Managing money in 2026 is no longer about simply tracking expenses, it’s about understanding behavior, anticipating cash-flow risks, and making smarter decisions in real time. With subscription creep, AI-driven pricing, volatile interest rates, and digital banking now standard, personal finance apps have become a necessity rather than a convenience.

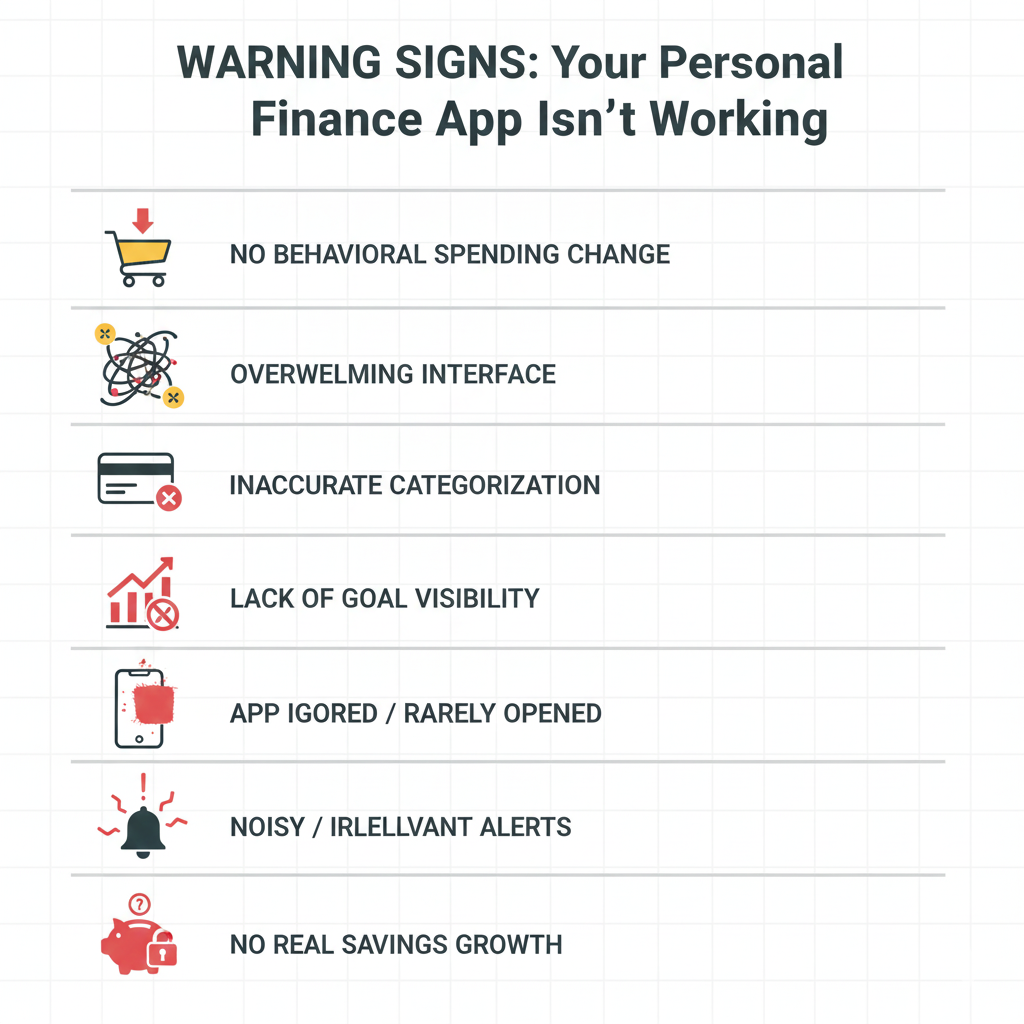

Yet most people still download apps they abandon within weeks.

Why? Because many apps track money but don’t actually change outcomes.

This guide focuses only on personal finance apps that actually work in 2026, meaning they help users spend less, save more, reduce debt faster, and make better financial decisions over time.

