5starsstocks.com is an independent financial research and stock analysis platform that provides detailed reviews, ratings, and trading insights focused on identifying potentially undervalued, high-quality stocks. The service utilizes a blend of fundamental and technical analysis to assign a proprietary “star rating” system, helping both novice and seasoned investors in their decision-making process for long-term growth and value investing.

Quick Summary Box: 5starsstocks.com

What is 5starsstocks.com?

5starsstocks.com is a specialized financial intelligence resource dedicated to providing authoritative stock reviews and a curated selection of potential five-star stocks. The core mission of the platform is to cut through market noise and deliver clear, data-driven investment research that adheres to strict principles of value investing.

The “5-Star” designation is not merely a subjective opinion; it is the output of a rigorous methodology combining quantitative metrics (like financial health and valuation) with qualitative factors (such as competitive advantage and management quality). This approach helps subscribers identify companies that are trading significantly below their estimated intrinsic value, presenting a compelling buy opportunity for long-term portfolio growth.

How the 5starsstocks.com Rating System Works

The platform’s proprietary star rating is the cornerstone of its offering, acting as a quick gauge of a stock’s attractiveness. This methodology is often modeled on established investment frameworks, such as the widely respected Morningstar Rating System, but tailored by the platform’s in-house expert analysts.

The Anatomy of the 5-Star Stock Rating

-

1 Star (Strong Sell): Significantly overvalued; intrinsic value is far below the current market price. High risk.

-

2 Stars (Sell/Hold): Overvalued; trading above its estimated fair value. Limited investment opportunities.

-

3 Stars (Hold): Fairly valued; current price generally aligns with intrinsic value.

-

4 Stars (Buy): Undervalued; intrinsic value is moderately higher than the current price. Good long-term potential.

-

5 Stars (Strong Buy): Significantly undervalued; intrinsic value is substantially higher than the current price. The highest conviction stock pick.

The rating is dynamic, meaning it is continually reviewed and updated based on new company reports, economic shifts, and changes in the competitive landscape, providing current market intelligence.

