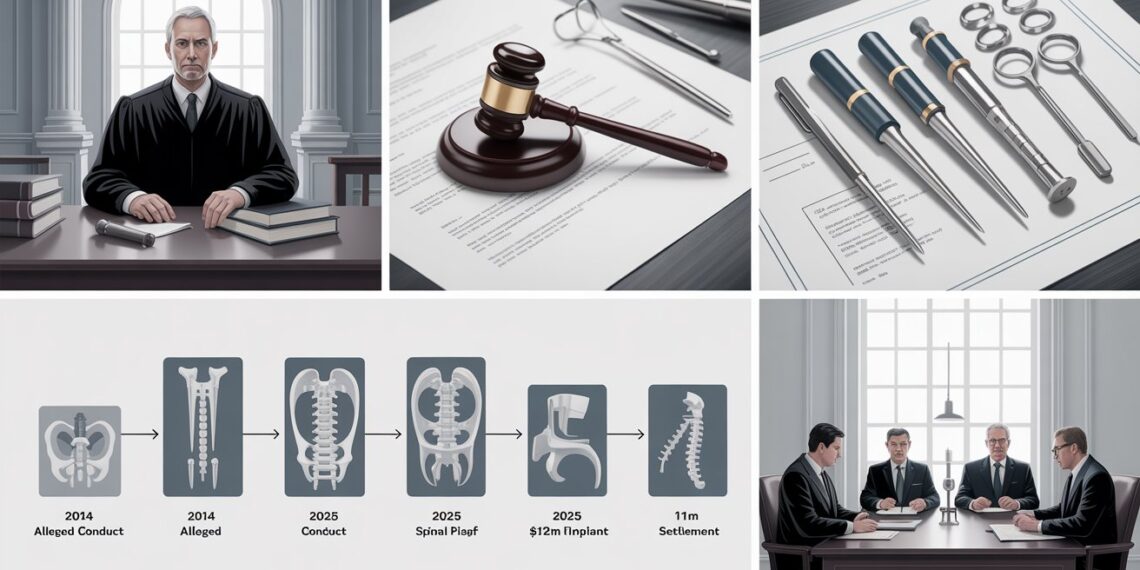

In May 2024, the U.S. Department of Justice (DOJ) announced that Innovasis Inc., a Utah-based spinal device manufacturer, and two of its executives agreed to pay $12 million to resolve allegations under the False Claims Act (FCA) and the Anti-Kickback Statute (AKS). The case centers on claims that the company provided improper financial incentives to physicians between 2014 and 2022. While Innovasis and its executives did not admit liability, the settlement reflects the government’s ongoing scrutiny of financial arrangements between medical device makers and healthcare providers.

Adding to Innovasis’s legal challenges, RSB Spine LLC filed a separate patent infringement lawsuit in April 2024 related to spinal implant technology. Together, these cases highlight the risks medical device companies face when navigating compliance, intellectual property, and physician relationships.

This article provides a comprehensive breakdown of the Innovasis lawsuit: the background, timeline, key allegations, settlement details, and compliance lessons for healthcare professionals. We also examine the separate patent case, answer common questions, and offer practical takeaways for the industry.

Executive Summary (Key Facts at a Glance)

-

Settlement Amount: $12 million

-

Statutes Involved: False Claims Act (FCA), Anti-Kickback Statute (AKS)

-

Defendants: Innovasis Inc., Brent Felix (founder, president, chair), Garth Felix (former executive, CFO)

-

Period of Alleged Conduct: 2014–2022

-

Physicians Involved: 17 spine surgeons

-

Whistleblower (Relator): Robert Richardson, former regional sales director

-

Relator Award: Approximately $2.2 million

-

Settlement Date: May 29, 2024

-

Separate Patent Case: RSB Spine v. Innovasis, filed April 10, 2024 in Utah (damages not confirmed in reliable sources)

-

Liability: No admission of wrongdoing; settlement resolves allegations only

Timeline of Key Events

Date |

Event |

|---|---|

2014–2022 |

Alleged remuneration provided to 17 surgeons (consulting, IP fees, perks) |

May 2019 |

Innovasis self-discloses certain conduct to HHS-OIG |

Oct 2019 |

Whistleblower Robert Richardson files qui tam complaint |

May 29, 2024 |

DOJ announces $12 million settlement; ~$2.2M awarded to relator |

Apr 10, 2024 |

RSB Spine files separate patent infringement lawsuit in Utah |

Who Was Involved in the Innovasis Case?

-

Innovasis Inc.: A spinal device manufacturer headquartered in Utah.

-

Brent Felix: Founder, president, and chair of Innovasis.

-

Garth Felix: Former executive and CFO.

-

Robert Richardson (Relator): Former regional sales director who filed a qui tam complaint, triggering DOJ involvement.

