As of 2026, payday loans remain one of the most controversial yet widely searched, financial products in the U.S. Among those searches, “payday loans eLoanWarehouse” continues to attract users looking for fast approval, minimal credit checks, and immediate cash relief.

But the lending ecosystem has evolved. Regulatory pressure, fintech competition, and consumer behavior shifts have reshaped how payday-style loans operate and how risky or useful they really are.

This guide doesn’t just explain what payday loans are. It breaks down how eLoanWarehouse-style loans function in 2026, why borrowers still use them, what lenders don’t emphasize, and which alternatives now outperform payday loans in most real-world scenarios.

Why People Still Search for Payday Loans eLoanWarehouse in 2026

Despite years of warnings from consumer advocates, payday loans haven’t disappeared they’ve adapted.

The Core Problem Payday Loans Still Solve

Borrowers searching for eLoanWarehouse are usually facing:

-

An urgent expense (rent, utilities, car repair, medical bill)

-

Limited or damaged credit history

-

No access to traditional bank credit

-

Time pressure (same-day or next-day funding)

In short, speed and certainty matter more than cost in these moments.

Why eLoanWarehouse Appears in These Searches

eLoanWarehouse is commonly associated with:

-

Online-only applications

-

Approval based on income rather than credit score

-

Short-term lending models

-

Accessibility for borrowers excluded by banks

This makes it visible in searches from people who already expect rejection elsewhere.

How Payday Loans Through eLoanWarehouse Work in 2026

Understanding the mechanics explains both the appeal and the risk.

Step-by-Step Loan Process

-

Online Application – Personal details, income source, bank account

-

Income Verification – Bank transaction history or pay documentation

-

Loan Offer – Typically $300–$1,500

-

Short Repayment Period – Often 14–30 days

-

Automatic Repayment – Funds withdrawn on payday

Why Approval Is Faster Than Traditional Loans

Payday-style lenders:

-

Ignore long-term creditworthiness

-

Prioritize short-term cash flow

-

Accept higher default risk

-

Compensate with higher fees and tighter repayment windows

Expert insight: Payday lending isn’t about trust, it’s about predictability of income timing, which is why approval rates remain high.