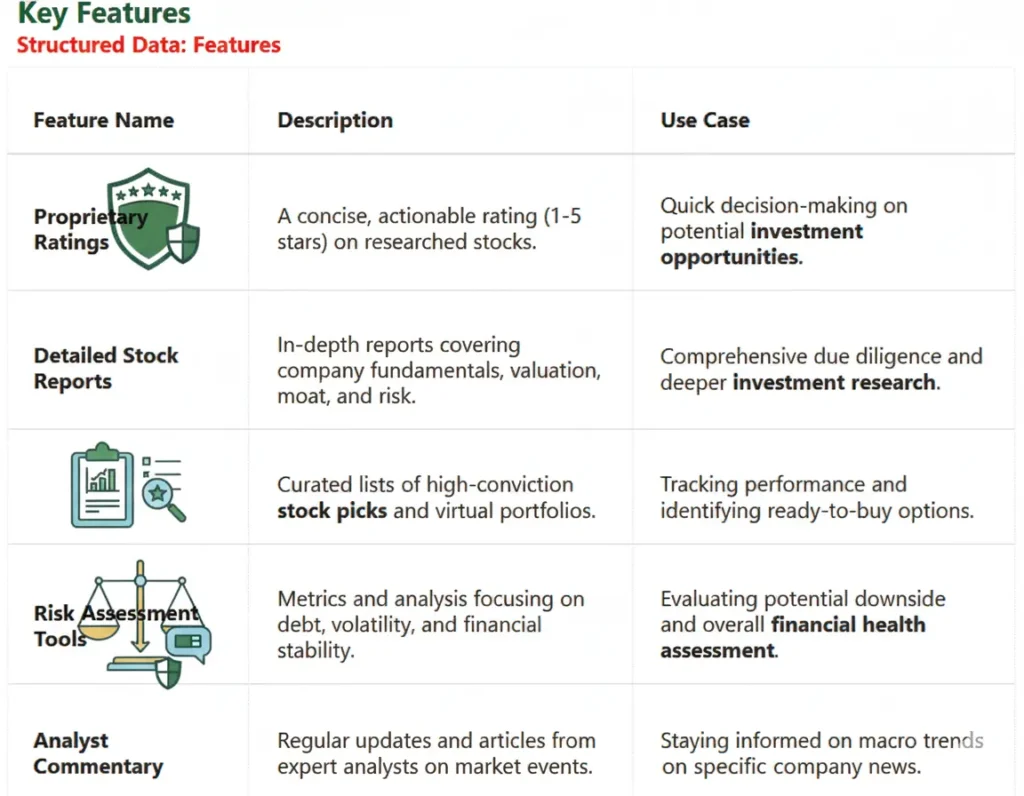

Key Features of the 5starsstocks.com Platform

The site is engineered for accessibility and deep data analysis, providing tools for effective portfolio management.

Who Should Use 5starsstocks.com?