You’ll find:

-

Expert analysis on why certain apps work

-

Real-world pros and limitations

-

Comparisons between hands-on vs automated tools

-

Updated trends shaping finance apps in 2026

-

Clear guidance on choosing the right app for your financial stage

Why Personal Finance Apps Matter More in 2026

As of late 2025, consumer finance behavior has shifted in three major ways:

1. Spending Is Harder to “Feel”

Contactless payments, BNPL (Buy Now Pay Later), and embedded subscriptions reduce spending friction making it easier to overspend without noticing.

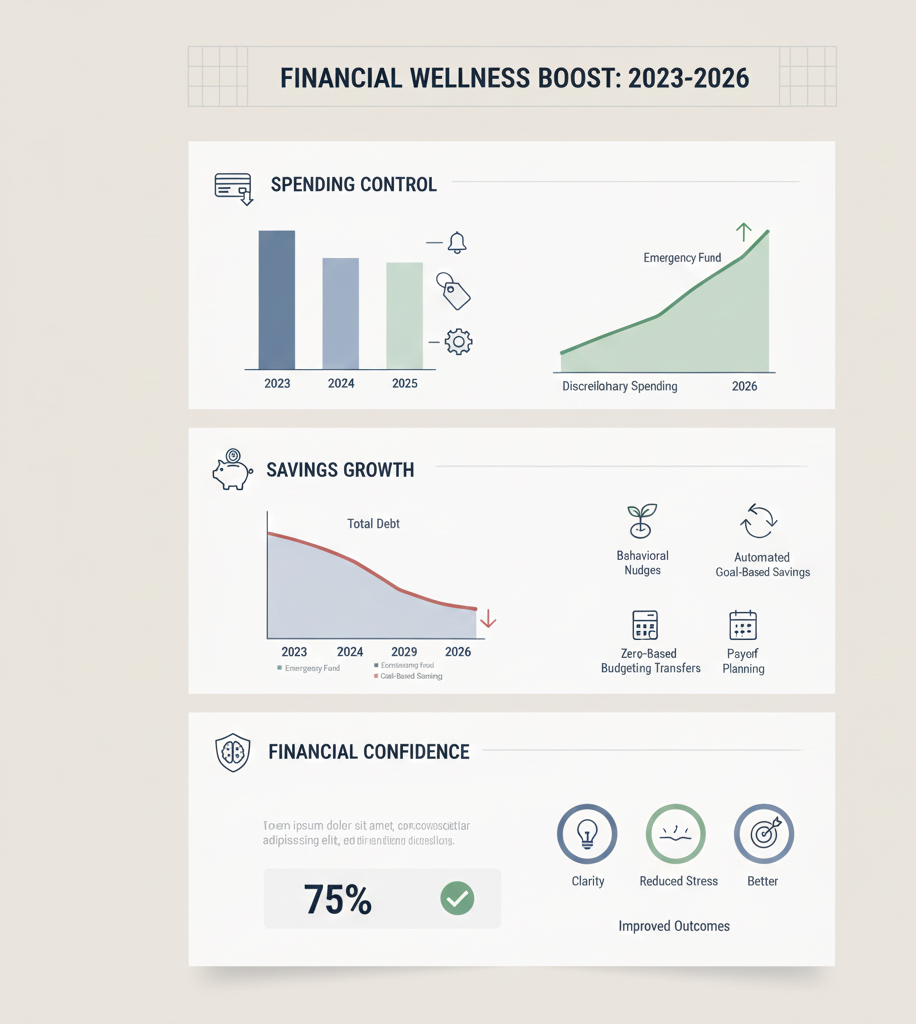

A 2024 Deloitte fintech study found:

-

Users underestimate discretionary spending by 18–25% without automated tracking.

-

Subscription-based expenses now account for over 12% of monthly household budgets on average.

2. Interest Rates Reward Cash Awareness

With savings rates fluctuating and credit costs still elevated in 2025–2026, small budgeting mistakes compound faster especially with credit cards and personal loans.

3. AI Is Changing Financial Coaching

The best apps no longer just show numbers, they interpret behavior, flag risky trends early, and nudge users toward better decisions.

Bottom line: In 2026, a finance app must do more than log transactions, it must actively influence outcomes.

What Makes a Personal Finance App Actually Work (Not Just Look Good)

Based on long-term user retention data and behavioral finance research, effective apps share these traits:

1. Full Financial Visibility

Apps must sync banks, credit cards, loans, investments, and subscriptions, partial visibility leads to false confidence.