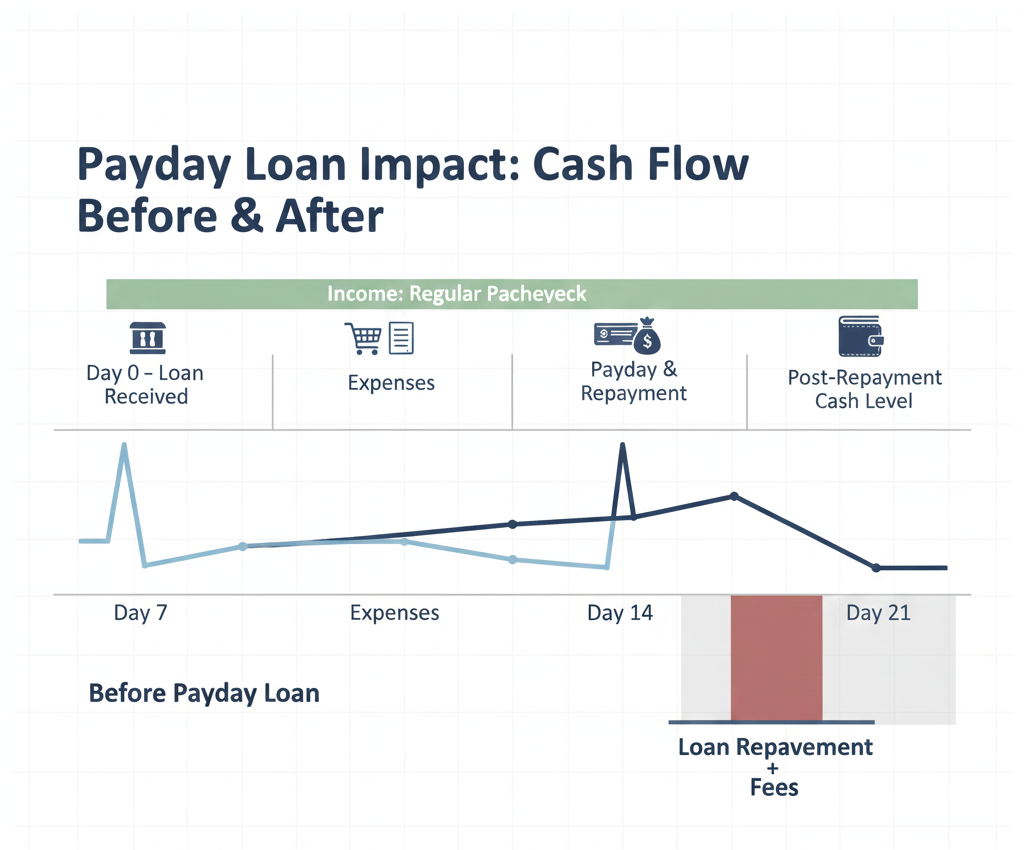

The True Cost of Payday Loans (Beyond the APR Number)

Most articles stop at “high APR.” That’s incomplete and misleading.

What Actually Hurts Borrowers

The real cost drivers are:

-

Short repayment deadlines

-

Single lump-sum repayment

-

Automatic withdrawals that trigger overdrafts

-

Rollover or re-borrowing cycles

Example (Illustrative)

-

Loan: $500

-

Fee: $75–$120

-

Repayment: Due in 14 days

Even borrowers who can repay often face:

-

Reduced cash flow for the next pay cycle

-

Increased likelihood of needing another loan

In 2026, consumer lending research consistently shows that repayment structure matters more than interest rate alone.