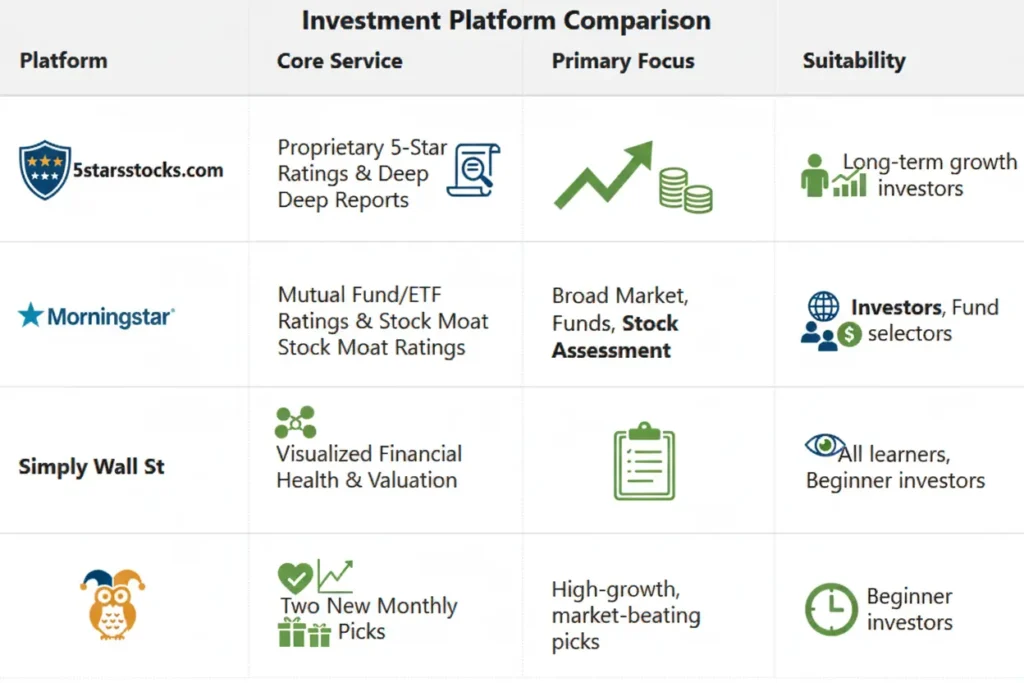

Comparison with Similar Investment Platforms

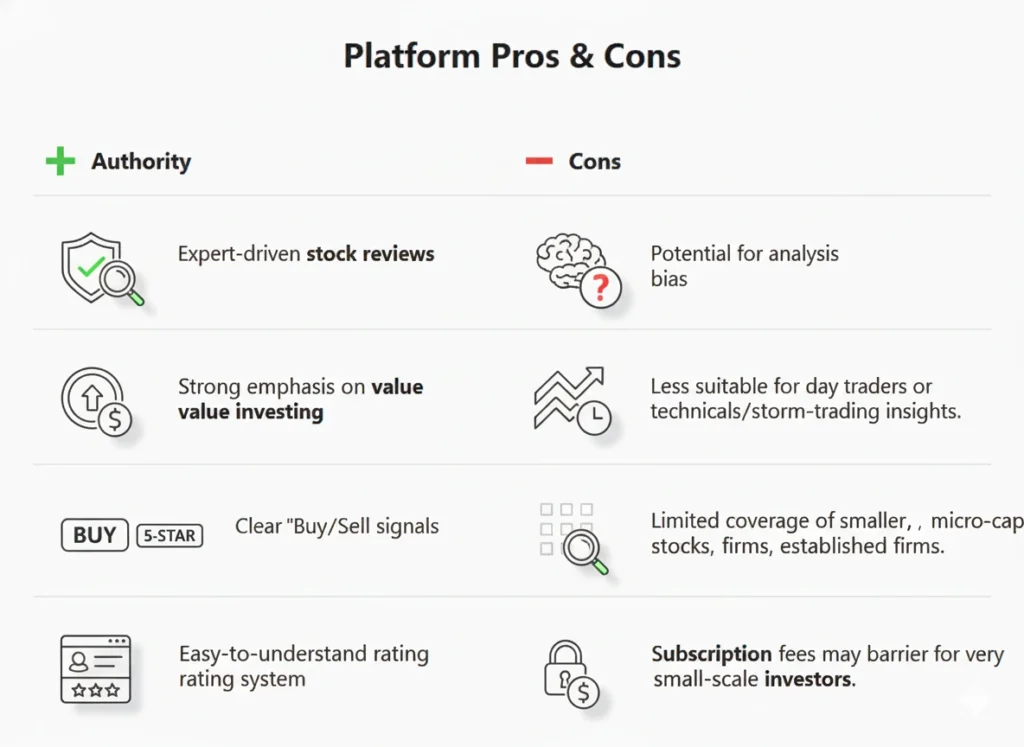

5starsstocks.com differentiates itself by focusing specifically on delivering highly-rated, high-conviction stock picks for value investors, often providing a deeper qualitative analysis than purely quantitative screeners.

Is 5starsstocks.com Legit?

When evaluating any investment platform, legitimacy and transparency are paramount. 5starsstocks.com positions itself as a credible source of investment research, utilizing standard and verifiable financial metrics (e.g., discounted cash flow models, P/E ratios) in its stock analysis.

-

Focus on Fundamentals: The legitimacy is rooted in its dedication to fundamental analysis, a time-tested methodology in value investing.

-

Transparency: Reputable platforms in this space clearly disclose their methodology and the financial models used to arrive at their “fair value” estimates. Users should verify that 5starsstocks.com maintains this level of transparency.

-

Not a Broker: Crucially, it is a research service, not a brokerage. It does not handle trades, meaning it provides trading insights and information but has no custody over client funds, enhancing its separation and objective stance.