Why it matters:

People budget better when they see total financial exposure, not isolated accounts.

2. Behavior-Based Budgeting (Not Static Limits)

Rigid budgets fail. Apps that adapt to spending patterns or explain why you overspent perform better long-term.

3. Clear Feedback Loops

Good apps answer:

-

“If I spend this, what happens next month?”

-

“Why am I short on cash before it happens?”

4. Friction Where It Matters

The best apps make saving easy and overspending slightly uncomfortable. That friction is intentional.

5. Security & Data Control

In 2026, apps without granular privacy controls and MFA are no longer acceptable.

Personal Finance Apps That Actually Work in 2026

1. You Need A Budget (YNAB)

Why It Still Works in 2026

YNAB remains one of the few apps proven to change financial behavior, not just record it. Its zero-based budgeting forces users to assign purpose to every dollar which increases intentional spending.

What Makes It Different

-

Budgets based on available cash, not forecasts

-

Strong psychological feedback loop

-

Continuous education baked into the product

Expert Insight

Users who actively use YNAB for 6+ months often report:

-

Faster emergency fund growth

-

Reduced credit card reliance

-

Greater confidence making large purchases

Limitations

-

Requires commitment and learning

-

Not ideal for users wanting passive automation

Best For

-

Debt payoff

-

Financial discipline

-

Income variability (freelancers, gig workers)

2. Mint (Legacy Users Only)

Status in 2026

Mint’s core features remain useful, but its value depends heavily on user tolerance for ads and limited customization.

Strength

-

Still one of the easiest entry points for beginners

-

Solid transaction tracking and alerts

Weakness

-

Limited behavioral insight

-

Budgeting logic hasn’t evolved significantly

Best For

-

First-time budgeters

-

Users wanting visibility without complexity

3. PocketGuard

Why It Works

PocketGuard’s “In My Pocket” feature answers a critical question most apps ignore:

“How much can I safely spend right now?”

This real-time clarity prevents accidental overspending especially useful in high-inflation environments.

Strength

-

Strong guardrails against impulse spending

-

Subscription tracking is particularly effective

Limitation

-

Not ideal for long-term financial planning

Best For

-

Day-to-day spending control

-

Users overwhelmed by detailed budgets

4. Quicken (Power Users)

Why It Still Dominates Advanced Planning

Quicken excels where others stop forecasting, investments, and long-term planning.

What Sets It Apart

-

Cash-flow projections

-

Retirement modeling

-

Detailed net-worth tracking

Trade-Off

-

Steep learning curve

-

Overkill for simple budgeting

Best For

-

Multi-account households

-

Investors

-

Pre-retirees and planners

5. GoodBudget

Why It Still Works

Manual input slows spending decisions and that’s the point.

Envelope budgeting reduces emotional spending by increasing awareness.

Strength

-

Excellent for couples & shared budgets

-

Promotes intentional spending habits

Limitation

-

No automation

-

Requires consistency

Best For

-

Couples

-

Families

-

Users rebuilding financial discipline

Side-by-Side Comparison: Which App Fits Which Financial Style?

Financial Need |

Best App |

|---|---|

Debt payoff & discipline |

YNAB |

Beginner-friendly & free |

Mint |

Avoiding overspending |

PocketGuard |

Advanced planning |

Quicken |

Shared budgets |

GoodBudget |

2026 Trends Shaping Personal Finance Apps

AI Coaching (Selective, Not Fully Trusted)

AI suggestions are useful but users still need transparency. Apps that explain reasoning outperform black-box recommendations.

Subscription Fatigue Tools

Apps that detect and flag recurring charges early are reducing waste significantly.

Cash-Flow Forecasting > Static Budgets

Forward-looking alerts prevent overdrafts and debt cycles better than monthly caps.

