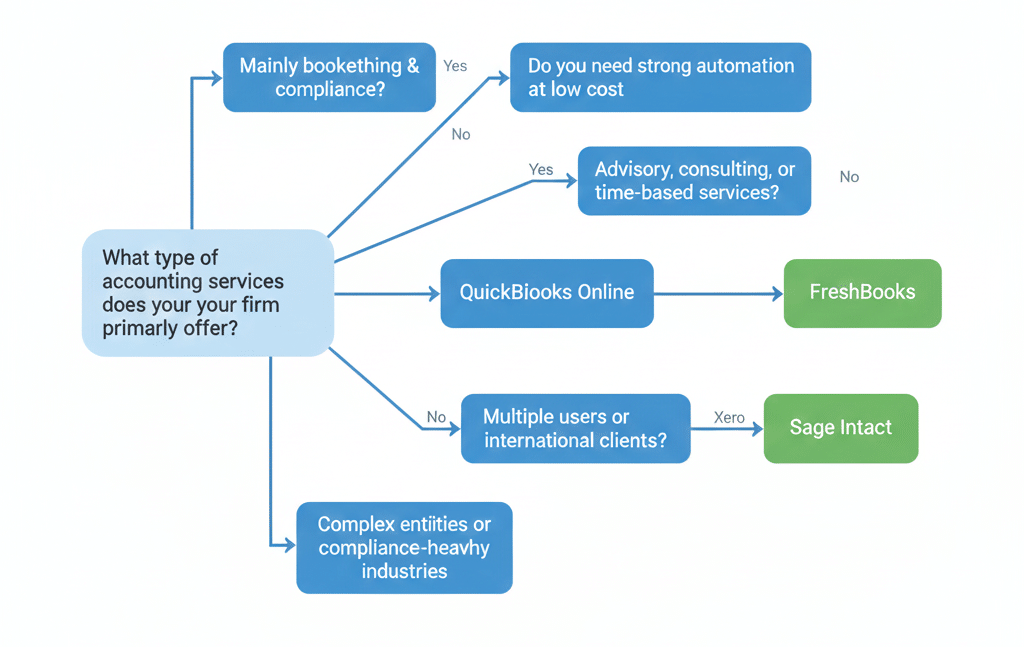

How to Choose the Right Accounting SaaS Tool in 2026

Ask these questions first:

-

Are you selling bookkeeping, or advisory services?

-

Do clients need real-time insights or just compliance?

-

How many clients will you manage in 12–24 months?

-

Do integrations reduce manual work, or add complexity?

Pro Insight:

The “best” tool is the one that reduces human effort per client while supporting your firm’s revenue model.

Frequently Asked Questions (People Also Ask – 2026)

Is SaaS accounting software safe for client data?

Yes top providers now exceed on-premise security through encryption, audit logs, and access controls.

Which tool is best for very small firms?

Zoho Books and FreshBooks offer the lowest learning curve and cost.

Can SaaS tools replace accountants?

No automation replaces data entry, not professional judgment or advisory services.

Should firms still use desktop accounting software in 2026?

Only in niche offline or legacy scenarios. SaaS is now the standard.

Final Verdict: Best Accounting SaaS Tools for Small Firms in 2026

In 2026, accounting SaaS tools are no longer optional they are strategic infrastructure.

The best platforms don’t just track numbers; they:

-

Reduce operational cost per client

-

Enable proactive advisory services

-

Scale without adding staff or complexity

QuickBooks Online, Xero, FreshBooks, Zoho Books, and Sage Intacct each serve different firm models but all represent modern, future-ready accounting systems.

The smartest move?

Choose the tool that aligns with how your firm makes money not just how it keeps records.