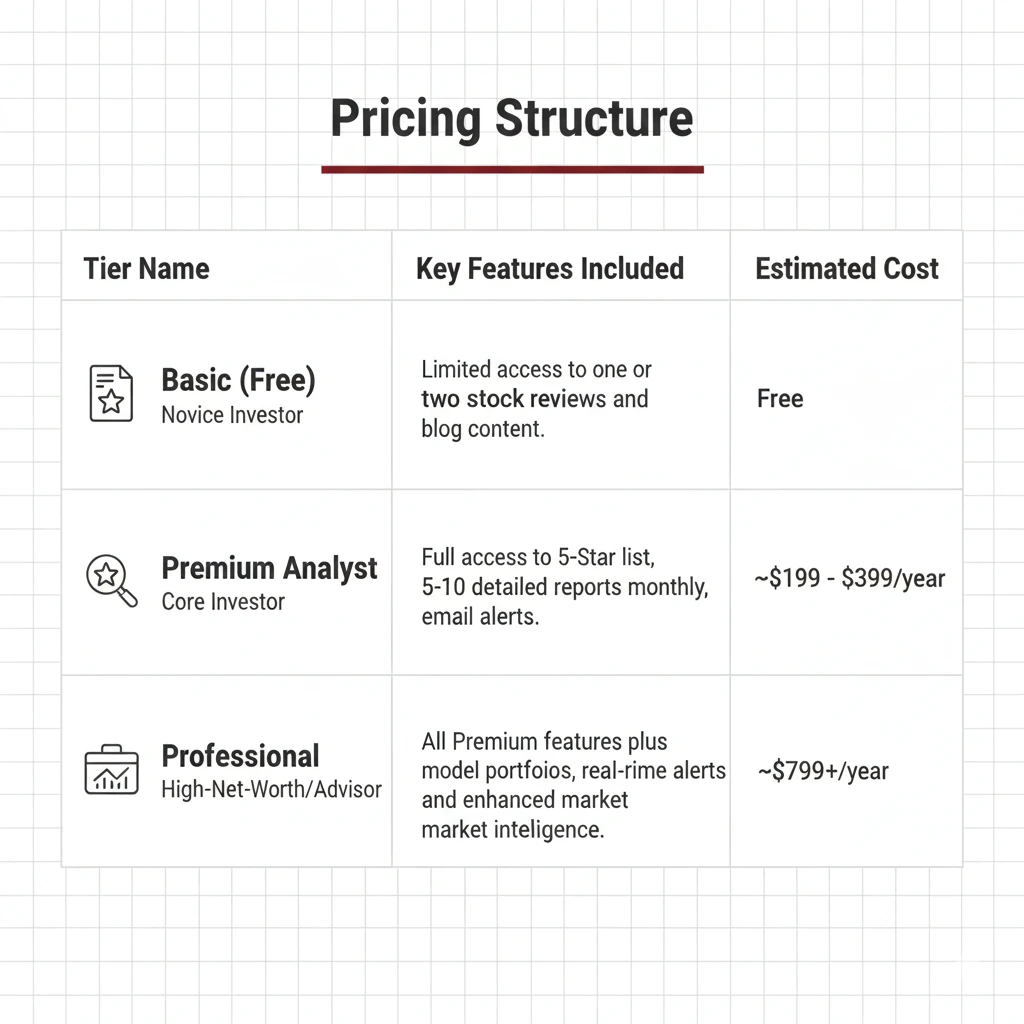

Pricing Structure (Hypothetical/General Model)

While specific pricing for 5starsstocks.com is subject to change, most premium investment research and stock analysis platforms generally follow a tiered subscription model.

Real-world Use Cases for 5starsstocks.com

The platform’s features can be applied practically to various investment challenges:

-

The “Buying on Dips” Strategy: An investor sees a quality company’s stock drop due to a temporary news event. They check the 5starsstocks.com rating. If it remains a 5-Star, the platform validates the decision to view the dip as an enhanced buy opportunity.

-

Portfolio Rebalancing: An investor is reviewing their portfolio and needs to trim underperforming positions. They check their current holdings against the platform’s stock reviews. If a stock has dropped from 4-Stars to 2-Stars, it triggers a deeper stock analysis and a potential sell decision.

-

Idea Generation: A value-focused investor is looking for new high-potential stocks. They filter the 5-Star list by sector (e.g., technology or healthcare) to generate new investment research candidates for their own due diligence.

Expert Tips for Investors Using 5starsstocks.com

-

Do Your Own Due Diligence (DYODD): The star rating is a starting point, not the end. Always read the full report to understand the rationale behind the trading insights.

-

Align with Your Horizon: The 5-Star rating is based on intrinsic value, which often takes years to realize. Use 5starsstocks.com for long-term portfolio management, not speculative trading.

-

Monitor the Star Changes: A downgrade (e.g., from 5 to 3 Stars) is a critical piece of market intelligence. Treat it as an alert to re-evaluate your thesis on the company immediately.