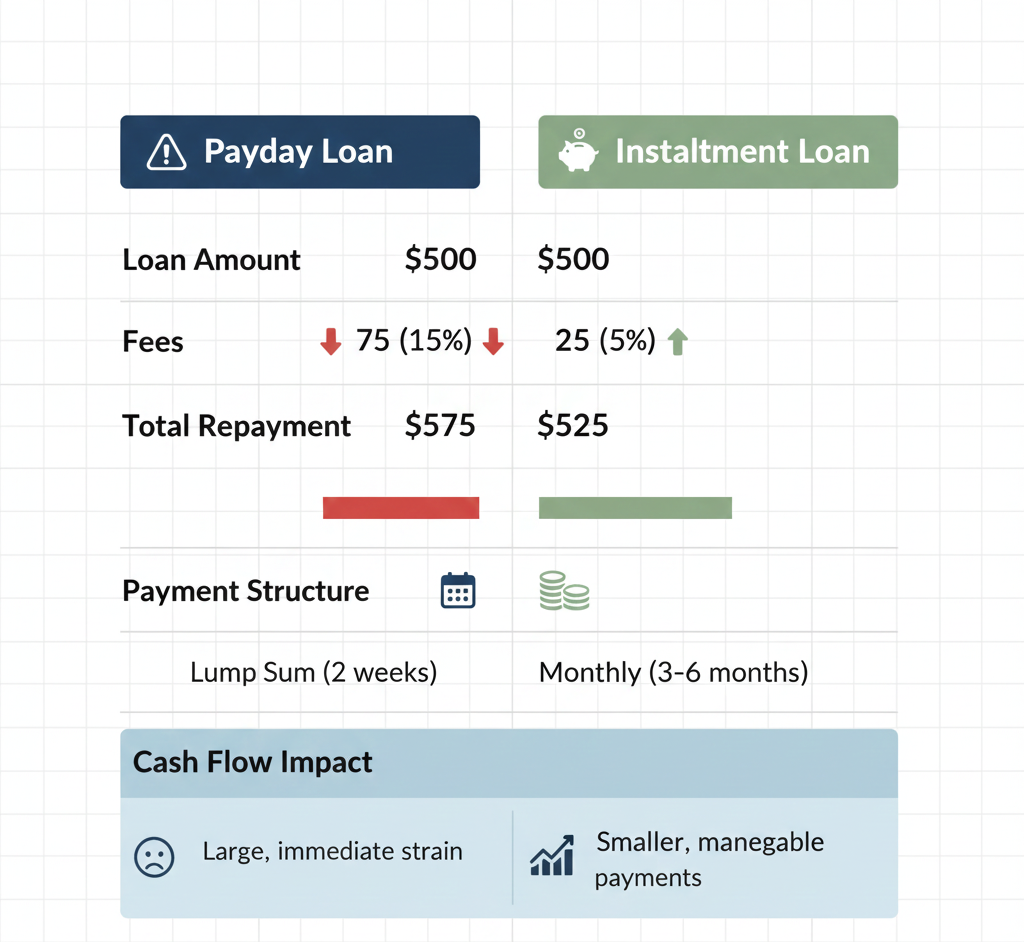

Payday Loans vs Installment Loans: The 2026 Reality

This comparison is critical and often misunderstood.

Payday Loan Model

-

One-time repayment

-

Very short term

-

High risk of cash-flow shock

Installment Loan Model

-

Fixed monthly payments

-

Longer repayment horizon

-

Easier budgeting and lower default risk

Feature |

Payday Loans |

Installment Loans |

|---|---|---|

Repayment Style |

Lump sum |

Monthly |

Cash Flow Impact |

Sudden |

Gradual |

Rollover Risk |

High |

Low |

Budget Predictability |

Poor |

Strong |

Key 2026 Insight:

Many lenders that once offered pure payday loans now quietly shift borrowers toward installment plans because borrowers repay more consistently and with fewer complaints.

Is eLoanWarehouse Legit and Safe in 2026?

This is one of the most common follow-up searches.

What “Legit” Actually Means

A lender can be legitimate if it:

-

Operates within state lending laws

-

Discloses fees and repayment terms

-

Uses secure application systems

However, legitimacy does not equal affordability or suitability.

Expert commentary: In 2026, consumer harm is less about fraud and more about structural debt traps created by short repayment cycles.