What Conduct Was Alleged?

According to DOJ filings and legal analyses, Innovasis allegedly provided various forms of remuneration to physicians who used its spinal implants. These included:

Type of Remuneration |

Why It’s Risky Under AKS/FCA |

|---|---|

Consulting fees |

Payments may exceed fair market value or lack documentation of services. |

Intellectual property (IP) acquisition fees & royalties |

Could serve as disguised kickbacks if not tied to genuine, novel IP. |

Clinical registry participation payments |

Potential to influence prescribing if tied to product use. |

Performance shares / stock options |

Financial stake in Innovasis may bias medical judgment. |

Travel, ski resort events, luxury dinners |

Lavish perks can improperly induce physician loyalty. |

The government alleged that some payments were not commercially reasonable, above fair market value, or not for bona fide services.

The Legal Framework: AKS and FCA

Anti-Kickback Statute (AKS)

-

Federal law that prohibits offering or receiving anything of value to induce referrals for items or services covered by federal healthcare programs.

-

Even potential influence on clinical decision-making can trigger violations.

False Claims Act (FCA)

-

Allows the government (and whistleblowers) to pursue entities that submit false claims for payment to Medicare or Medicaid.

-

Violations of the AKS often lead to FCA liability because claims submitted after kickbacks are deemed “tainted.”

Settlement Terms

-

Total Payment: $12 million.

-

Allocation: Approximately $2.2 million awarded to the relator, Robert Richardson.

-

Liability: Innovasis and its executives denied wrongdoing; the settlement does not constitute an admission of liability.

-

Enforcement Message: DOJ emphasized that physician relationships must be structured around patient welfare, not financial incentives.

The Self-Disclosure Wrinkle

In May 2019, Innovasis made a self-disclosure to the Office of Inspector General (OIG). However, the DOJ still pursued and settled the case, underscoring an important lesson:

-

Self-disclosure ≠ immunity.

-

The government evaluates the timing, completeness, and seriousness of the disclosure.

-

Partial or late disclosures may not prevent enforcement action.

The Separate RSB Spine Patent Lawsuit

In April 2024, RSB Spine LLC filed a patent infringement suit against Innovasis in the District of Utah. The case reportedly involves Innovasis’s InterPlate and stand-alone ALIF systems.

-

Status: Filed April 10, 2024.

-

Damages: Some reports mention large figures (e.g., $50M), but reputable trade press has not confirmed this amount.

-

Implication: Highlights that Innovasis faces not only regulatory scrutiny but also intellectual property disputes that could impact its product line.

Compliance Lessons for Healthcare Companies

The Innovasis case provides practical compliance takeaways:

-

Fair Market Value (FMV): Always benchmark payments for consulting or IP licensing.

-

Documentation: Maintain detailed contracts, proof of services, and third-party valuation.

-

Hospitality Rules: Avoid lavish travel, entertainment, or “all-expenses-paid” events.

-

Education vs. Promotion: Distinguish CME or registry participation from product marketing.

-

Centralized Oversight: Use a compliance committee to vet physician engagements.

-

Self-Disclosure Strategy: Consult counsel before disclosing; timing and completeness matter.

-

Monitoring & Audits: Regularly review financial relationships for red flags.

FAQs

What is the Innovasis lawsuit about?

The DOJ alleged that Innovasis paid physicians improper remuneration (consulting fees, IP royalties, travel perks) to induce use of its spinal implants, violating the AKS and FCA.

Did Innovasis admit wrongdoing?

No. The settlement was civil in nature and resolved allegations without a determination of liability.

How much did the whistleblower receive?

Robert Richardson, the relator, received approximately $2.2 million as part of the settlement.

What is the Anti-Kickback Statute (AKS)?

A federal law that prohibits offering or receiving anything of value to influence referrals for federally reimbursed healthcare services.

What’s happening with the RSB Spine patent case?

RSB Spine filed suit against Innovasis in April 2024 over alleged infringement of spinal implant patents. Damages amounts cited in some outlets remain unverified by primary sources.

Does this mean Innovasis can no longer sell devices?

No. The settlement does not ban Innovasis from selling products, but it raises compliance scrutiny.

Conclusion

The Innovasis lawsuit demonstrates the risks medical device manufacturers face when physician relationships blur the line between collaboration and improper influence. With a $12 million settlement under the FCA and AKS, plus a pending patent infringement case, Innovasis serves as a cautionary tale for companies across the healthcare sector.

For compliance officers, executives, and physicians, the lessons are clear: maintain fair market value arrangements, document every engagement, and prioritize patient welfare above all.

As DOJ enforcement remains active in the life sciences sector, this case is a reminder that proactive compliance and transparent practices are not optional—they are essential.