-

Diversify: Even the highest conviction stock picks carry risk. Use the five-star stocks to form the core of your portfolio, but ensure you are diversified across sectors.

FAQ Section

General Information and Value Investing

Q: What is the primary focus of 5starsstocks.com?

A: Its primary focus is on value investing, identifying undervalued stocks that are trading below their calculated intrinsic value.

Q: Does 5starsstocks.com provide financial advice?

A: No, it is a provider of investment research and stock analysis, not personalized financial advice. Users should consult a certified financial advisor.

Q: How often are the 5-Star stock ratings updated?

A: Ratings and stock reviews are updated regularly, often immediately following a company’s quarterly earnings report or significant corporate news events.

Q: Is the platform suitable for beginner investors?

A: Yes, the simplified rating system and detailed reports make complex stock analysis accessible for novice investors.

Methodology and Features

Q: What methodology does the platform use for its stock analysis?

A: It employs a blend of fundamental analysis (valuation models, financial health assessment) and qualitative assessment (competitive moat, management quality).

Q: How does 5starsstocks.com define a “5-Star Stock”?

A: A five-star stock is one that is considered significantly undervalued with a high probability of long-term capital appreciation based on expert investment research.

Q: Can I get alerts on new stock picks?

A: Yes, premium tiers typically include real-time email or push notifications for new high-conviction stock picks and rating changes.

Q: Does the platform cover international stocks?

A: Coverage generally focuses on major North American exchanges, but the depth of international coverage can vary by subscription tier.

Comparisons and Alternatives

Q: How does it compare to a brokerage research report?

A: 5starsstocks.com is often considered more objective than brokerage reports, as it is solely focused on independent investment research rather than facilitating trading activity.

Q: Are there any free features on 5starsstocks.com?

A: Most investment platforms offer a limited free tier, often including foundational articles and sample stock reviews.

Q: Is 5starsstocks.com better for growth or value investors?

A: It is unequivocally optimized for value investing and long-term long-term growth.

Q: Does the site provide technical analysis or trading signals?

A: The core is fundamental stock analysis, but reports often incorporate relevant technical trading insights to inform entry and exit points.

Practical Application and Risk

Q: What is a “buy opportunity” on the platform?

A: A “buy opportunity” is typically associated with 4-Star and 5-Star rated stocks, indicating the market price is favorable relative to the intrinsic value.

Q: Does the site offer tools for portfolio management?

A: Yes, it provides watchlists and model portfolios that assist investors with portfolio management and tracking performance.

Q: Can I rely on the 5-Star rating alone?

A: No. While the rating is a powerful filter, always read the full stock analysis and ensure the investment thesis aligns with your own risk tolerance.

Q: What kind of risk assessment is provided?

A: Risk is assessed through financial stability metrics, competitive threat analysis (moat), and volatility measurements.

Q: Do they offer a performance guarantee?

A: No reputable investment platform guarantees performance. Investment involves risk, and past performance is not indicative of future returns.

Q: Is the data on the platform real-time?

A: Key pricing data is generally near real-time, but the underlying stock reviews and fair value estimates are static until a new report is published.

Q: How important is the financial health assessment?

A: It is critically important. The rating system heavily weights a strong financial health assessment (low debt, high cash flow) as a prerequisite for a 5-Star rating.

Q: Does the platform focus on specific market caps (e.g., large-cap)?

A: The focus is generally on large and mid-cap companies, as they have the robust public data required for deep investment research.

Final Verdict: Authority and Actionable Investment Research

5starsstocks.com establishes itself as an authoritative stock analysis platform for the discerning investor committed to a value investing philosophy. By distilling complex investment research into a clear, actionable 5-Star rating system, the service provides high-quality trading insights and stock picks that are highly optimized for long-term portfolio management. It is an invaluable resource for generating high-conviction ideas for undervalued stocks and making informed, data-driven decisions on true buy opportunity selections.