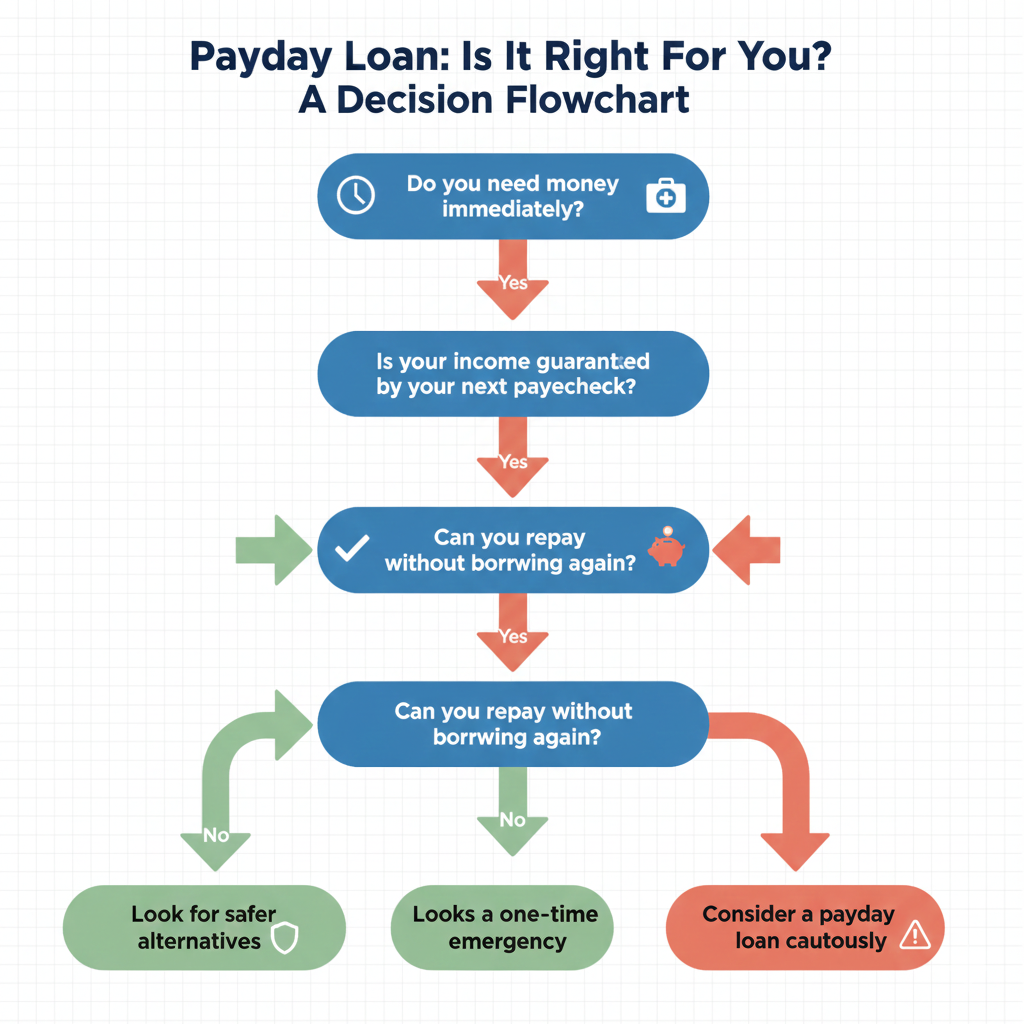

Who Payday Loans Are (and Aren’t) Right For

May Make Sense If:

-

Income is stable and guaranteed

-

Expense is one-time and unavoidable

-

Repayment will not require re-borrowing

Risky If:

-

Income fluctuates (gig work, tips, commissions)

-

Existing debt already strains cash flow

-

Loan is used for ongoing expenses

Borrower experience data consistently shows that repeat usage, not first-time borrowing, causes the most financial damage.

Better Alternatives to Payday Loans in 2026

The emergency lending landscape has expanded significantly.

1. Earned Wage Access (EWA)

-

Access wages already earned

-

Often fee-free or very low cost

-

Increasingly offered by employers

2. Credit Union Small-Dollar Loans

-

Lower interest caps

-

Installment repayment

-

Designed specifically to replace payday loans

3. Fintech Installment Lenders

-

Transparent pricing

-

Flexible repayment

-

Better consumer protections

4. Community & Utility Assistance

-

Emergency grants

-

Payment extensions

-

Local relief programs

2026 trend: Speed no longer requires extreme cost competition has reshaped emergency lending.

Frequently Asked Questions About Payday Loans eLoanWarehouse

Do payday loans help build credit?

Usually no. Most short-term lenders do not report positive payments to credit bureaus.

What happens if I miss repayment?

Possible outcomes:

-

Rollover fees

-

Extended payment plans (state-dependent)

-

Overdraft fees from automatic withdrawals

Are payday loans still legal everywhere?

No. Availability and terms vary widely by state, and many lenders adjust products to comply with local laws.

Final Expert Verdict: Are Payday Loans eLoanWarehouse Worth It in 2026?

Payday loans still exist because financial emergencies still happen. But in 2026, they are no longer the only fast option or the smartest one.

eLoanWarehouse-style payday loans should be treated strictly as a last-resort liquidity tool, not a financial strategy.

The most important question isn’t approval.

It’s whether repayment will force you to borrow again.

Borrowers who understand that distinction make better decisions and avoid long-term damage.