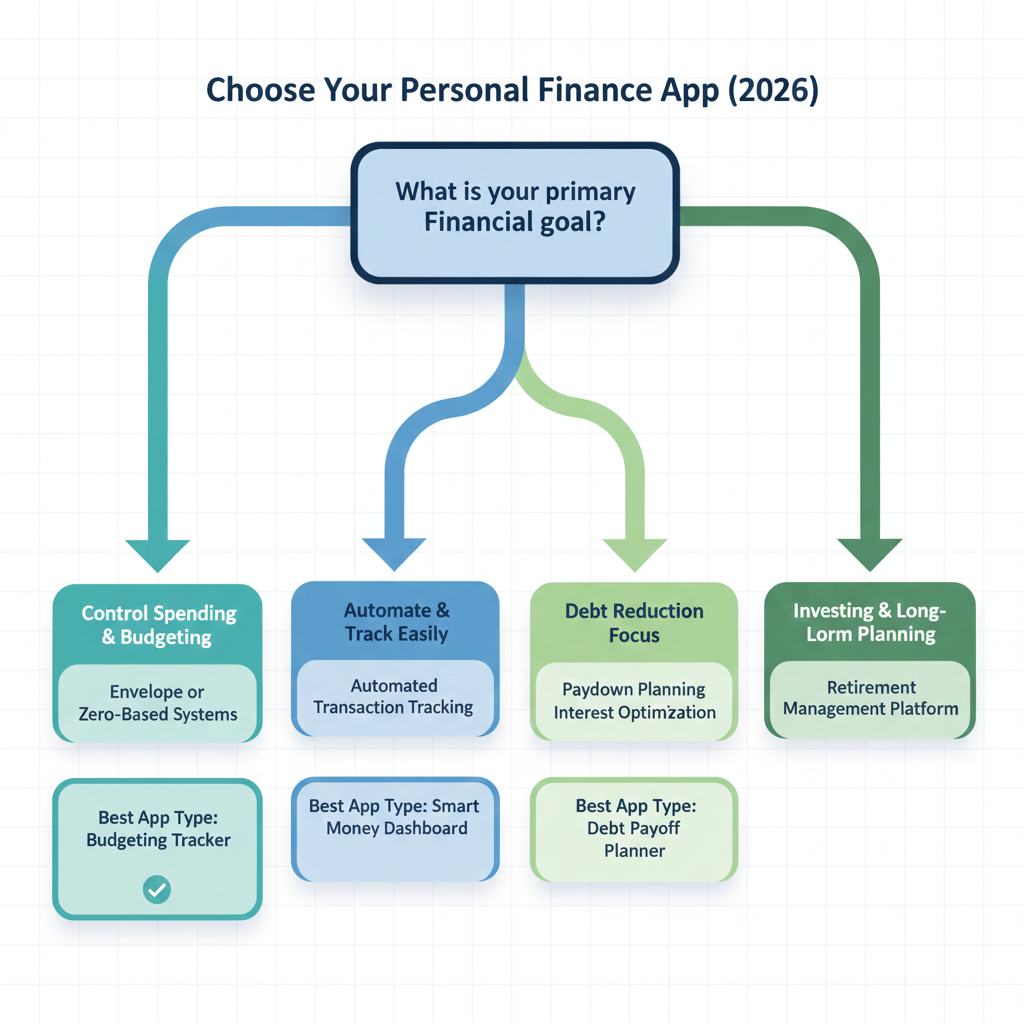

How to Choose the Right App in 2026 (Decision Framework)

Ask yourself:

-

Do I want control or convenience?

-

Am I managing debt, spending, or long-term planning?

-

Will I actually maintain manual input?

-

Do I need shared access?

-

Does this app change behavior or just show data?

Common Mistakes Users Still Make

-

Downloading multiple apps and using none consistently

-

Ignoring alerts after initial setup

-

Over-optimizing budgets instead of simplifying

-

Trusting automation without verification

FAQs (People Also Ask)

Are personal finance apps safe in 2026?

Yes reputable apps use bank-grade encryption and MFA. Avoid apps that sell identifiable spending data.

Can one app handle everything?

Rarely. Budgeting and investing often require different tools.

Do paid apps actually work better?

Often yes because incentives align with user success, not ad revenue.

Are finance apps worth it long-term?

Users who stick with one app for 12 months typically report better savings consistency and lower financial stress.

Final Thoughts

In 2026, the best personal finance apps aren’t the flashiest, they’re the ones that quietly reshape habits.

The right app won’t magically fix your finances, but it will:

-

Make mistakes visible

-

Reduce decision fatigue

-

Replace anxiety with clarity

Choose one that aligns with how you actually behave not how you wish you behaved.